PNC Bank 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

9G

OODWILL AND

O

THER

I

NTANGIBLE

A

SSETS

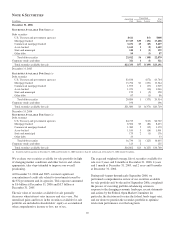

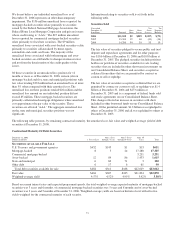

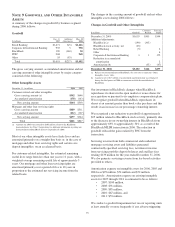

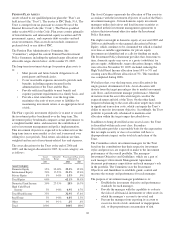

A summary of the changes in goodwill by business segment

during 2006 follows:

Goodwill

In millions

Dec. 31

2005

Additions/

Adjustments

Dec. 31

2006

Retail Banking $1,471 $(5) $1,466

Corporate & Institutional Banking 935 3 938

BlackRock 190 (160) 30

PFPC 968 968

Other 55 (55)

Total $3,619 $(217) $3,402

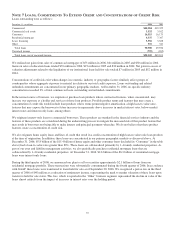

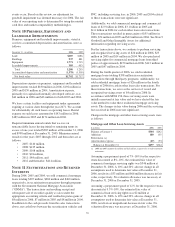

The gross carrying amount, accumulated amortization and net

carrying amount of other intangible assets by major category

consisted of the following:

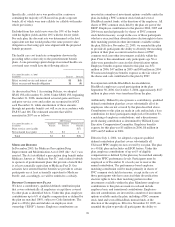

Other Intangible Assets

December 31 - in millions 2006 2005

Customer-related and other intangibles

Gross carrying amount (a) $342 $646

Accumulated amortization (178) (143)

Net carrying amount $164 $503

Mortgage and other loan servicing rights

Gross carrying amount $689 $511

Accumulated amortization (212) (167)

Net carrying amount $477 $344

Total $641 $847

(a) Amounts for 2006 were reduced by $305 million related to the BlackRock

deconsolidation. See Note 2 Acquisitions for additional information regarding our

deconsolidation of BlackRock effective September 29, 2006.

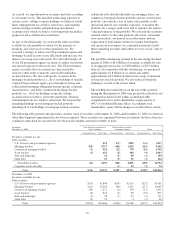

Most of our other intangible assets have finite lives and are

amortized primarily on a straight-line basis or, in the case of

mortgage and other loan servicing rights and certain core

deposit intangibles, on an accelerated basis.

For customer-related intangibles, the estimated remaining

useful lives range from less than one year to 11 years, with a

weighted-average remaining useful life of approximately 5

years. Our mortgage and other loan servicing rights are

amortized primarily over a period of five to 10 years in

proportion to the estimated net servicing income from the

related loans.

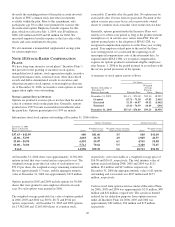

The changes in the carrying amount of goodwill and net other

intangible assets during 2006 follows:

Changes in Goodwill and Other Intangibles

In millions Goodwill

Customer-

Related

Servicing

Rights

December 31, 2005 $3,619 $503 $344

Additions/adjustments:

BlackRock (a) (190) (305)

BlackRock stock activity, net (25)

Retail Banking (5) 2

Other 4

Corporate & Institutional Banking 3 1 172

Reduction in accumulated

amortization 2

Amortization (b) (35) (47)

December 31, 2006 $3,402 $164 $477

(a) Reflects our deconsolidation of BlackRock. See also note (a) under the “Other

Intangible Assets” table.

(b) Amount is net of $17 million of accumulated amortization that was eliminated

during the third quarter of 2006 in connection with the deconsolidation of

BlackRock.

Our investment in BlackRock changes when BlackRock

repurchases its shares in the open market or issues shares for

an acquisition or pursuant to its employee compensation plans.

We recognize goodwill when BlackRock repurchases its

shares at an amount greater than book value per share and this

results in an increase in our percentage ownership interest.

We recognized a net reduction to goodwill of approximately

$25 million related to BlackRock stock activity, primarily due

to the decrease in our ownership interest in BlackRock from

approximately 69% to approximately 34% as a result of the

BlackRock/MLIM transaction in 2006. The reduction in

goodwill reduced the gain realized by PNC from the

transaction.

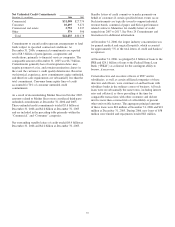

Servicing revenue from both commercial and residential

mortgage servicing assets and liabilities generated

contractually specified servicing fees, net interest income

from servicing portfolio deposit balances and ancillary fees

totaling $139 million for the year ended December 31, 2006.

We also generate servicing revenue from fee-based activities

provided to others.

Amortization expense on intangible assets for 2006, 2005 and

2004 was $99 million, $74 million and $52 million,

respectively. Amortization expense on existing intangible

assets for 2007 through 2011 is estimated to be as follows:

• 2007: $100 million,

• 2008: $91 million,

• 2009: $85 million,

• 2010: $67 million, and

• 2011: $53 million.

We conduct a goodwill impairment test on our reporting units

at least annually or more frequently if any adverse triggering

95