PNC Bank 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

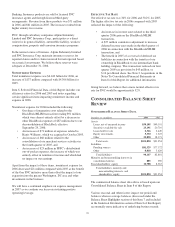

The increase in Equity investments above reflects BlackRock

as an equity investment at December 31, 2006. BlackRock’s

assets and liabilities were consolidated on our Consolidated

Balance Sheet at December 31, 2005.

The impact of the deconsolidation of BlackRock’s balance

sheet amounts and recognition of our ownership interest in

BlackRock as an equity investment upon the closing of the

BlackRock/MLIM transaction is discussed in the BlackRock

portion of the Business Segments Review section of this

Item 7.

An analysis of changes in selected other balance sheet

categories follows.

L

OANS

,N

ET OF

U

NEARNED

I

NCOME

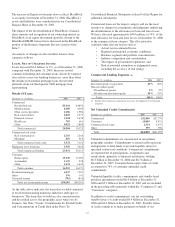

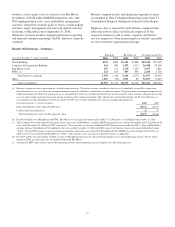

Loans increased $1.0 billion, or 2%, as of December 31, 2006

compared with December 31, 2005. Increases in total

commercial lending and consumer loans, driven by targeted

sales efforts across our banking businesses, more than offset

the decline in residential mortgage loans that resulted

primarily from our third quarter 2006 mortgage loan

repositioning.

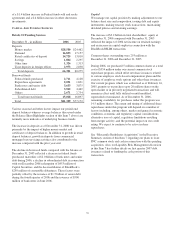

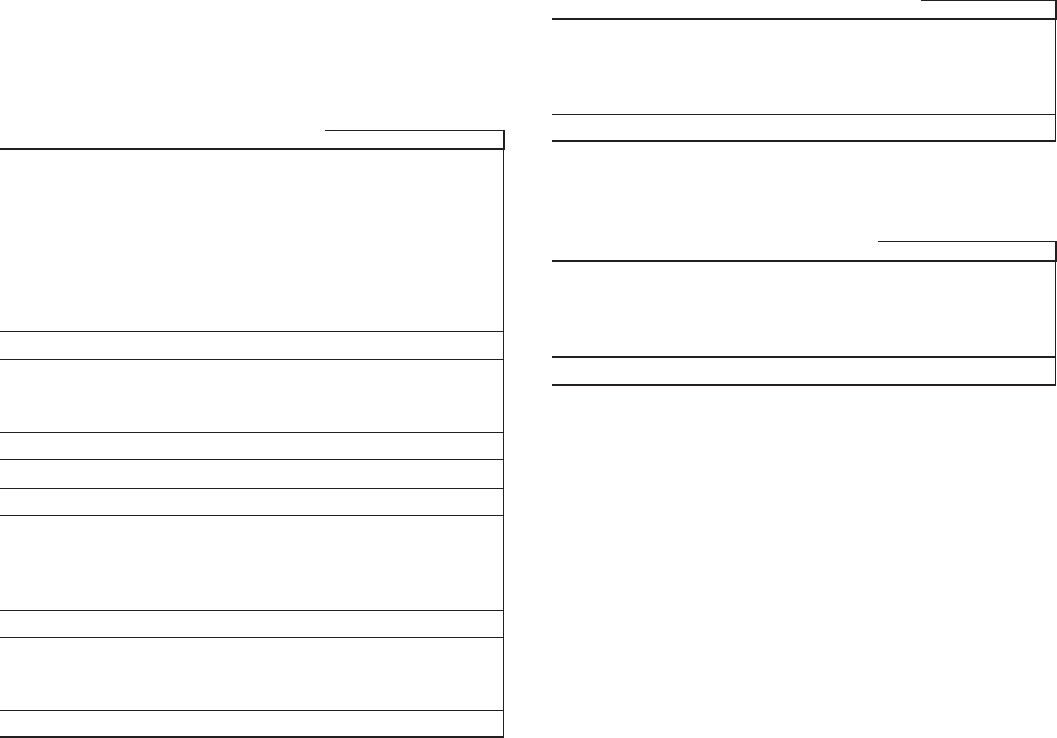

Details Of Loans

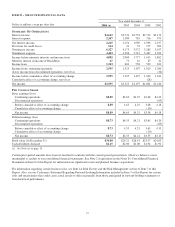

December 31 - in millions 2006 2005

Commercial

Retail/wholesale $5,301 $4,854

Manufacturing 4,189 4,045

Other service providers 2,186 1,986

Real estate related 2,825 2,577

Financial services 1,324 1,438

Health care 707 616

Other 4,052 3,809

Total commercial 20,584 19,325

Commercial real estate

Real estate projects 2,716 2,244

Mortgage 816 918

Total commercial real estate 3,532 3,162

Equipment lease financing 3,556 3,628

Total commercial lending 27,672 26,115

Consumer

Home equity 13,749 13,790

Automobile 1,135 938

Other 1,631 1,445

Total consumer 16,515 16,173

Residential mortgage 6,337 7,307

Other 376 341

Unearned income (795) (835)

Total, net of unearned income $50,105 $49,101

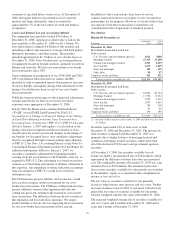

As the table above indicates, the loans that we hold continued

to be diversified among numerous industries and types of

businesses. The loans that we hold are also concentrated in,

and diversified across, the geographic areas where we do

business. See Note 7 Loans, Commitments To Extend Credit

and Concentrations of Credit Risk in the Notes To

Consolidated Financial Statements in Item 8 of this Report for

additional information.

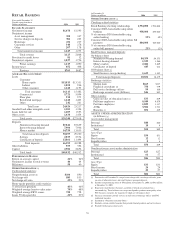

Commercial loans are the largest category and are the most

sensitive to changes in assumptions and judgments underlying

the determination of the allowance for loan and lease losses.

We have allocated approximately $443 million, or 79%, of the

total allowance for loan and lease losses at December 31, 2006

to the commercial loan category. This allocation also

considers other relevant factors such as:

• Actual versus estimated losses,

• Regional and national economic conditions,

• Business segment and portfolio concentrations,

• Industry competition and consolidation,

• The impact of government regulations, and

• Risk of potential estimation or judgmental errors,

including the accuracy of risk ratings.

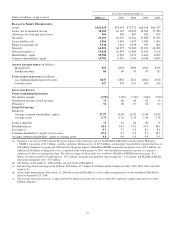

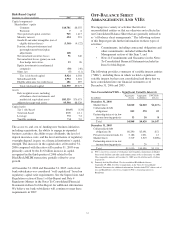

Commercial Lending Exposure (a)

December 31 - in millions 2006 2005

Investment grade or equivalent 49% 46%

Non-investment grade

$50 million or greater 2% 2%

All other non-investment grade 49% 52%

Total 100% 100%

(a) Includes total commercial, commercial real estate, and equipment lease financing

categories.

Net Unfunded Credit Commitments

December 31 - in millions 2006 2005

Commercial $31,009 $27,774

Consumer 10,495 9,471

Commercial real estate 2,752 2,337

Other 579 596

Total $44,835 $40,178

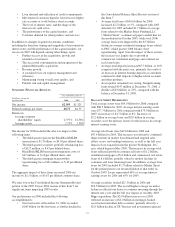

Unfunded commitments are concentrated in our primary

geographic markets. Commitments to extend credit represent

arrangements to lend funds or provide liquidity subject to

specified contractual conditions. Commercial commitments

are reported net of participations, assignments and

syndications, primarily to financial institutions, totaling

$8.3 billion at December 31, 2006 and $6.7 billion at

December 31, 2005. Consumer home equity lines of credit

accounted for 74% of consumer unfunded credit

commitments.

Unfunded liquidity facility commitments and standby bond

purchase agreements totaled $6.0 billion at December 31,

2006 and $5.1 billion at December 31, 2005 and are included

in the preceding table primarily within the “Commercial” and

“Consumer” categories.

In addition to credit commitments, our net outstanding

standby letters of credit totaled $4.4 billion at December 31,

2006 and $4.2 billion at December 31, 2005. Standby letters

of credit commit us to make payments on behalf of our

27