PNC Bank 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

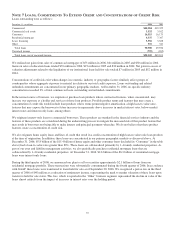

•Insurance Claims. In March 2005, we settled our

claim against one of our insurers under our Executive

Blended Risk insurance coverage related to our

contribution of $90 million to the Restitution Fund.

Under this settlement, the insurer has paid us $11.25

million, but we are obligated to return this amount if

the settlement of the consolidated class action

referred to above does not receive court approval

does not become effective or becomes unenforceable.

The amount of this settlement will not be recognized

in our income statement until the potential obligation

to return the funds has been eliminated. This

settlement was in addition to settlements with

AISLIC in December 2004 and with another of our

insurers under the Executive Blended Risk policy in

January 2005.

•Other Claims. In connection with the settlement of

the consolidated class action, the claims of IFS on

behalf of our Incentive Savings Plan and its

participants are being resolved and the class covered

by the settlement has been expanded to include

participants in the Plan. The Department of Labor is

not, however, a party to this settlement and thus the

settlement does not necessarily resolve its

investigation. In addition, the derivative claims

asserted by one of our putative shareholders and any

other derivative demands that may be filed in

connection with the PAGIC transactions are being

resolved as a result of the settlement of the

consolidated class action.

•Releases. We are releasing the insurers providing our

Executive Blended Risk insurance coverage from any

further liability to PNC arising out of the events that

gave rise to the consolidated class action, except for

the claims against these insurers (other than those

with whom we have settled) relating to the $90

million payment to the Restitution Fund. In addition,

PNC and AIG are releasing each other with respect to

all claims between us arising out of the PAGIC

transactions.

We will be responsible for the costs of administering the

settlement and the Restitution Fund and may incur additional

costs in the future in connection with the advancement of

expenses and/or indemnification obligations related to the

subject matter of this lawsuit. We do not expect such costs to

be material.

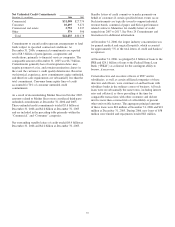

In connection with industry-wide investigations of practices in

the mutual fund industry including market timing, late day

trading, employee trading in mutual funds and other matters,

several of our subsidiaries have received requests for

information and other inquiries from state and federal

governmental and regulatory authorities. These subsidiaries

are fully cooperating in all of these matters. In addition, as a

result of the regulated nature of our business and that of a

number of our subsidiaries, particularly in the banking and

securities areas, we and our subsidiaries are the subject from

time to time of investigations and other forms of regulatory

inquiry, often as part of industry-wide regulatory reviews of

specified activities. Our practice is to cooperate fully with

these investigations and inquiries.

In addition to the proceedings or other matters described

above, PNC and persons to whom we may have

indemnification obligations, in the normal course of business,

are subject to various other pending and threatened legal

proceedings in which claims for monetary damages and other

relief are asserted. We do not anticipate, at the present time,

that the ultimate aggregate liability, if any, arising out of such

other legal proceedings will have a material adverse effect on

our financial position. However, we cannot now determine

whether or not any claims asserted against us or others to

whom we may have indemnification obligations, whether in

the proceedings or other matters specifically described above

or otherwise, will have a material adverse effect on our results

of operations in any future reporting period.

88