PNC Bank 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

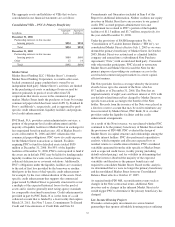

Banking. Insurance products are sold by licensed PNC

insurance agents and through licensed third-party

arrangements. Revenue from these products was $71 million

in 2006 and $61 million in 2005. The increase resulted from

higher annuity fee revenue.

PNC, through subsidiary companies Alpine Indemnity

Limited and PNC Insurance Corp., participates as a direct

writer for its general liability, automobile liability, workers’

compensation, property and terrorism insurance programs.

In the normal course of business, Alpine Indemnity Limited

and PNC Insurance Corp. maintain insurance reserves for

reported claims and for claims incurred but not reported based

on actuarial assessments. We believe these reserves were

adequate at December 31, 2006.

N

ONINTEREST

E

XPENSE

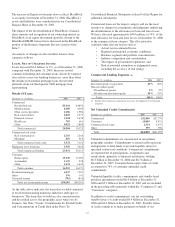

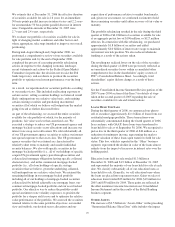

Total noninterest expense was $4.443 billion for 2006, an

increase of $137 million compared with $4.306 billion for

2005.

Item 6, Selected Financial Data, of this Report includes our

efficiency ratios for 2006 and 2005 and notes regarding

certain significant items impacting noninterest income and

expense in 2006.

Noninterest expense for 2006 included the following:

• Our share of integration costs related to the

BlackRock/MLIM transaction totaling $91 million,

which were almost entirely offset by a decrease in

other BlackRock expenses of $87 million due to our

deconsolidation of BlackRock effective

September 29, 2006,

• An increase of $71 million of expenses related to

Harris Williams, which we acquired in October 2005,

• An increase of $60 million related to the

consolidation of our merchant services activities in

the fourth quarter of 2005, and

• An increase of $23 million in PFPC’s distribution/

out-of-pocket expenses, the increase of which was

entirely offset in noninterest income and which had

no impact on our earnings.

Apart from the impact of these items, noninterest expense for

2006 decreased $21 million compared with 2005 as the benefit

of the One PNC initiative more than offset the impact of our

expansion into the greater Washington, DC area and other

investments in the business.

We will have a continued emphasis on expense management

in 2007 as we continue our focus on sustaining positive

operating leverage.

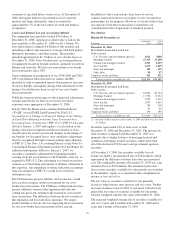

E

FFECTIVE

T

AX

R

ATE

Our effective tax rate was 34% for 2006 and 30.2% for 2005.

The higher effective tax rate in 2006 compared with 2005

reflected the impact of the following:

• An increase in income taxes related to the third

quarter 2006 gain on the BlackRock/MLIM

transaction,

• A $57 million cumulative adjustment to increase

deferred income taxes made in the third quarter of

2006 in connection with the BlackRock/MLIM

transaction, and

• The benefit in 2005 of a reversal of deferred tax

liabilities in connection with the transfer of our

ownership in BlackRock to our intermediate bank

holding company. This transaction reduced our first

quarter 2005 tax provision by $45 million, or

$.16 per diluted share. See Note 2 Acquisitions in the

Notes To Consolidated Financial Statements in

Item 8 of this Report for additional information.

Going forward, we believe that a more normal effective tax

rate for PNC would be approximately 32%.

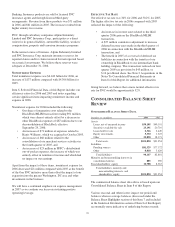

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

S

UMMARIZED

B

ALANCE

S

HEET

D

ATA

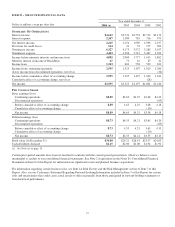

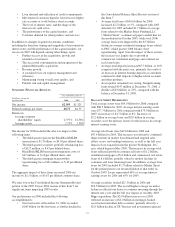

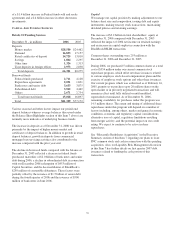

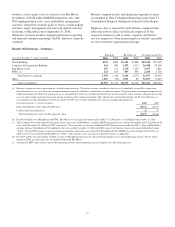

December 31 - in millions 2006 2005

Assets

Loans, net of unearned income $50,105 $49,101

Securities available for sale 23,191 20,710

Loans held for sale 2,366 2,449

Equity investments 5,330 1,323

Other 20,828 18,371

Total assets $101,820 $91,954

Liabilities

Funding sources $81,329 $77,172

Other 8,818 5,629

Total liabilities 90,147 82,801

Minority and noncontrolling interests in

consolidated entities 885 590

Total shareholders’ equity 10,788 8,563

Total liabilities, minority and

noncontrolling interests, and

shareholders’ equity $101,820 $91,954

The summarized balance sheet data above is based upon our

Consolidated Balance Sheet in Item 8 of this Report.

Various seasonal and other factors impact our period-end

balances whereas average balances (discussed under the

Balance Sheet Highlights section of this Item 7 and included

in the Statistical Information section of Item 8 of this Report)

are normally more indicative of underlying business trends.

26