PNC Bank 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For 2004, 2005 and the nine months ended September 30,

2006, our Consolidated Income Statement included our former

69%-71% ownership interest in BlackRock’s net income

through the BlackRock/MLIM transaction closing date.

However, beginning September 30, 2006, our Consolidated

Balance Sheet no longer reflected the consolidation of

BlackRock’s balance sheet but recognized our 34% ownership

interest in BlackRock as an investment accounted for under

the equity method. Our share of BlackRock’s net income is

now reported within asset management noninterest income in

our Consolidated Income Statement.

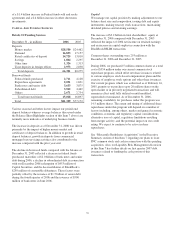

PFPC

PFPC’s earnings of $124 million in 2006 increased

$20 million, or 19%, compared with $104 million in 2005.

Earnings for 2006 included the impact of a $14 million

reversal of deferred taxes related to earnings from a foreign

subsidiary following management’s determination that the

earnings would be indefinitely reinvested outside of the

United States. Earnings for 2005 included the after-tax impact

of a one-time termination fee of $6 million and a prepayment

penalty of $5 million, along with $4 million of various tax

benefits. Higher earnings in 2006 reflected servicing revenue

contributions from several growth areas of the business and

the successful implementation of expense control initiatives.

Other

“Other” earnings for 2006 totaled $1.1 billion, while “Other”

2005 was a net loss of $93 million. “Other” earnings for 2006

included the $1.3 billion after-tax gain on the BlackRock/

MLIM transaction recorded in the third quarter of 2006,

partially offset by the impact of charges related to the

following, on an after-tax basis:

• Third quarter 2006 balance sheet repositioning

activities amounting to $158 million, and

• BlackRock/MLIM integration costs of $47 million.

“Other” for 2005 included the impact of implementation costs

related to the One PNC initiative totaling $35 million after-

tax, net securities losses of $27 million after-tax, and Riggs

acquisition integration costs totaling $20 million after-tax.

These factors were partially offset by the first quarter 2005

benefit recognized from a $45 million deferred tax liability

reversal related to the internal transfer of our investment in

BlackRock as described above under Summary Financial

Results.

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

N

ET

I

NTEREST

I

NCOME

-O

VERVIEW

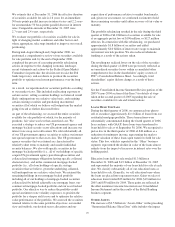

Changes in net interest income and margin result from the

interaction of the volume and composition of interest-earning

assets and related yields, interest-bearing liabilities and related

rates paid, and noninterest-bearing sources.

See Statistical Information – Analysis of Year-To-Year

Changes In Net Interest Income and Average Consolidated

Balance Sheet and Net Interest Analysis in Item 8 of this

Report for additional information.

N

ET

I

NTEREST

I

NCOME

- GAAP R

ECONCILIATION

The interest income earned on certain assets is completely or

partially exempt from federal income tax. As such, these

tax-exempt instruments typically yield lower returns than a

taxable investment. To provide more meaningful comparisons

of yields and margins for all interest-earning assets, we also

provide net interest income on a taxable-equivalent basis by

increasing the interest income earned on tax-exempt assets to

make it fully equivalent to interest income earned on other

taxable investments. This adjustment is not permitted under

GAAP.

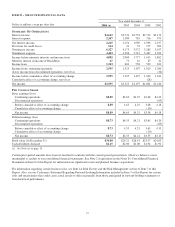

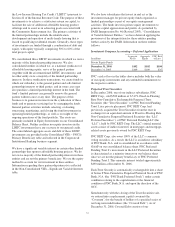

A reconciliation of net interest income as reported in the

Consolidated Income Statement (GAAP basis) to net interest

income on a taxable-equivalent basis follows (in millions):

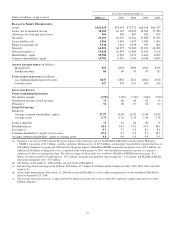

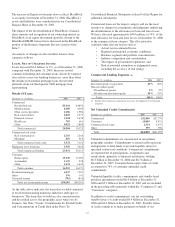

For the year ended December 31,

2006 2005 2004

Net interest income, GAAP basis $2,245 $2,154 $1,969

Taxable-equivalent adjustment 25 33 20

Net interest income, taxable-

equivalent basis $2,270 $2,187 $1,989

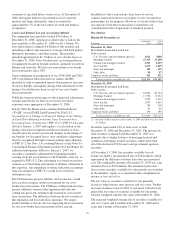

Taxable-equivalent net interest income increased $83 million,

or 4%, in 2006 compared with 2005. The increase reflected

the impact of the 6% increase in average interest-earning

assets during 2006 partially offset by a decline in the net

interest margin as further described below.

N

ET

I

NTEREST

M

ARGIN

The net interest margin was 2.92% in 2006 compared with

3.00% for 2005, an 8 basis point decline. The following

factors contributed to the decline in net interest margin in

2006:

• An increase in the average rate paid on interest-

bearing deposits of 104 basis points for 2006

compared with the 2005 period. The average rate

paid on money market accounts, the largest single

component of interest-bearing deposits, increased

111 basis points.

• An increase in the average rate paid on borrowed

funds of 147 basis points for 2006 compared with

2005.

23