PNC Bank 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

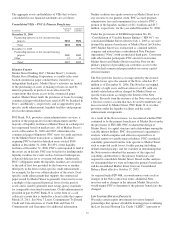

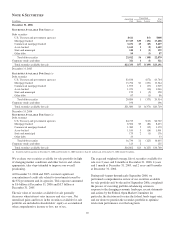

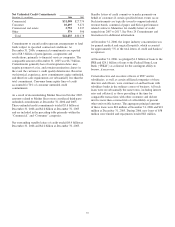

The aggregate assets and liabilities of VIEs that we have

consolidated in our financial statements are as follows:

Consolidated VIEs – PNC Is Primary Beneficiary

In millions

Aggregate

Assets

Aggregate

Liabilities

December 31, 2006

Partnership interests in low income housing

projects $834 $834

Total $834 $834

December 31, 2005

Partnership interests in low income housing

projects $680 $680

Other 12 10

Total $692 $690

M

ARKET

S

TREET

Market Street Funding LLC (“Market Street”), formerly

Market Street Funding Corporation, is a multi-seller asset-

backed commercial paper conduit that is owned by an

independent third party. Market Street’s activities are limited

to the purchasing of assets or making of loans secured by

interests primarily in pools of receivables from US

corporations that desire access to the commercial paper

market. Market Street funds the purchases or loans by issuing

commercial paper which has been rated A1/P1 by Standard &

Poor’s and Moody’s, respectively, and is supported by pool-

specific credit enhancement, liquidity facilities and program-

level credit enhancement.

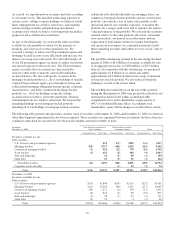

PNC Bank, N.A. provides certain administrative services, a

portion of the program-level credit enhancement and the

majority of liquidity facilities to Market Street in exchange for

fees negotiated based on market rates. All of Market Street’s

assets at December 31, 2006 and 2005 collateralize the

commercial paper obligations. PNC views its credit exposure

for the Market Street transactions as limited. Facilities

requiring PNC to fund for defaulted assets totaled $850

million at December 31, 2006. For 85% of the liquidity

facilities at December 31, 2006, PNC is not required to fund if

the assets are in default. PNC may be liable for funding under

liquidity facilities for events such as borrower bankruptcies,

collateral deficiencies or covenant violations. Additionally,

PNC’s obligations under the liquidity facilities are secondary

to the risk of first loss provided by the borrower or another

third party in the form of deal-specific credit enhancement –

for example, by the over collateralization of the assets. Deal-

specific credit enhancement that supports the commercial

paper issued by Market Street is generally structured to cover

a multiple of the expected historical losses for the pool of

assets and is sized to generally meet rating agency standards

for comparably structured transactions. Credit enhancement is

provided in part by PNC Bank, N.A. in the form of a cash

collateral account that is funded by a loan facility that expires

March 25, 2011. See Note 7 Loans, Commitments To Extend

Credit and Concentrations of Credit Risk and Note 24

Commitments and Guarantees for additional information.

Neither creditors nor equity investors in Market Street have

any recourse to our general credit. PNC accrued program

administrator fees and commitment fees related to PNC’s

portion of the liquidity facilities of $11.3 million and $3.7

million, respectively, for the year ended December 31, 2006.

Under the provisions of FASB Interpretation No. 46,

“Consolidation of Variable Interest Entities (“FIN 46”), we

consolidated Market Street effective July 1, 2003 as we were

deemed the primary beneficiary of Market Street. In October

2005, Market Street was restructured as a limited liability

company and entered into a subordinated Note Purchase

Agreement (“Note”) with an unrelated third party. Consistent

with other market participants PNC elected to restructure

Market Street and Market Street issued the Note for the

primary purpose of providing our customers access to the

asset-backed commercial paper markets in a more capital-

efficient manner.

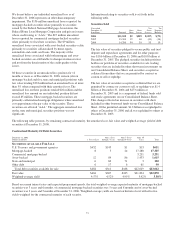

The Note provides first loss coverage whereby the investor

absorbs losses up to the amount of the Note, which is $5.7

million as of December 31, 2006. The Note has an original

maturity of eight years and bears interest at 18% with any

default-related interest/fees charged by Market Street on

specific transactions accruing to the benefit of the Note

holder. Proceeds from the issuance of the Note were placed in

a first loss reserve account that may be used to reimburse any

losses incurred by Market Street, PNC Bank, N.A. or other

providers under the liquidity facilities and the credit

enhancement arrangements.

As a result of the Note issuance, we reevaluated whether PNC

continued to be the primary beneficiary of Market Street under

the provisions of FIN 46R. PNC evaluated the design of

Market Street, its capital structure and relationships among the

variable interest holders. PNC also performed a quantitative

analysis, which computes and allocates expected loss or

residual returns to variable interest holders. PNC considered

variability generated from the risks specific to Market Street

such as expected credit losses, facility pricing (including

default-related pricing), and fee volatility in determining that

the Note investor absorbed the majority of the expected

variability and therefore is the primary beneficiary and

required to consolidate Market Street. Based on this analysis,

we determined that we were no longer the primary beneficiary

and deconsolidated Market Street from our Consolidated

Balance Sheet effective October 17, 2005.

As required under FIN 46R, reconsideration events such as

changes in the Note contractual terms, additional Note

investors and or changes in the inherent Market Street risks

would trigger PNC to determine if the primary beneficiary has

changed.

L

OW

I

NCOME

H

OUSING

P

ROJECTS

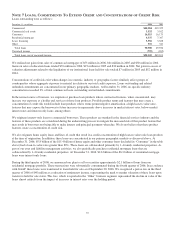

We make certain equity investments in various limited

partnerships that sponsor affordable housing projects utilizing

the Low Income Housing Tax Credit (“LIHTC”) pursuant to

83