PNC Bank 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

behalf of our Incentive Savings Plan and its

participants are being resolved and the class covered

by the settlement has been expanded to include

participants in the Plan. The Department of Labor is

not, however, a party to this settlement and thus the

settlement does not necessarily resolve its

investigation. In addition, the derivative claims

asserted by one of our putative shareholders and any

other derivative demands that may be filed in

connection with the PAGIC transactions are being

resolved as a result of the settlement of the

consolidated class action.

•Releases. We are releasing the insurers providing our

Executive Blended Risk insurance coverage from any

further liability to PNC arising out of the events that

gave rise to the consolidated class action, except for

the claims against these insurers (other than those

with whom we have settled) relating to the $90

million payment to the Restitution Fund. In addition,

PNC and AIG are releasing each other with respect to

all claims between us arising out of the PAGIC

transactions.

We will be responsible for the costs of administering the

settlement and the Restitution Fund and may incur additional

costs in the future in connection with the advancement of

expenses and/or indemnification obligations related to the

subject matter of this lawsuit. We do not expect such costs to

be material.

In connection with industry-wide investigations of practices in

the mutual fund industry including market timing, late day

trading, employee trading in mutual funds and other matters,

several of our subsidiaries have received requests for

information and other inquiries from state and federal

governmental and regulatory authorities. These subsidiaries

are fully cooperating in all of these matters. In addition, as a

result of the regulated nature of our business and that of a

number of our subsidiaries, particularly in the banking and

securities areas, we and our subsidiaries are the subject from

time to time of investigations and other forms of regulatory

inquiry, often as part of industry-wide regulatory reviews of

specified activities. Our practice is to cooperate fully with

these investigations and inquiries.

In addition to the proceedings or other matters described

above, PNC and persons to whom we may have

indemnification obligations, in the normal course of business,

are subject to various other pending and threatened legal

proceedings in which claims for monetary damages and other

relief are asserted. We do not anticipate, at the present time,

that the ultimate aggregate liability, if any, arising out of such

other legal proceedings will have a material adverse effect on

our financial position. However, we cannot now determine

whether or not any claims asserted against us or others to

whom we may have indemnification obligations, whether in

the proceedings or other matters specifically described above

or otherwise, will have a material adverse effect on our results

of operations in any future reporting period.

ITEM

4–

SUBMISSION OF MATTERS TO A VOTE OF

SECURITY HOLDERS

None during the fourth quarter of 2006.

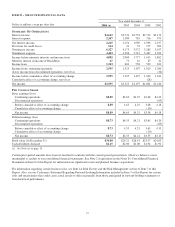

EXECUTIVE OFFICERS OF THE REGISTRANT

Information

regarding each of our executive officers as of February 16,

2007 is set forth below. Executive officers do not have a

stated term of office. Each executive officer has held the

position or positions indicated or another executive position

with the same entity or one of its affiliates for the past five

years unless otherwise indicated below.

Name Age Position with PNC

Year

Employed(1)

James E. Rohr 58 Chairman and Chief

Executive Officer (2)

1972

Joseph C. Guyaux 56 President 1972

William S. Demchak 44 Vice Chairman 2002

William C. Mutterperl 60 Vice Chairman 2002

Timothy G. Shack 56 Executive Vice President

and Chief Information

Officer

1976

Thomas K. Whitford 50 Executive Vice President

and Chief Risk Officer

1983

Michael J. Hannon 50 Senior Vice President

and Chief Credit

Policy Officer

1982

Richard J. Johnson 50 Senior Vice President

and Chief Financial

Officer

2002

Samuel R. Patterson 48 Senior Vice President

and Controller

1986

Helen P. Pudlin 57 Senior Vice President

and General Counsel

1989

John J. Wixted, Jr. 55 Senior Vice President

and Chief Compliance

and Regulatory

Officer

2002

(1) Where applicable, refers to year employed by predecessor company.

(2) Also serves as a director of PNC.

William S. Demchak joined PNC as Vice Chairman and Chief

Financial Officer in September 2002. In August 2005, he took

on additional oversight responsibilities for the Corporation’s

Corporate & Institutional Banking business and continued to

oversee PNC’s asset and liability management and equity

management activities while transitioning the responsibilities

of Chief Financial Officer to Richard J. Johnson. From 1997

to 2002, he served as Global Head of Structured Finance and

Credit Portfolio for J.P. Morgan Chase & Co.

15