PNC Bank 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

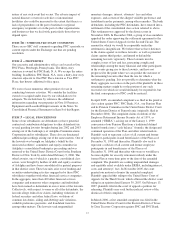

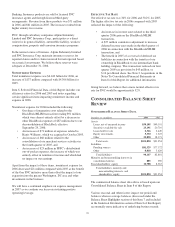

ITEM

6-

SELECTED FINANCIAL DATA

Year ended December 31

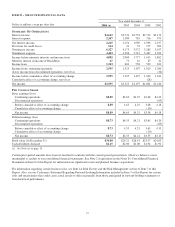

Dollars in millions, except per share data 2006 (a) 2005 2004 2003 2002

S

UMMARY

O

F

O

PERATIONS

Interest income $4,612 $3,734 $2,752 $2,712 $3,172

Interest expense 2,367 1,580 783 716 975

Net interest income 2,245 2,154 1,969 1,996 2,197

Provision for credit losses 124 21 52 177 309

Noninterest income 6,327 4,173 3,572 3,263 3,197

Noninterest expense 4,443 4,306 3,712 3,467 3,223

Income before minority interests and income taxes 4,005 2,000 1,777 1,615 1,862

Minority interest in income of BlackRock 47 71 42 47 41

Income taxes 1,363 604 538 539 621

Income from continuing operations 2,595 1,325 1,197 1,029 1,200

(Loss) income from discontinued operations, net of tax (16)

Income before cumulative effect of accounting change 2,595 1,325 1,197 1,029 1,184

Cumulative effect of accounting change, net of tax (28)

Net income $2,595 $1,325 $1,197 $1,001 $1,184

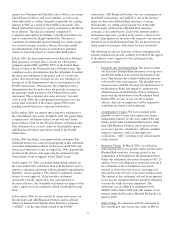

P

ER

C

OMMON

S

HARE

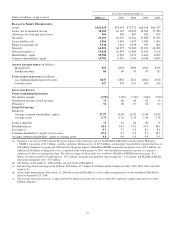

Basic earnings (loss)

Continuing operations $8.89 $4.63 $4.25 $3.68 $4.23

Discontinued operations (.05)

Before cumulative effect of accounting change 8.89 4.63 4.25 3.68 4.18

Cumulative effect of accounting change (.10)

Net income $8.89 $4.63 $4.25 $3.58 $4.18

Diluted earnings (loss)

Continuing operations $8.73 $4.55 $4.21 $3.65 $4.20

Discontinued operations (.05)

Before cumulative effect of accounting change 8.73 4.55 4.21 3.65 4.15

Cumulative effect of accounting change (.10)

Net income $8.73 $4.55 $4.21 $3.55 $4.15

Book value (At December 31) $36.80 $29.21 $26.41 $23.97 $24.03

Cash dividends declared $2.15 $2.00 $2.00 $1.94 $1.92

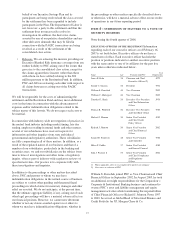

(a) See Note (a) on page 19.

Certain prior-period amounts have been reclassified to conform with the current period presentation, which we believe is more

meaningful to readers of our consolidated financial statements. See Note 2 Acquisitions in the Notes To Consolidated Financial

Statements in Item 8 of this Report for information on significant recent and planned business acquisitions.

For information regarding certain business risks, see Item 1A Risk Factors and the Risk Management section of Item 7 of this

Report. Also, see our Cautionary Statement Regarding Forward-Looking Information included in Item 7 of this Report for certain

risks and uncertainties that could cause actual results to differ materially from those anticipated in forward-looking statements or

from historical performance.

18