PNC Bank 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

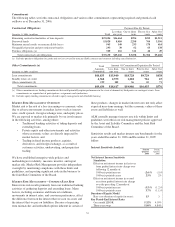

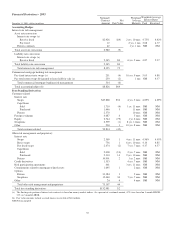

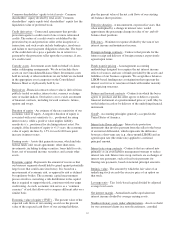

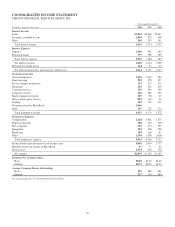

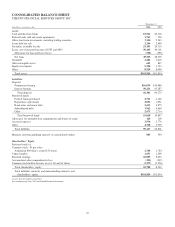

Financial Derivatives - 2005

December 31, 2005 - dollars in millions

Notional/

Contract

Amount

Net

Fair Value

Weighted

Average

Maturity

Weighted-Average

Interest Rates

Paid Received

Accounting Hedges

Interest rate risk management

Asset rate conversion

Interest rate swaps (a)

Receive fixed $2,926 $(9) 2 yrs. 10 mos. 4.75% 4.42%

Pay fixed 12 2 yrs. 1 mo. 3.68 4.77

Futures contracts 42 1 yr. 1 mo. NM NM

Total asset rate conversion 2,980 (9)

Liability rate conversion

Interest rate swaps (a)

Receive fixed 5,345 84 6 yrs. 5 mos. 4.87 5.37

Total liability rate conversion 5,345 84

Total interest rate risk management 8,325 75

Commercial mortgage banking risk management

Pay fixed interest rate swaps (a) 251 (4) 10 yrs. 9 mos. 5.05 4.88

Pay total return swaps designated to loans held for sale (a) 250 (2) 1 mo. NM 4.37

Total commercial mortgage banking risk management 501 (6)

Total accounting hedges (b) $8,826 $69

Free-Standing Derivatives

Customer-related

Interest rate

Swaps $43,868 $34 4 yrs. 2 mos. 4.69% 4.69%

Caps/floors

Sold 1,710 (4) 1 yr. 11 mos. NM NM

Purchased 1,446 3 11 mos. NM NM

Futures 2,570 10 mos. NM NM

Foreign exchange 4,687 4 5 mos. NM NM

Equity 2,744 (79) 1 yr. 6 mos. NM NM

Swaptions 2,559 (1) 8 yrs. 11mos. NM NM

Other 230 1 10 yrs. 8 mos. NM NM

Total customer-related 59,814 (42)

Other risk management and proprietary

Interest rate

Swaps 2,369 1 4 yrs. 11 mos. 4.56% 4.65%

Basis swaps 756 1 6 yrs. 10 mos. 4.14 4.85

Pay fixed swaps 2,474 (2) 7 yrs. 7 mos. 4.37 4.57

Caps/floors

Sold 2,000 (10) 2 yrs. 7 mos. NM NM

Purchased 2,310 14 2 yrs. 10 mos. NM NM

Futures 10,901 2 1 yr. 2 mos. NM NM

Credit derivatives 1,353 4 yrs. 7 mos. NM NM

Risk participation agreements 461 3 yrs. 11 mos. NM NM

Commitments related to mortgage-related assets 1,695 1 2 mos. NM NM

Options

Futures 33,384 3 5 mos. NM NM

Swaptions 15,440 30 7 yrs. 7 mos. NM NM

Other 24 4 4 mos. NM NM

Total other risk management and proprietary 73,167 44

Total free-standing derivatives $132,981 $2

(a) The floating rate portion of interest rate contracts is based on money-market indices. As a percent of a notional amount, 67% were based on 1-month LIBOR,

33% on 3-month LIBOR.

(b) Fair value amounts include accrued interest receivable of $81 million.

NM Not meaningful

59