PNC Bank 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

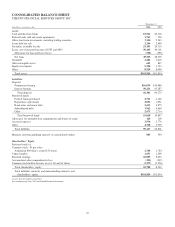

capacity. We do not include these assets on our Consolidated

Balance Sheet.

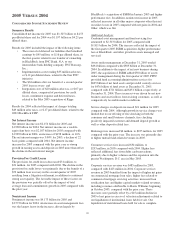

Noninterest income to total revenue - Noninterest income

divided by the sum of net interest income and noninterest

income.

Nonperforming assets - Nonperforming assets include

nonaccrual loans, troubled debt restructured loans, nonaccrual

loans held for sale, foreclosed assets and other assets. We do

not accrue interest income on assets classified as

nonperforming.

Nonperforming loans - Nonperforming loans include loans to

commercial, commercial real estate, equipment lease

financing, consumer, and residential mortgage customers as

well as troubled debt restructured loans. Nonperforming loans

do not include nonaccrual loans held for sale or foreclosed and

other assets. We do not accrue interest income on loans

classified as nonperforming.

Notional amount - A number of currency units, shares, or

other units specified in a derivatives contract.

Operating leverage - The period to period percentage change

in total revenue less the percentage change in noninterest

expense. A positive percentage indicates that revenue growth

exceeded expense growth (i.e., positive operating leverage)

while a negative percentage implies expense growth exceeded

revenue growth (i.e., negative operating leverage).

Options - Contracts that grant the purchaser, for a premium

payment, the right, but not the obligation, to either purchase or

sell the associated financial instrument at a set price during a

period or at a specified date in the future.

Recovery - Cash proceeds received on a loan that we had

previously charged off. We credit the amount received to the

allowance for loan and lease losses.

Return on average capital - Annualized net income divided by

average capital.

Return on average assets - Annualized net income divided by

average assets.

Return on average common equity - Annualized net income

divided by average common shareholders’ equity.

Risk-weighted assets - Primarily computed by the assignment

of specific risk-weights (as defined by The Board of

Governors of the Federal Reserve System) to assets and

off-balance sheet instruments.

Securitization - The process of legally transforming financial

assets into securities.

Swaptions - Contracts that grant the purchaser, for a premium

payment, the right, but not the obligation, to enter into an

interest rate swap agreement during a period or at a specified

date in the future.

Tangible common equity ratio - Period-end common

shareholders’ equity less goodwill and other intangible assets

(net of eligible deferred taxes), and excluding mortgage

servicing rights, divided by period-end assets less goodwill

and other intangible assets (net of eligible deferred taxes), and

excluding mortgage servicing rights.

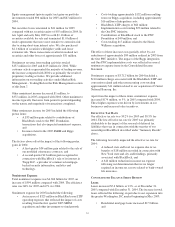

Taxable-equivalent interest - The interest income earned on

certain assets is completely or partially exempt from federal

income tax. As such, these tax-exempt instruments typically

yield lower returns than a taxable asset. To provide more

meaningful comparisons of yields and margins for all interest-

earning assets, we also provide revenue on a taxable-

equivalent basis by increasing the interest income earned on

tax-exempt assets to make it fully equivalent to interest

income earned on other taxable assets. This adjustment is not

permitted under GAAP on the Consolidated Income

Statement.

Tier 1 risk-based capital - Tier 1 risk-based capital equals:

total shareholders’ equity, plus trust preferred capital

securities, plus certain minority interests that are held by

others; less goodwill and certain other intangible assets (net of

eligible deferred taxes), less equity investments in

nonfinancial companies and less net unrealized holding losses

on available-for-sale equity securities. Net unrealized holding

gains on available-for-sale equity securities, net unrealized

holding gains (losses) on available-for-sale debt securities and

net unrealized holding gains (losses) on cash flow hedge

derivatives are excluded from total shareholders’ equity for

tier 1 risk-based capital purposes.

Tier 1 risk-based capital ratio - Tier 1 risk-based capital

divided by period-end risk-weighted assets.

Total fund assets serviced - Total domestic and offshore fund

investment assets for which we provide related processing

services. We do not include these assets on our Consolidated

Balance Sheet.

Total return swap - A non-traditional swap where one party

agrees to pay the other the “total return” of a defined

underlying asset (e.g., a loan), usually in return for receiving a

stream of LIBOR-based cash flows. The total returns of the

asset, including interest and any default shortfall, are passed

through to the counterparty. The counterparty is therefore

assuming the credit and economic risk of the underlying asset.

Total risk-based capital - Tier 1 risk-based capital plus

qualifying subordinated debt and trust preferred securities,

other minority interest not qualified as tier 1, and the

allowance for loan and lease losses, subject to certain

limitations.

64