PNC Bank 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

E

MPLOYEE

S

TOCK

P

URCHASE

P

LAN

Our ESPP has approximately 1.4 million shares available for

issuance. Full-time employees with six months and part-time

employees with 12 months of continuous employment with us

are eligible to participate in the ESPP at the commencement of

the next six-month offering period. Eligible participants may

purchase our common stock at 95% of the fair market value

on the last day of each six-month offering period. No charge

to earnings is recorded with respect to the ESPP.

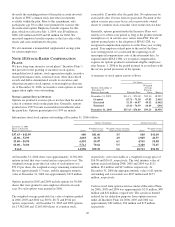

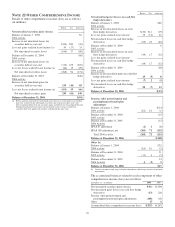

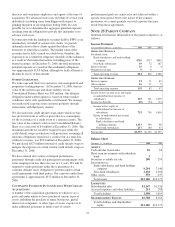

Shares issued pursuant to the ESPP were as follows:

Year ended December 31 Shares Price Per Share

2006 105,041 $66.66 and $70.34

2005 138,754 51.74 and 58.74

2004 156,753 50.43 and 54.57

B

LACK

R

OCK

LTIP P

ROGRAMS

BlackRock adopted the 2002 LTIP program to help attract and

retain qualified professionals. At that time, we agreed to

transfer 4 million of the shares of BlackRock common stock

then held by us to fund the 2002 and future programs

approved by BlackRock’s board of directors, subject to certain

conditions and limitations. Prior to 2006, BlackRock granted

awards under the 2002 LTIP program of approximately $230

million, of which approximately $210 million was paid on

January 30, 2007. The awards were paid approximately 17%

in cash by BlackRock and the remainder in BlackRock

common stock transferred by us to the LTIP participants

(approximately 1 million shares). As permitted under the

award agreements, employees elected to put approximately

95% of the stock portion of the awards back to BlackRock.

These shares were retained by BlackRock as treasury stock.

BlackRock granted additional restricted stock unit awards in

January 2007, all of which are subject to achieving earnings

performance goals prior to the vesting date of September 29,

2011. Of the shares of BlackRock common stock that we have

agreed to transfer to fund their LTIP programs, approximately

1.6 million shares have been committed to fund the restricted

stock unit awards vesting in 2011 and the amount remaining

would then be available for future awards.

We reported noninterest expense of $33 million, $64 million

and $110 million for the years ended December 31, 2006,

2005 and 2004, respectively, related to the BlackRock LTIP

awards. Additionally, noninterest income in the fourth quarter

of 2006 included a $12 million charge related to our

commitment to fund the BlackRock LTIP programs. This

charge represents the mark-to-market of our BlackRock LTIP

obligation as of December 31, 2006 and is a result of the

fourth quarter increase in the market value of BlackRock

common shares.

N

OTE

19 E

ARNINGS

P

ER

S

HARE

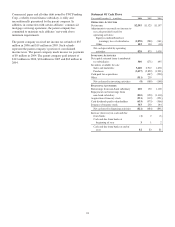

The following table sets forth basic and diluted earnings per common share calculations:

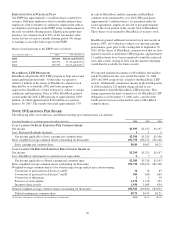

Year ended December 31 - in millions, except share and per share data 2006 2005 2004

C

ALCULATION

O

F

B

ASIC

E

ARNINGS

P

ER

C

OMMON

S

HARE

Net income $2,595 $1,325 $1,197

Less: Preferred dividends declared 111

Net income applicable to basic earnings per common share $2,594 $1,324 $1,196

Basic weighted-average common shares outstanding (in thousands) 291,758 286,276 281,248

Basic earnings per common share $8.89 $4.63 $4.25

C

ALCULATION

O

F

D

ILUTED

E

ARNINGS

P

ER

C

OMMON

S

HARE

(a)

Net income $2,595 $1,325 $1,197

Less: BlackRock adjustment for common stock equivalents 674

Net income applicable to diluted earnings per common share $2,589 $1,318 $1,193

Basic weighted-average common shares outstanding (in thousands) 291,758 286,276 281,248

Weighted-average common shares to be issued using average market price and assuming:

Conversion of preferred stock Series A and B 70 78 85

Conversion of preferred stock Series C and D 584 618 663

Conversion of debentures 2210

Exercise of stock options 2,178 1,178 992

Incentive share awards 1,930 1,688 634

Diluted weighted-average common shares outstanding (in thousands) 296,522 289,840 283,632

Diluted earnings per common share $8.73 $4.55 $4.21

(a) Excludes stock options considered to be anti-dilutive (in thousands) 4,230 10,532 10,762

107