PNC Bank 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

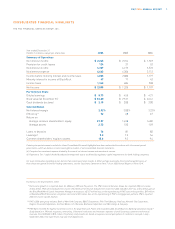

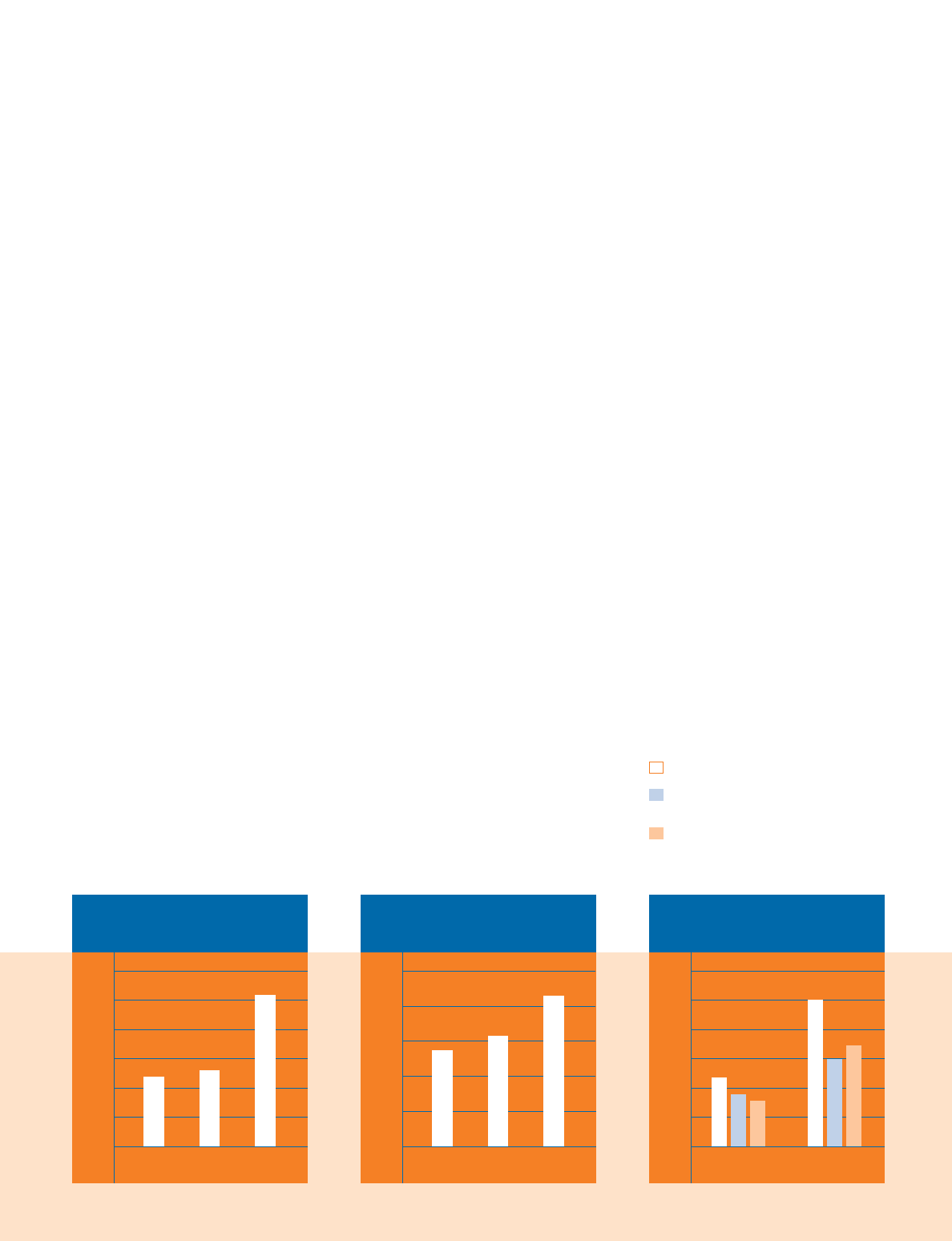

EARNINGS

$ Billions

0.0

0.5

1.0

1.5

2.0

2.5

3.0

060504

REVENUE

$ Billions

0

2

4

6

8

10

060504

SHAREHOLDER RETURN

0%

10%

20%

30%

40%

50%

60%

3–Year1–Year

PNC 2006 ANNUAL REPORT 3

We have upgraded the signage and other features of many of our branches, which

are our main distribution channel and the face of PNC in our communities. New

stand-alone branches are being constructed in locations convenient to growing

populations with expanding incomes. Branch staff is receiving enhanced training

on new products, new services and better ways to meet client needs. In 2006, an

independent analyst visiting bank branches in the Washington, D.C. area found

PNC employees to be the most knowledgeable he encountered.

We have supported all of this brand-building activity with strong advertising and

marketing. We began with television commercials for our free-ATM offer last

September. In February of this year, we introduced “Leading the Way,” the most

comprehensive brand advertising campaign in PNC’s history.

It is still early, but our efforts are beginning to show success. Initial balances in new

checking accounts are higher by 20 percent. Our PNC-branded credit card, which

launched in September, quickly surpassed our initial expectations. More than 70,000

consumers now carry the card, and receivables total more than $140 million. The

initial results of the mass affluent initiative, too, are promising. Loans, deposits and

investments among customers in the initiative’s pilot have grown faster than those

of similarly situated, unassigned customers.

We leveraged our market leadership. The effort to deepen relationships extends to

our Corporate & Institutional Banking segment, where the focus is on middle market

customers with between $30 million and $1 billion in annual revenues.

We have national reach, with commercial real estate lending and servicing, asset-based

lending, treasury management, capital markets, and the mergers and acquisitions

advisory services of Harris Williams.

PNC

11-Company

Peer Group Average**

S&P Index

For the period ending

December 31, 2006