PNC Bank 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

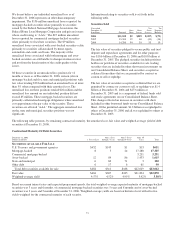

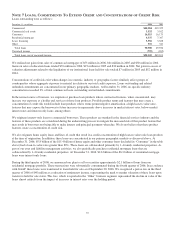

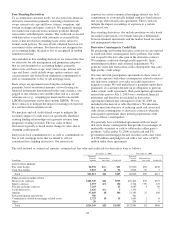

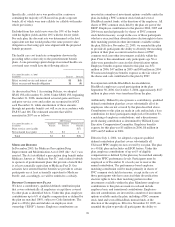

During February 2007, in connection with our planned

acquisition of Mercantile, we issued $1.9 billion of debt to

fund the cash portion of this transaction, comprised of the

following:

• On February 1, 2007, we issued $775 million of

floating rate senior notes due January 2012. Interest

will be reset quarterly to 3-month LIBOR plus 14

basis points and interest will be paid quarterly.

• Also on February 1, 2007, we issued $500 million of

floating rate senior notes due January 2014. Interest

will be reset quarterly to 3-month LIBOR plus 20

basis points and will be paid quarterly.

• On February 8, 2007, we issued $600 million of

subordinated notes due February 2017. These notes

pay interest semiannually at a fixed rate of 5.625%.

See Note 2 Acquisitions for additional information regarding

Mercantile.

N

OTE

14 C

APITAL

S

ECURITIES OF

S

UBSIDIARY

T

RUSTS

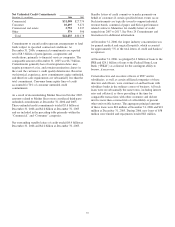

In December 2006, we elected to redeem all of the underlying

Capital Securities related to the PNC Institutional Capital

Trust A, UNB Capital Statutory Trust II, and Riggs Capital

Trust I. The total Capital Securities redeemed totaled $453

million.

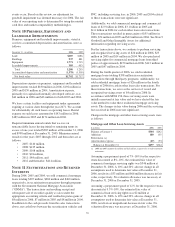

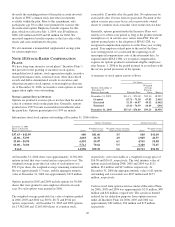

At December 31, 2006, the following capital securities

represent non-voting preferred beneficial interests in the assets

of PNC Institutional Capital Trust B, PNC Capital Trusts C

and D, UNB Capital Trust I, and the Riggs Capital Trust II

(the “Trusts”). All of these Trusts are wholly owned finance

subsidiaries of PNC. UNB Capital Trust I was acquired

effective January 1, 2004 as part of the United National

acquisition. Riggs Capital Trust II was acquired in May 2005

as part of the Riggs acquisition. In the event of certain

changes or amendments to regulatory requirements or federal

tax rules, the capital securities are redeemable in whole. The

financial statements of the Trusts are not included in PNC’s

consolidated financial statements in accordance with GAAP.

• Trust B, formed in May 1997, issued $300 million of

8.315% capital securities due May 15, 2027, that are

redeemable after May 15, 2007 at a premium that

declines from 104.1575% to par on or after May 15,

2017.

• Trust C, formed in June 1998, issued $200 million of

capital securities due June 1, 2028, bearing interest at a

floating rate per annum equal to 3-month LIBOR plus

57 basis points. The rate in effect at December 31,

2006 was 5.94%. Trust C Capital Securities are

redeemable on or after June 1, 2008 at par.

• Trust D, formed in December 2003, issued $300

million of 6.125% capital securities due

December 15, 2033 that are redeemable on or after

December 18, 2008 at par.

• UNB Capital Trust I, formed in March 1997 with $16

million outstanding of 10.01% capital securities due

March 15, 2027, that are redeemable on or after

March 15, 2007 at a premium that declines from

105.00% to par on or after March 15, 2017. PNC has

delivered redemption notices to the related trustee to

redeem all of these securities on March 15, 2007.

• Riggs Capital Trust II was formed in March 1997

when $200 million of 8

7

⁄

8

% capital securities were

issued. These securities are due March 15, 2027, and

are redeemable after March 15, 2007 at a premium

that declines from 104.438% to par on or after

March 15, 2017. Riggs had acquired less than 50% of

the capital securities and, therefore, under FIN 46R

PNC is not deemed to be the primary beneficiary.

Accordingly, the financial statements of this Trust are

not consolidated into PNC’s financial results. Junior

subordinated debt of $206 million owed by PNC to

this Trust is included in PNC’s balance sheet, with

the related service cost included in interest expense.

The $50 million of acquired capital securities are

included as securities available for sale, with the

related dividends included in interest income. PNC

has delivered redemption notices to the related

trustee to redeem all of these securities on March 15,

2007.

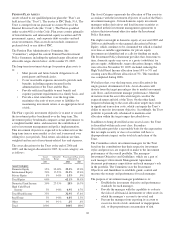

At December 31, 2006, PNC’s junior subordinated debt of

$1.1 billion represented debentures issued by PNC and

purchased and held as assets by the Trusts.

The obligations of the respective parent of each Trust, when

taken collectively, are the equivalent of a full and

unconditional guarantee of the obligations of such Trust under

the terms of the Capital Securities. Such guarantee is

subordinate in right of payment in the same manner as other

junior subordinated debt. There are certain restrictions on

PNC’s overall ability to obtain funds from its subsidiaries. For

additional disclosure on these funding restrictions, including

an explanation of dividend and intercompany loan limitations,

see Note 4 Regulatory Matters.

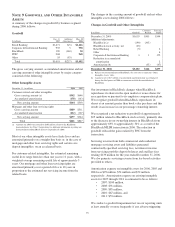

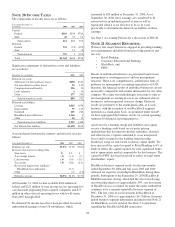

N

OTE

15 S

HAREHOLDERS

’E

QUITY

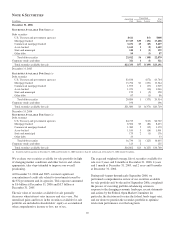

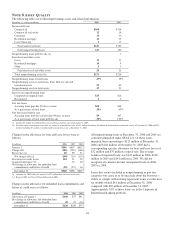

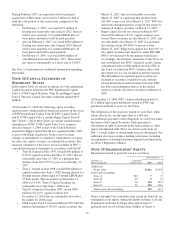

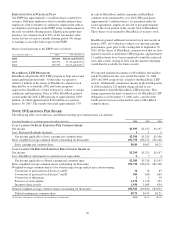

Information related to preferred stock is as follows:

Preferred Shares

December 31

Shares in thousands

Liquidation

value per share 2006 2005

Authorized

$1 par value 17,012 17,030

Issued and outstanding

Series A $40 77

Series B 40 22

Series C 20 144 152

Series D 20 196 206

Total issued and outstanding 349 367

Series A through D are cumulative and, except for Series B, are

redeemable at our option. Annual dividends on Series A, B and

D preferred stock total $1.80 per share and on Series C

preferred stock total $1.60 per share. Holders of Series A

98