PNC Bank 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

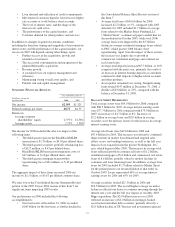

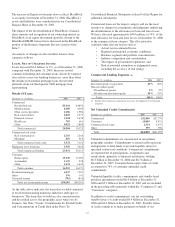

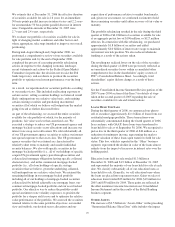

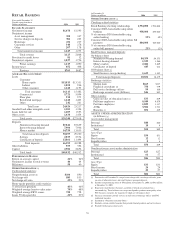

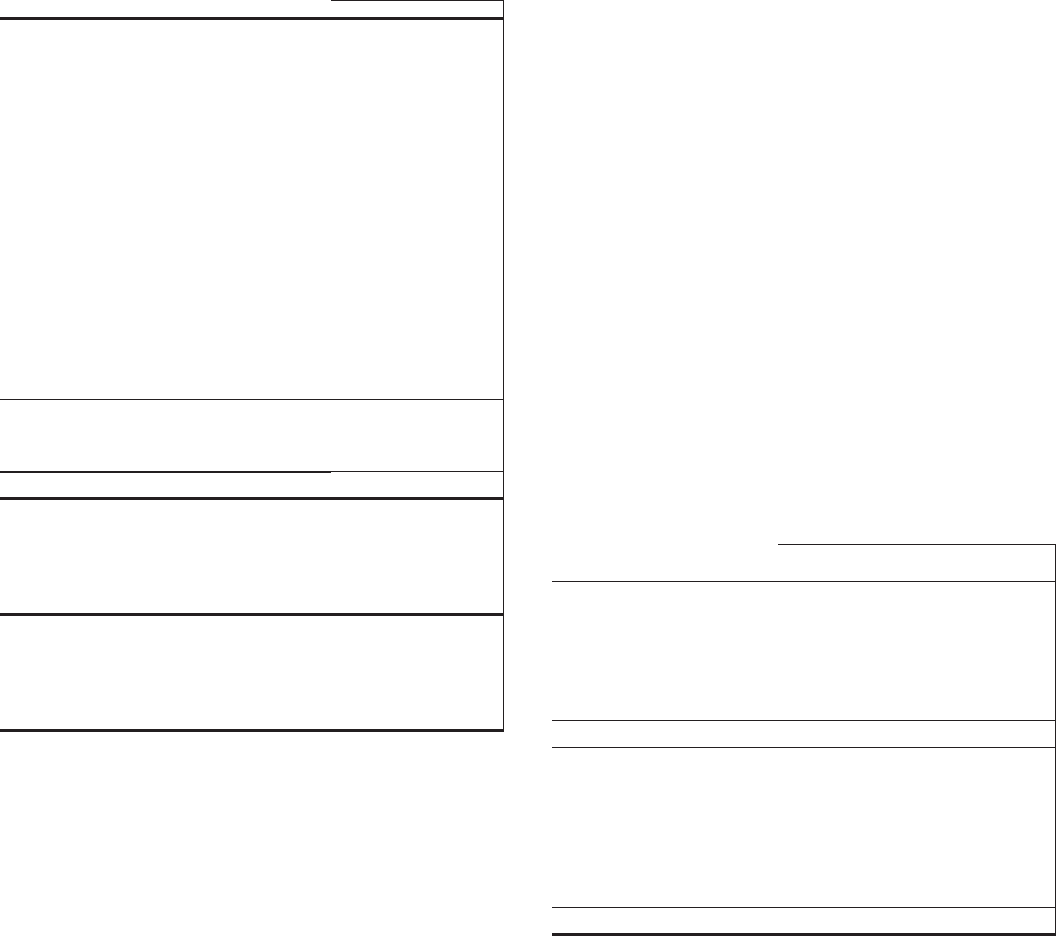

Risk-Based Capital

December 31 - dollars in millions 2006 2005

Capital components

Shareholders’ equity

Common $10,781 $8,555

Preferred 78

Trust preferred capital securities 965 1,417

Minority interest 494 291

Goodwill and other intangibles (net of

eligible deferred taxes) (3,540) (4,122)

Pension, other postretirement and

postemployment benefit plan

adjustments 148

Net unrealized securities losses 91 240

Net unrealized losses (gains) on cash

flow hedge derivatives 13 26

Equity investments in nonfinancial

companies (30) (40)

Other, net (5) (11)

Tier 1 risk-based capital 8,924 6,364

Subordinated debt 1,954 2,216

Eligible allowance for credit losses 681 697

Total risk-based capital $11,559 $9,277

Assets

Risk-weighted assets, including

off-balance-sheet instruments and

market risk equivalent assets $85,539 $76,673

Adjusted average total assets 95,590 88,329

Capital ratios

Tier 1 risk-based 10.4% 8.3%

Total risk-based 13.5 12.1

Leverage 9.3 7.2

Tangible common 7.4 5.0

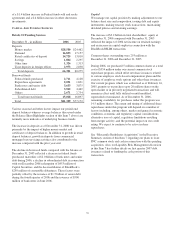

The access to, and cost of, funding new business initiatives

including acquisitions, the ability to engage in expanded

business activities, the ability to pay dividends, the level of

deposit insurance costs, and the level and nature of regulatory

oversight depend, in part, on a financial institution’s capital

strength. The increases in the capital ratios at December 31,

2006 compared with the ratios at December 31, 2005 were

primarily caused by the $1.6 billion increase in capital

recognized in the third quarter of 2006 related to the

BlackRock/MLIM transaction, partially offset by asset

growth.

At December 31, 2006 and December 31, 2005, each of our

bank subsidiaries was considered “well capitalized” based on

regulatory capital ratio requirements. See the Supervision And

Regulation section of Item 1 of this Report and Note 4

Regulatory Matters in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional information.

We believe our bank subsidiaries will continue to meet these

requirements in 2007.

O

FF

-B

ALANCE

S

HEET

A

RRANGEMENTS

A

ND

VIE

S

We engage in a variety of activities that involve

unconsolidated entities or that are otherwise not reflected in

our Consolidated Balance Sheet that are generally referred to

as “off-balance sheet arrangements.” The following sections

of this Report provide further information on these types of

activities:

• Commitments, including contractual obligations and

other commitments, included within the Risk

Management section of this Item 7, and

• Note 24 Commitments and Guarantees in the Notes

To Consolidated Financial Statements included in

Item 8 of this Report.

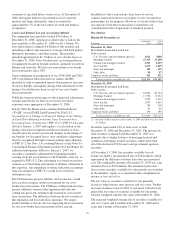

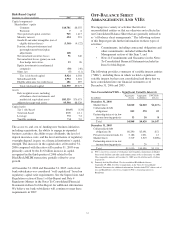

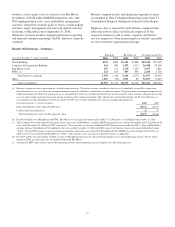

The following provides a summary of variable interest entities

(“VIEs”), including those in which we hold a significant

variable interest but have not consolidated and those that we

have consolidated into our financial statements as of

December 31, 2006 and 2005.

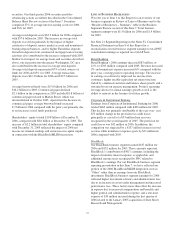

Non-Consolidated VIEs – Significant Variable Interests

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC Risk

of Loss

December 31, 2006

Market Street $4,020 $4,020 $6,117(a)

Collateralized debt

obligations 815 570 22

Partnership interests in low

income housing projects 33 30 8

Total $4,868 $4,620 $6,147

December 31, 2005

Collateralized debt

obligations (b) $6,290 $5,491 $51

Private investment funds (b) 5,186 1,051 13

Market Street 3,519 3,519 5,089(a)

Partnership interests in low

income housing projects 35 29 2

Total $15,030 $10,090 $5,155

(a) PNC’s risk of loss consists of off-balance sheet liquidity commitments to Market

Street of $5.6 billion and other credit enhancements of $.6 at December 31, 2006.

The comparable amounts at December 31, 2005 were $4.6 billion and $.4 billion,

respectively.

(b) Primarily held by BlackRock. We deconsolidated BlackRock effective

September 29, 2006. See Note 2 Acquisitions in the Notes To Consolidated

Financial Statements for additional information. Includes both PNC’s direct risk of

loss and BlackRock’s risk of loss, limited to PNC’s ownership interest in

BlackRock.

31