PNC Bank 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

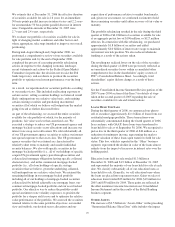

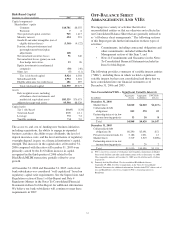

• By comparison, the yield on interest-earning assets

increased only 81 basis points. Loans, the single

largest component, increased 83 basis points.

• These factors were partially offset by the favorable

impact on net interest margin in 2006 of an increase

of 20 basis points related to noninterest-bearing

sources of funding.

The average federal funds rate for 2006 was 4.97% compared

with 3.21% for 2005.

We believe that net interest margins for our industry will

continue to be challenged if the yield curve remains flat or

inverted, as competition for loans and deposits remains

intense, as customers continue to migrate from lower cost to

higher cost deposits or other products and as the benefit of

adding investment securities is diminished.

From PNC’s perspective, we believe that net interest income

will increase and net interest margin will remain relatively

stable in 2007 compared with 2006. However, due to seasonal

factors in the first quarter of the year, we expect that our net

interest margin will be pressured and that our net interest

income will be relatively flat for the first quarter of 2007.

These projections are based on assumptions underlying our

most likely net interest income scenario, which may change

over time.

P

ROVISION

F

OR

C

REDIT

L

OSSES

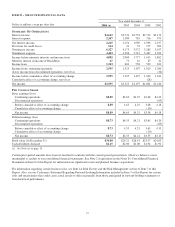

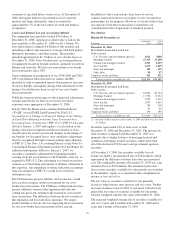

The provision for credit losses was $124 million for 2006

compared with $21 million for 2005. The provision for credit

losses for 2005 included the benefit of a $53 million loan

recovery in the second quarter of that year resulting from a

litigation settlement. In addition to this item, the increase in

the provision for credit losses in 2006 reflected the following

factors:

• The impact of overall loan growth, as average total

loans increased $2.2 billion in 2006 compared with

the prior year;

• The effect of a single large overdraft situation that

occurred during the second quarter of 2006, and

• Growth in unfunded commitments.

We do not expect to sustain asset quality at its current level.

However, based on the assets we currently hold and current

business trends and activities, we believe that overall asset

quality will remain strong by historical standards for at least

the near term. To the extent actual outcomes differ from our

estimates, additional provision for credit losses may be

required that would reduce future earnings.

See the Credit Risk Management portion of the Risk

Management section of this Item 7 for additional information

regarding factors impacting the provision for credit losses.

N

ONINTEREST

I

NCOME

Summary

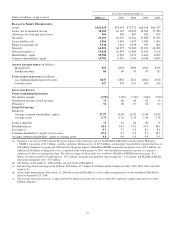

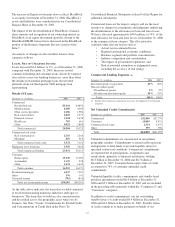

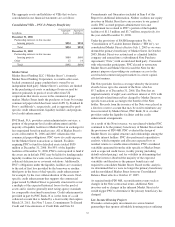

Noninterest income was $6.327 billion for 2006 and

$4.173 billion for 2005. Noninterest income for 2006 included

the impact of the gain on the BlackRock/MLIM transaction,

which totaled $2.078 billion, partially offset by the effects of

our third quarter 2006 balance sheet repositioning activities

that resulted in charges totaling $244 million.

Additional analysis

Asset management fees amounted to $1.420 billion for 2006

and $1.443 billion for 2005, a decline of $23 million. Our

equity income from BlackRock was included in asset

management fees beginning with the fourth quarter of 2006.

Asset management fees for 2005 and the first nine months of

2006 reflected the impact of BlackRock’s revenue on a

consolidated basis.

Assets managed at December 31, 2006 totaled $54 billion

compared with $494 billion at December 31, 2005 and

reflected the deconsolidation of BlackRock effective

September 29, 2006. We refer you to the Retail Banking

section of the Business Segments Review section of this

Item 7 for further discussion of Retail Banking’s assets under

management.

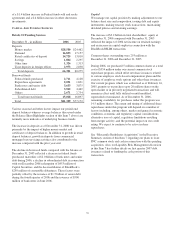

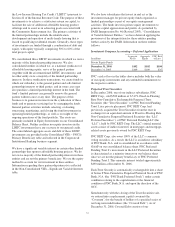

Fund servicing fees increased $23 million in 2006, to

$893 million, compared with $870 million in the prior year.

Included in these amounts were distribution/out-of-pocket

revenue amounts at PFPC totaling $170 million in 2006 and

$147 million in 2005, the impacts of which were offset by

expenses in the same amounts in each year.

PFPC provided fund accounting/administration services for

$837 billion of net fund assets and provided custody services

for $427 billion of fund assets at December 31, 2006,

compared with $835 billion and $476 billion, respectively, at

December 31, 2005. The decrease in custody fund assets at

December 31, 2006 compared with December 31, 2005

resulted primarily from the deconversion of a major client

during the first quarter of 2006, which was partially offset by

new business, asset inflows from existing customers, and

equity market appreciation.

Service charges on deposits increased $40 million, to

$313 million, for 2006 compared with 2005. Customer

growth, expansion of the branch network, including our

expansion into the greater Washington, DC area that began in

May 2005, and various pricing actions resulting from the One

PNC initiative all contributed to the increase in 2006.

Brokerage fees increased $21 million, to $246 million, for

2006 compared with the prior year. The increase was

primarily due to higher annuity income and mutual fund-

related revenues, including favorable production from the

fee-based fund advisory business.

24