PNC Bank 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fixed income instruments. Plan fiduciaries determine and

review the plan’s investment policy.

We calculate the expense associated with the pension plan in

accordance with SFAS 87, “Employers’ Accounting for

Pensions,” and we use assumptions and methods that are

compatible with the requirements of SFAS 87, including a

policy of reflecting trust assets at their fair market value. On

an annual basis, we review the actuarial assumptions related to

the pension plan, including the discount rate, rate of

compensation increase and the expected return on plan assets.

Neither the discount rate nor the compensation increase

assumptions significantly affect pension expense.

The expected long-term return on assets assumption does

significantly affect pension expense. We decreased the

expected long-term return on plan assets from the 8.50% used

for 2005 to 8.25% for determining net periodic pension cost

for 2006. Under current accounting rules, the difference

between expected long-term returns and actual returns is

accumulated and amortized to pension expense over future

periods. Each one percentage point difference in actual return

compared with our expected return causes expense in the

following year to change by approximately $3 million.

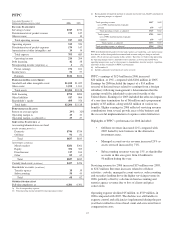

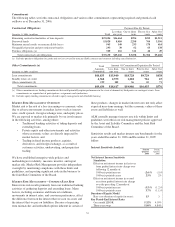

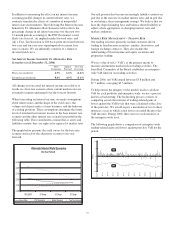

The table below reflects the estimated effects on pension

expense of certain changes in assumptions, using 2007

estimated expense as a baseline.

Change in Assumption

Estimated

Increase to 2007

Pension

Expense

(In millions)

.5% decrease in discount rate $2

.5% decrease in expected long-term return on

assets $8

.5% increase in compensation rate $2

We currently estimate a pretax pension benefit of $33 million

in 2007 compared with a pretax benefit of $12 million in

2006.

In September 2006, the FASB issued SFAS 158, “Employers’

Accounting for Defined Benefit Pension and Other

Postretirement Plans – an amendment of FASB Statements

No. 87, 88, 106 and 132 (R).” This statement affects the

accounting and reporting for our qualified pension plan, our

nonqualified retirement plans, our postretirement welfare

benefit plans, and our postemployment benefit plans. SFAS

158 requires recognition on the balance sheet of the over- or

underfunded position of these plans as the difference between

the fair value of plan assets and the related benefit obligations.

To the extent that a plan’s net funded status differs from the

amounts currently recognized on the balance sheet, the

difference, net of tax, will be recorded as a part of

accumulated other comprehensive income or loss (“AOCI”)

within the shareholders’ equity section of the balance sheet.

This guidance also requires the recognition of any

unrecognized actuarial gains and losses and unrecognized

prior services costs to AOCI, net of tax. Post-adoption

changes in unrecognized actuarial gains and losses as well as

unrecognized prior service costs will be recognized in other

comprehensive income, net of tax. The year-end 2006

adjustment to our plans’ funded status for all unamortized net

actuarial losses and prior service costs was $132 million after

tax. SFAS 158 was effective for PNC as of December 31,

2006, with no restatements permitted for prior year-end

reporting periods.

Plan asset investment performance has the most impact on

contribution requirements. However, contribution

requirements are not particularly sensitive to actuarial

assumptions. Investment performance will drive the amount of

permitted contributions in future years. Also, current law,

including the provisions of the Pension Protection Act of

2006, sets limits as to both minimum and maximum

contributions to the plan. In any event, any large near-term

contributions to the plan will be at our discretion, as we expect

that the minimum required contributions under the law will be

minimal or zero for several years.

During the second quarter of 2005, we acquired a frozen

defined benefit pension plan as a result of the Riggs

acquisition. Plan assets and projected benefit obligations of

the Riggs plan were approximately $107 million and

$116 million, respectively, at acquisition date. The $9 million

funding deficit was recognized as part of the Riggs acquisition

purchase price allocation. For determining contribution

amounts to the plan, deficits are calculated using ERISA-

mandated rules, and on this basis we contributed

approximately $16 million to the Riggs plan during the third

quarter of 2005. We integrated the Riggs plan into the PNC

plan on December 30, 2005.

We maintain other defined benefit plans that have a less

significant effect on financial results, including various

nonqualified supplemental retirement plans for certain

employees. See Note 17 Employee Benefit Plans in the Notes

To Consolidated Financial Statements in Item 8 of this Report

for additional information.

R

ISK

M

ANAGEMENT

We encounter risk as part of the normal course of our business

and we design risk management processes to help manage

these risks. This Risk Management section first provides an

overview of the risk measurement, control strategies, and

monitoring aspects of our corporate-level risk management

processes. Following that discussion is an analysis of the risk

management process for what we view as our primary areas of

risk: credit, operational, liquidity, and market. The discussion

of market risk is further subdivided into interest rate, trading,

and equity and other investment risk areas. Our use of

financial derivatives as part of our overall asset and liability

47