PNC Bank 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

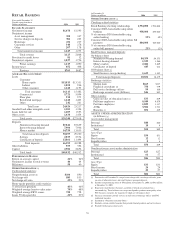

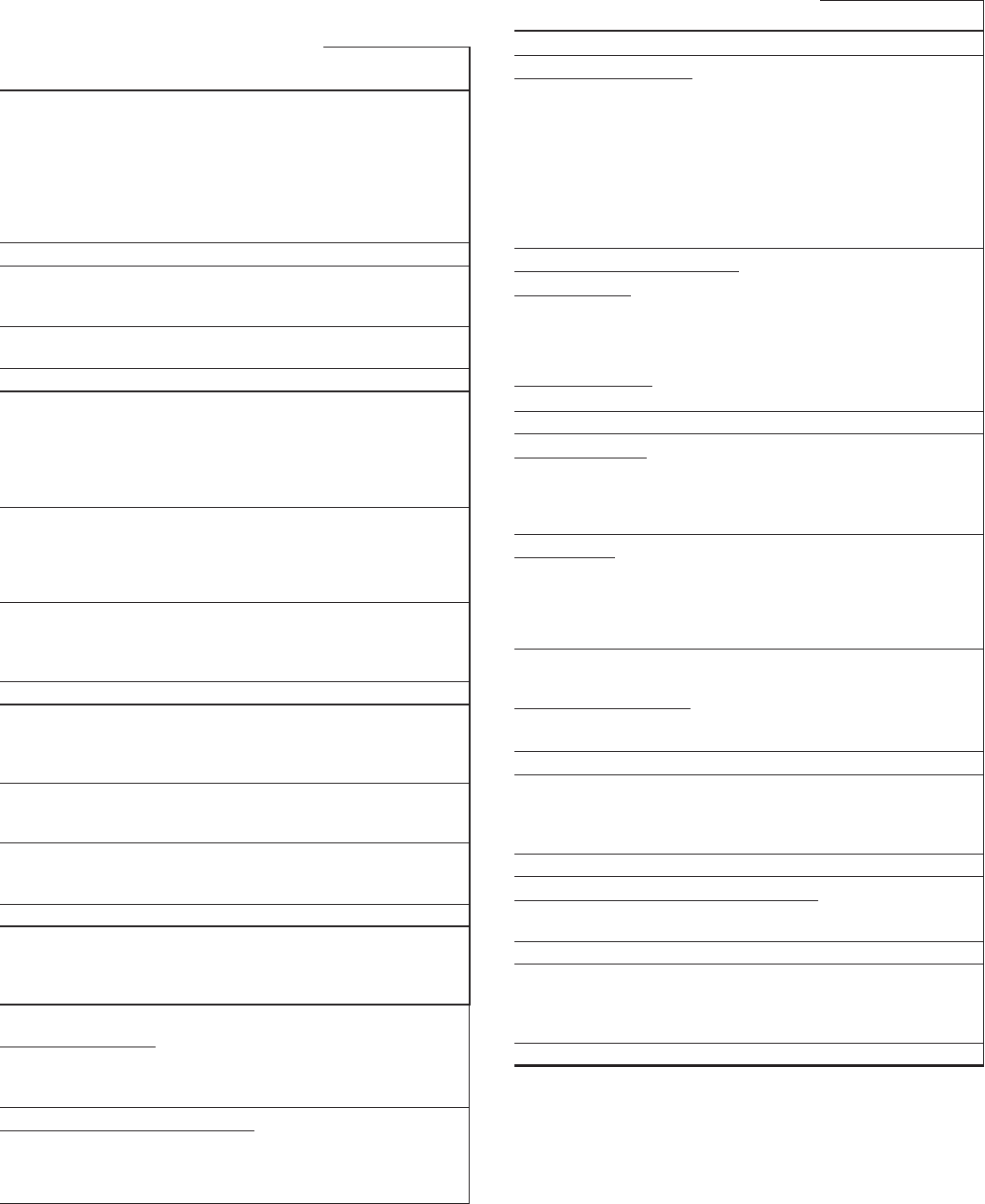

R

ETAIL

B

ANKING

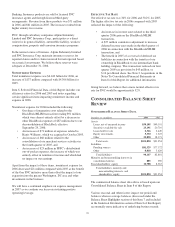

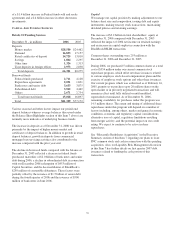

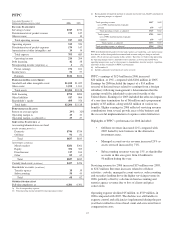

Year ended December 31

Taxable-equivalent basis

Dollars in millions 2006 2005

I

NCOME

S

TATEMENT

Net interest income $1,678 $1,593

Noninterest income

Asset management 352 337

Service charges on deposits 304 265

Brokerage 236 217

Consumer services 348 278

Other 207 178

Total noninterest income 1,447 1,275

Total revenue 3,125 2,868

Provision for credit losses 81 52

Noninterest expense 1,827 1,726

Pretax earnings 1,217 1,090

Income taxes 452 408

Earnings $765 $682

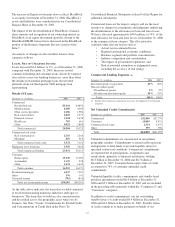

A

VERAGE

B

ALANCE

S

HEET

Loans

Consumer

Home equity $13,813 $13,351

Indirect 1,052 936

Other consumer 1,248 1,195

Total consumer 16,113 15,482

Commercial 5,721 5,094

Floor plan 910 975

Residential mortgage 1,440 1,405

Other 242 261

Total loans 24,426 23,217

Goodwill and other intangible assets 1,581 1,394

Loans held for sale 1,607 1,553

Other assets 1,634 1,454

Total assets $29,248 $27,618

Deposits

Noninterest-bearing demand $7,841 $7,639

Interest-bearing demand 7,906 7,946

Money market 14,750 13,635

Total transaction deposits 30,497 29,220

Savings 2,035 2,574

Certificates of deposit 13,861 11,494

Total deposits 46,393 43,288

Other liabilities 553 392

Capital 2,986 2,852

Total funds $49,932 $46,532

P

ERFORMANCE

R

ATIOS

Return on average capital 26% 24%

Noninterest income to total revenue 46 44

Efficiency 58 60

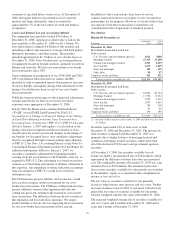

O

THER

I

NFORMATION

(a)

Credit-related statistics:

Nonperforming assets (b) $106 $90

Net charge-offs $85 $53

Net charge-off ratio .35% .23%

Home equity portfolio credit statistics:

% of first lien positions 43% 46%

Weighted average loan-to-value ratios 70% 68%

Weighted average FICO scores 728 728

Loans 90 days past due .24% .21%

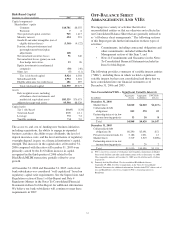

At December 31

Dollars in millions 2006 2005

O

THER

I

NFORMATION

(a)

Checking-related statistics:

Retail Banking checking relationships 1,954,000 1,934,000

Consumer DDA households using online

banking 938,000 855,000

% of consumer DDA households using

online banking 53% 49%

Consumer DDA households using online bill

payment 404,000 205,000

% of consumer DDA households using

online bill payment 23% 12%

Small business managed deposits:

On-balance sheet

Noninterest-bearing demand $4,359 $4,353

Interest-bearing demand 1,529 1,560

Money market 2,684 2,849

Certificates of deposit 645 412

Off-balance sheet (c)

Small business sweep checking 1,619 1,305

Total managed deposits 10,836 10,479

Brokerage statistics:

Margin loans $163 $217

Financial consultants (d) 758 779

Full service brokerage offices 99 100

Brokerage account assets (billions) $46 $42

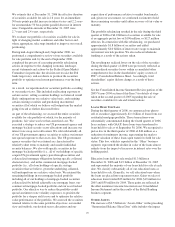

Other statistics:

Gains on sales of education loans (e) $33 $19

Full-time employees 9,549 9,679

Part time employees 1,829 1,117

ATMs 3,581 3,721

Branches (f) 852 839

ASSETS UNDER ADMINISTRATION

(in billions) (g)

Assets under management

Personal $44 $40

Institutional 10 9

Total $54 $49

Asset Type

Equity $34 $31

Fixed income 12 12

Liquidity/other 86

Total $54 $49

Nondiscretionary assets under administration

Personal $25 $27

Institutional 61 57

Total $86 $84

Asset Type

Equity $33 $33

Fixed income 24 24

Liquidity/other 29 27

Total $86 $84

(a) Presented as of December 31 except for net charge-offs, net charge-off ratio, gains

on sales of education loans, and small business managed deposits.

(b) Includes nonperforming loans of $96 million at December 31, 2006 and $81 million

at December 31, 2005.

(c) Represents small business balances, a portion of which are calculated on a

one-month lag. These balances are swept into liquidity products managed by other

PNC business segments, the majority of which are off-balance sheet.

(d) Financial consultants provide services in full service brokerage offices and PNC

traditional branches.

(e) Included in “Noninterest income-Other.”

(f) Excludes certain satellite branches that provide limited products and service hours.

(g) Excludes brokerage account assets.

36