PNC Bank 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reports to the Chief Risk Officer. Corporate Audit also

provides an independent assessment of the effectiveness of the

credit risk management process.

Nonperforming, Past Due And Potential Problem Assets

See the Nonperforming Assets And Related Information table

in the Statistical Information (Unaudited) section of Item 8 of

this Report and included here by reference for details of the

types of nonperforming assets that we held at December 31,

2006, 2005, 2004, 2003 and 2002. In addition, certain

performing assets that have interest payments that are past due

or have the potential for future repayment problems.

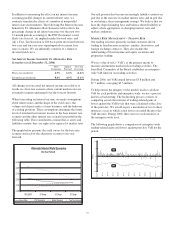

Total nonperforming assets at December 31, 2006 decreased

$45 million, to $171 million, compared with the prior

year-end as nonperforming loans declined $43 million in the

comparison.

The amount of nonperforming loans that was current as to

principal and interest was $59 million at December 31, 2006

and $115 million at December 31, 2005. While we believe that

overall asset quality will remain strong for the near term, the

current level of asset quality is not sustainable for the

foreseeable future.

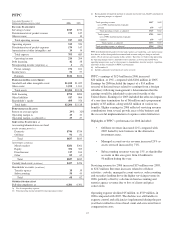

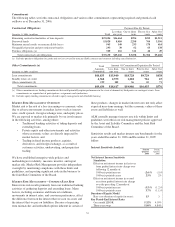

Nonperforming Assets By Business

In millions

December 31

2006

December 31

2005

Retail Banking $106 $90

Corporate & Institutional Banking 63 124

Other 22

Total nonperforming assets $171 $216

Change In Nonperforming Assets

In millions 2006 2005

January 1 $216 $175

Transferred from accrual 225 340

Returned to performing (17) (10)

Principal reductions and payoffs (116) (183)

Asset sales (17) (16)

Charge-offs and valuation adjustments (120) (90)

December 31 $171 $216

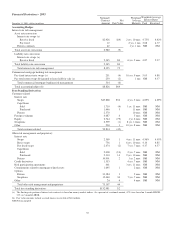

Accruing Loans And Loans Held For Sale Past Due 90 Days

Or More

Amount

Percent of Total

Outstandings

Dollars in millions

Dec. 31

2006

Dec. 31

2005

Dec. 31

2006

Dec. 31

2005

Commercial $9 $12 .04% .06%

Commercial real estate 52.14 .06

Consumer 28 22 .17 .14

Residential mortgage 710 .11 .14

Other 1 .27

Total loans 50 46 .10 .09

Loans held for sale 947 .38 1.92

Total loans and

loans held for sale $59 $93 .11% .18%

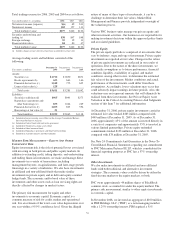

Loans that are not included in nonperforming or past due

categories but cause us to be uncertain about the borrower’s

ability to comply with existing repayment terms over the next

six months totaled $41 million at December 31, 2006,

compared with $67 million at December 31, 2005.

Approximately 59% of these loans are in the Corporate &

Institutional Banking portfolio.

Allowances For Loan And Lease Losses And Unfunded

Loan Commitments And Letters Of Credit

We maintain an allowance for loan and lease losses to absorb

losses from the loan portfolio. We determine the allowance

based on quarterly assessments of the probable estimated

losses inherent in the loan portfolio. While we make

allocations to specific loans and pools of loans, the total

reserve is available for all loan and lease losses.

In addition to the allowance for loan and lease losses, we

maintain an allowance for unfunded loan commitments and

letters of credit. We report this allowance as a liability on our

Consolidated Balance Sheet. We determine this amount using

estimates of the probability of the ultimate funding and losses

related to those credit exposures. This methodology is similar

to the one we use for determining the adequacy of our

allowance for loan and lease losses.

We refer you to Note 8 Asset Quality in the Notes To

Consolidated Financial Statements in Item 8 of this Report

regarding changes in the allowance for loan and lease losses

and in the allowance for unfunded loan commitments and

letters of credit. Also see the Allocation Of Allowance For

Loan And Lease Losses table in the Statistical Information

(Unaudited) section of Item 8 of this Report for additional

information included herein by reference.

We establish specific allowances for loans considered

impaired using a method prescribed by SFAS 114,

49