PNC Bank 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

8A

SSET

Q

UALITY

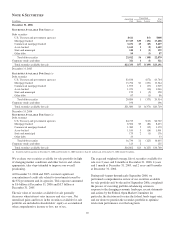

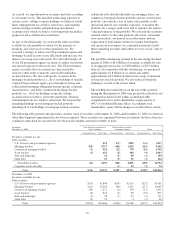

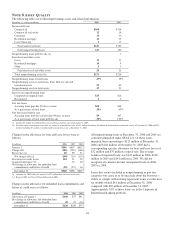

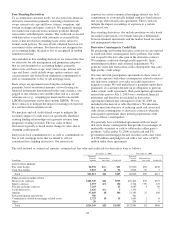

The following table sets forth nonperforming assets and related information:

December 31 - dollars in millions 2006 2005

Nonaccrual loans

Commercial $109 $134

Commercial real estate 12 14

Consumer 13 10

Residential mortgage 12 15

Lease financing 117

Total nonaccrual loans $147 $190

Total nonperforming loans 147 190

Nonperforming loans held for sale (a) 1

Foreclosed and other assets

Lease 12 13

Residential mortgage 10 9

Other 23

Total foreclosed and other assets 24 25

Total nonperforming assets (b) $171 $216

Nonperforming loans to total loans .29% .39%

Nonperforming assets to total loans, loans held for sale and

foreclosed assets .33 .42

Nonperforming assets to total assets .17 .23

Interest on nonperforming loans

Computed on original terms $15 $16

Recognized 45

Past due loans

Accruing loans past due 90 days or more $50 $46

As a percentage of total loans .10% .09%

Past due loans held for sale

Accruing loans held for sale past due 90 days or more $9 $47

As a percentage of total loans held for sale .38% 1.92%

(a) Includes $1 million of troubled debt restructured loans held for sale at December 31, 2005.

(b) Excludes equity management assets that are carried at estimated fair value of $11 million (including $4 million of troubled debt restructured assets) at December 31, 2006 and $25

million (including $7 million of troubled debt restructured assets) at December 31, 2005.

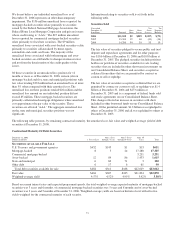

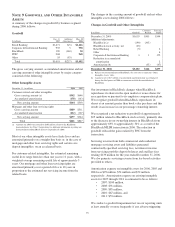

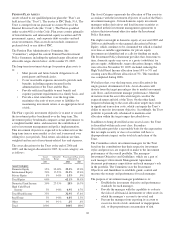

Changes in the allowance for loan and lease losses were as

follows:

In millions 2006 2005 2004

January 1 $596 $607 $632

Charge-offs (180) (129) (166)

Recoveries (a) 40 99 51

Net charge-offs (a) (140) (30) (115)

Provision for credit losses 124 21 52

Acquired allowance (b) 23 22

Net change in allowance for unfunded loan

commitments and letters of credit (20) (25) 16

December 31 $560 $596 $607

(a) Amounts for 2005 reflect the impact of a $53 million loan recovery in that year.

(b) Riggs in 2005 and United National Bancorp in 2004.

Changes in the allowance for unfunded loan commitments and

letters of credit were as follows:

In millions 2006 2005 2004

Allowance at January 1 $100 $75 $91

Net change in allowance for unfunded loan

commitments and letters of credit 20 25 (16)

December 31 $120 $100 $75

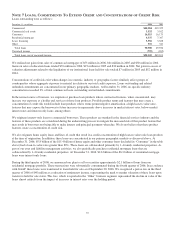

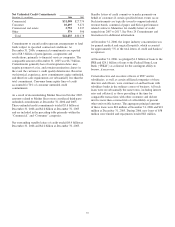

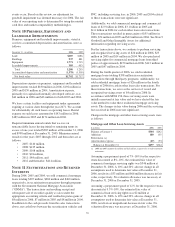

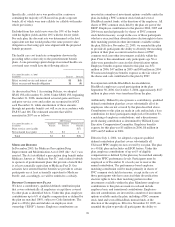

All nonperforming loans at December 31, 2006 and 2005 are

considered impaired under SFAS 114. Of these totals,

impaired loans amounting to $121 million at December 31,

2006 and $148 million at December 31, 2005 had a

corresponding specific allowance for loan and lease losses of

$32 million and $37 million, respectively. The average

balance of impaired loans was $147 million in 2006, $106

million in 2005 and $141 million in 2004. We did not

recognize any interest income on impaired loans in 2006,

2005 or 2004.

Loans that are not included in nonperforming or past due

categories but cause us to be uncertain about the borrower’s

ability to comply with existing repayment terms over the next

six months totaled $41 million at December 31, 2006

compared with $67 million at December 31, 2005.

Approximately 59% of these loans are in the Corporate &

Institutional Banking portfolio.

94