PNC Bank 2006 Annual Report Download - page 48

Download and view the complete annual report

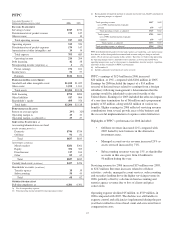

Please find page 48 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.balances per account. Two features of the new product line,

free access to ATMs worldwide and a first time overdraft fee

waiver, will, however, negatively impact growth rates on

service charges on deposits fee income and noninterest

expenses.

Full-time employees at December 31, 2006 totaled 9,549, a

decline of 130 from December 31, 2005. Part-time employees

have increased by 712 since December 31, 2005. The decline

in full-time employees and increase in part-time employees is

a direct result of various customer service enhancement and

efficiency initiatives. These initiatives include utilizing more

part-time customer-facing employees during peak business

hours versus full-time employees for the entire day.

We have adopted a relationship-based lending strategy to

target specific customer sectors (homeowners, small

businesses and auto dealerships) while seeking to maintain a

moderate risk profile in the loan portfolio.

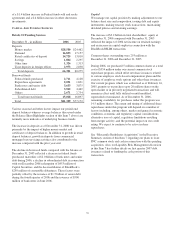

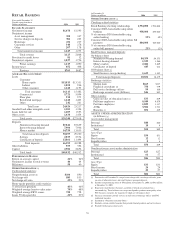

• Average commercial loans grew $627 million, or 12%,

on the strength of increased loan demand from existing

small business customers and the acquisition of new

relationships through our sales efforts.

• Average home equity loans grew by $462 million, or 3%,

compared with 2005. Consumer loan demand has slowed

as a result of the current rate environment.

• Average indirect loans grew $116 million, or 12%,

compared with 2005. The indirect auto business benefited

from increased sales and marketing efforts.

• Average residential mortgage loans increased

$35 million, or 2%, primarily due to the addition of loans

from our new greater Washington, DC area market.

Payoffs in our existing portfolio, which will continue

throughout 2007, reduced the impact of the additional

loans acquired. Additionally, our transfer of residential

mortgages to held for sale and subsequent sale of those

loans at the end of September reduced the size of this

loan portfolio.

Growing core checking deposits as a lower cost-funding

source and as the cornerstone product to build customer

relationships is the primary objective of our deposit strategy.

Average total deposits increased $3.1 billion, or 7%,

compared with 2005. The deposit growth was driven by

increases in the number of checking relationships and the

recapture of consumer certificate of deposit balances as

interest rates have risen.

During the current rate environment, we expect the rate of

growth in demand deposit balances to be equal to or less than

the rate of overall growth for customer checking relationships.

Additionally, we expect to see customers shift their funds

from lower yielding interest-bearing deposits to higher

yielding deposits or investment products, and to pay off loans.

The shift has been evident during the past year and has

impacted the level of average demand deposits in that period.

• Certificates of deposits increased $2.4 billion and money

market deposits increased $1.1 billion. These increases

were attributable to the current interest rate environment

attracting customers back into these products.

• Average demand deposit growth of $162 million, or 1%,

was impacted by customers shifting funds into higher

yielding deposits, small business sweep checking

products, and investment products.

• Small business and consumer-related checking

relationships retention remained strong and stable.

Consumer-related checking relationship retention has

benefited from improved penetration rates of debit cards,

online banking and online bill payment.

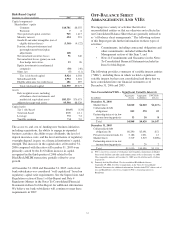

Assets under management of $54 billion at December 31,

2006 increased $5 billion compared with the balance at

December 31, 2005. Asset growth was driven by the effect of

comparatively higher equity markets combined with a

breakeven position in client net asset flows. Client net asset

flows are the result of investment additions from new and

existing clients net of ordinary course distributions from trust

and investment management accounts and account closures.

Nondiscretionary assets under administration of $86 billion at

December 31, 2006 increased $2 billion compared with the

balance at December 31, 2005. The effect of comparatively

higher equity markets was partially offset by the loss of one

significant master custody account and a sizeable reduction of

another client account with minimal earnings impact.

38