PNC Bank 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

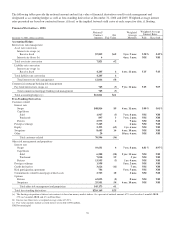

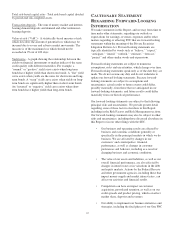

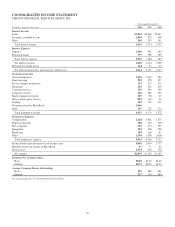

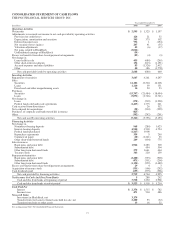

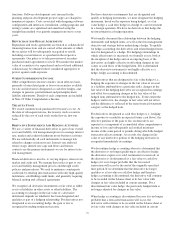

CONSOLIDATED INCOME STATEMENT

THE PNC FINANCIAL SERVICES GROUP, INC.

Year ended December 31

In millions, except per share data 2006 2005 2004

Interest Income

Loans $3,203 $2,669 $2,043

Securities available for sale 1,049 822 568

Other 360 243 141

Total interest income 4,612 3,734 2,752

Interest Expense

Deposits 1,590 981 484

Borrowed funds 777 599 299

Total interest expense 2,367 1,580 783

Net interest income 2,245 2,154 1,969

Provision for credit losses 124 21 52

Net interest income less provision for credit losses 2,121 2,133 1,917

Noninterest Income

Asset management 1,420 1,443 994

Fund servicing 893 870 817

Service charges on deposits 313 273 252

Brokerage 246 225 219

Consumer services 365 293 259

Corporate services 626 485 423

Equity management gains 107 96 67

Net securities gains (losses) (207) (41) 55

Trading 183 157 113

Net gains related to BlackRock 2,066

Other 315 372 373

Total noninterest income 6,327 4,173 3,572

Noninterest Expense

Compensation 2,128 2,061 1,755

Employee benefits 304 332 309

Net occupancy 310 313 267

Equipment 303 296 290

Marketing 104 106 87

Other 1,294 1,198 1,004

Total noninterest expense 4,443 4,306 3,712

Income before minority interest and income taxes 4,005 2,000 1,777

Minority interest in income of BlackRock 47 71 42

Income taxes 1,363 604 538

Net income $2,595 $1,325 $1,197

Earnings Per Common Share

Basic $8.89 $4.63 $4.25

Diluted $8.73 $4.55 $4.21

Average Common Shares Outstanding

Basic 292 286 281

Diluted 297 290 284

See accompanying Notes To Consolidated Financial Statements.

68