PNC Bank 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

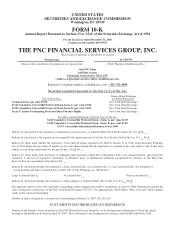

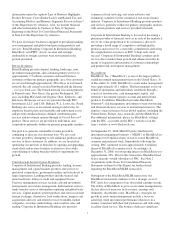

TABLE OF CONTENTS

PART I Page

Item 1 Business. 2

Item 1A Risk Factors. 9

Item 1B Unresolved Staff Comments. 12

Item 2 Properties. 12

Item 3 Legal Proceedings. 12

Item 4 Submission of Matters to a Vote of Security

Holders. 15

Executive Officers of the Registrant 15

Directors of the Registrant 16

PART II

Item 5 Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer

Purchases of Equity Securities. 16

Common Stock Performance Graph 17

Item 6 Selected Financial Data. 18

Item 7 Management’s Discussion and Analysis of

Financial Condition and Results of

Operations. 20

Item 7A Quantitative and Qualitative Disclosures

About Market Risk. 67

Item 8 Financial Statements and Supplementary

Data. 67

Item 9 Changes in and Disagreements With

Accountants on Accounting and Financial

Disclosure. 123

Item 9A Controls and Procedures. 123

Item 9B Other Information. 124

PART III

Item 10 Directors, Executive Officers and Corporate

Governance. 124

Item 11 Executive Compensation. 125

Item 12 Security Ownership of Certain Beneficial

Owners and Management and Related

Stockholder Matters. 125

Item 13 Certain Relationships and Related

Transactions, and Director Independence. 126

Item 14 Principal Accounting Fees and Services. 126

PART IV

Item 15 Exhibits, Financial Statement Schedules. 126

SIGNATURES 127

EXHIBIT INDEX E-1

PART I

Forward-Looking Statements: From time to time The PNC

Financial Services Group, Inc. (“PNC” or the “Corporation”)

has made and may continue to make written or oral forward-

looking statements regarding our outlook or expectations for

earnings, revenues, expenses, capital levels, asset quality or

other future financial or business performance, strategies or

expectations, or the impact of legal, regulatory or supervisory

matters on our business operations or performance. This

Annual Report on Form 10-K (the “Report” or “Form 10-K”)

also includes forward-looking statements. With respect to all

such forward-looking statements, you should review our Risk

Factors discussion in Item 1A and our Cautionary Statement

Regarding Forward-Looking Information included in Item 7 of

this Report.

ITEM

1–

BUSINESS

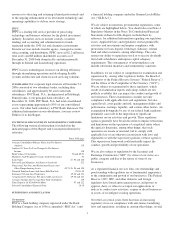

BUSINESS OVERVIEW

We are one of the largest diversified

financial services companies in the United States based on

assets, with businesses engaged in retail banking, corporate

and institutional banking, asset management and global fund

processing services. We provide many of our products and

services nationally and others in our primary geographic

markets located in Pennsylvania; New Jersey; the greater

Washington, DC area, including Maryland and Virginia; Ohio;

Kentucky; and Delaware. We also provide certain global fund

processing services internationally. At December 31, 2006,

our consolidated total assets, deposits and shareholders’ equity

were $101.8 billion, $66.3 billion and $10.8 billion,

respectively.

We were incorporated under the laws of the Commonwealth

of Pennsylvania in 1983 with the consolidation of Pittsburgh

National Corporation and Provident National Corporation.

Since 1983, we have diversified our geographical presence,

business mix and product capabilities through internal growth,

strategic bank and non-bank acquisitions and equity

investments, and the formation of various non-banking

subsidiaries.

On October 8, 2006, we entered into a definitive agreement

with Mercantile Bankshares Corporation (“Mercantile”) for

PNC to acquire Mercantile. Mercantile shareholders will be

entitled to .4184 shares of PNC common stock and $16.45 in

cash for each share of Mercantile, or in the aggregate

approximately 53 million shares of PNC common stock and

$2.1 billion in cash. Based on PNC’s recent stock prices, this

transaction is valued at approximately $6.0 billion in the

aggregate.

Mercantile is a bank holding company with approximately

$18 billion in assets that provides banking and investment and

wealth management services through 240 offices in Maryland,

Virginia, the District of Columbia, Delaware and southeastern

Pennsylvania. The transaction is expected to close in March

2007 and is subject to customary closing conditions, including

regulatory approvals.

We acquired Riggs National Corporation (“Riggs”), a

Washington, DC based banking company, effective May 13,

2005. Under the terms of the agreement, Riggs merged into

The PNC Financial Services Group, Inc. and PNC Bank,

National Association (“PNC Bank, N.A.”), our principal bank

subsidiary, acquired substantially all of the assets of Riggs

Bank, N.A., the principal banking subsidiary of Riggs.

We include information on significant recent acquisitions in

Note 2 Acquisitions in the Notes To Consolidated Financial

Statements in Item 8 of this Report and here by reference.

REVIEW OF LINES OF BUSINESS

In addition to the following

information relating to our lines of business, we incorporate

2