PNC Bank 2006 Annual Report Download - page 56

Download and view the complete annual report

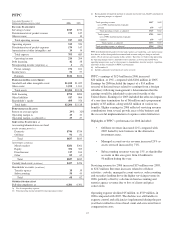

Please find page 56 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amount of goodwill. See Note 9 Goodwill and Other

Intangible Assets in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional information.

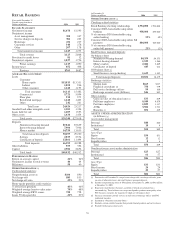

Revenue Recognition

We derive net interest and noninterest income from various

sources, including:

• Lending,

• Securities portfolio,

• Asset management and fund servicing,

• Customer deposits,

• Loan servicing,

• Brokerage services,

• Merger and acquisition advisory services,

• Sale of loans and securities,

• Certain private equity activities, and

• Securities and derivatives trading activities including

foreign exchange.

We also earn fees and commissions from issuing loan

commitments, standby letters of credit and financial

guarantees, selling various insurance products, providing

treasury management services and participating in certain

capital markets transactions.

The timing and amount of revenue that we recognize in any

period is dependent on estimates, judgments, assumptions, and

interpretation of contractual terms. Changes in these factors

can have a significant impact on revenue recognized in any

period due to changes in products, market conditions or

industry norms.

Income Taxes

In the normal course of business, we and our subsidiaries enter

into transactions for which the tax treatment is unclear or

subject to varying interpretations. In addition, filing

requirements, methods of filing and the calculation of taxable

income in various state and local jurisdictions are subject to

differing interpretations.

We evaluate and assess the relative risks and merits of the

appropriate tax treatment of transactions, filing positions,

filing methods and taxable income calculations after

considering statutes, regulations, judicial precedent, and other

information, and maintain tax accruals consistent with our

evaluation of these relative risks and merits. The result of our

evaluation and assessment is by its nature an estimate. We and

our subsidiaries are routinely subject to audit and challenges

from taxing authorities. In the event we resolve a challenge for

an amount different than amounts previously accrued, we will

account for the difference in the period in which we resolve

the matter.

Our tax treatment of certain leasing transactions is currently

being challenged by the IRS, as described in greater detail in

Cross-Border Leases and Related Tax and Accounting Matters

in the Consolidated Balance Sheet Review section of this

Item 7.

R

ECENT

A

CCOUNTING

P

RONOUNCEMENTS

See Note 1 Accounting Policies in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information on the following recent accounting

pronouncements that are relevant to our business, including a

description of each new pronouncement, the required date of

adoption, our planned date of adoption, and the expected

impact on our consolidated financial statements. All of the

following pronouncements were issued by the FASB unless

otherwise noted.

The following was issued in 2007:

• SFAS 159, “The Fair Value Option for Financial

Assets and Financial Liabilities – Including an

amendment of FASB Statement No. 115”

The following were issued during 2006:

• SFAS 158, “Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Benefit

Plans – an amendment of FASB Statements No. 87,

88, 106 and 132(R)”

• SFAS 157, “Fair Value Measurements”

• SFAS 156, “Accounting for Servicing of Financial

Assets – an amendment of FASB Statement No. 140”

• SFAS 155, “Accounting for Certain Hybrid Financial

Instruments – an amendment of FASB Statements

No. 133 and 140”

• FASB Interpretation (“FIN”) No. 48, “Accounting

for Uncertainty in Income Taxes – an interpretation

of FASB Statement No. 109”

• FASB Staff Position No. (“FSP”) FAS 13-2,

“Accounting for a Change or Projected Change in the

Timing of Cash Flows Relating to Income Taxes

Generated by a Leveraged Lease Transaction”

Issued during 2005 with an effective date in 2006:

• In June 2005, the FASB’s Emerging Issues Task

Force (“EITF”) issued EITF Issue 04-5,

“Determining Whether a General Partner, or the

General Partners as a Group, Controls a Limited

Partnership or Similar Entity When the Limited

Partners Have Certain Rights”

S

TATUS

O

F

D

EFINED

B

ENEFIT

P

ENSION

P

LAN

We have a noncontributory, qualified defined benefit pension

plan (“plan” or “pension plan”) covering eligible employees.

Benefits are derived from a cash balance formula based on

compensation levels, age and length of service. Pension

contributions are based on an actuarially determined amount

necessary to fund total benefits payable to plan participants.

Plan assets are currently approximately 60% invested in

equity investments with most of the remainder invested in

46