PNC Bank 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

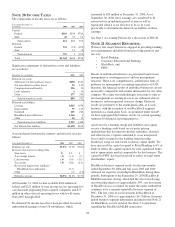

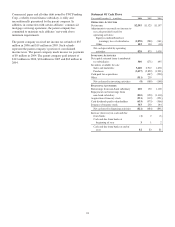

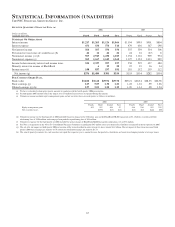

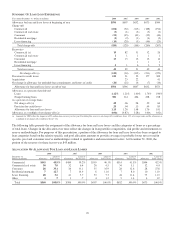

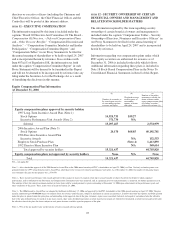

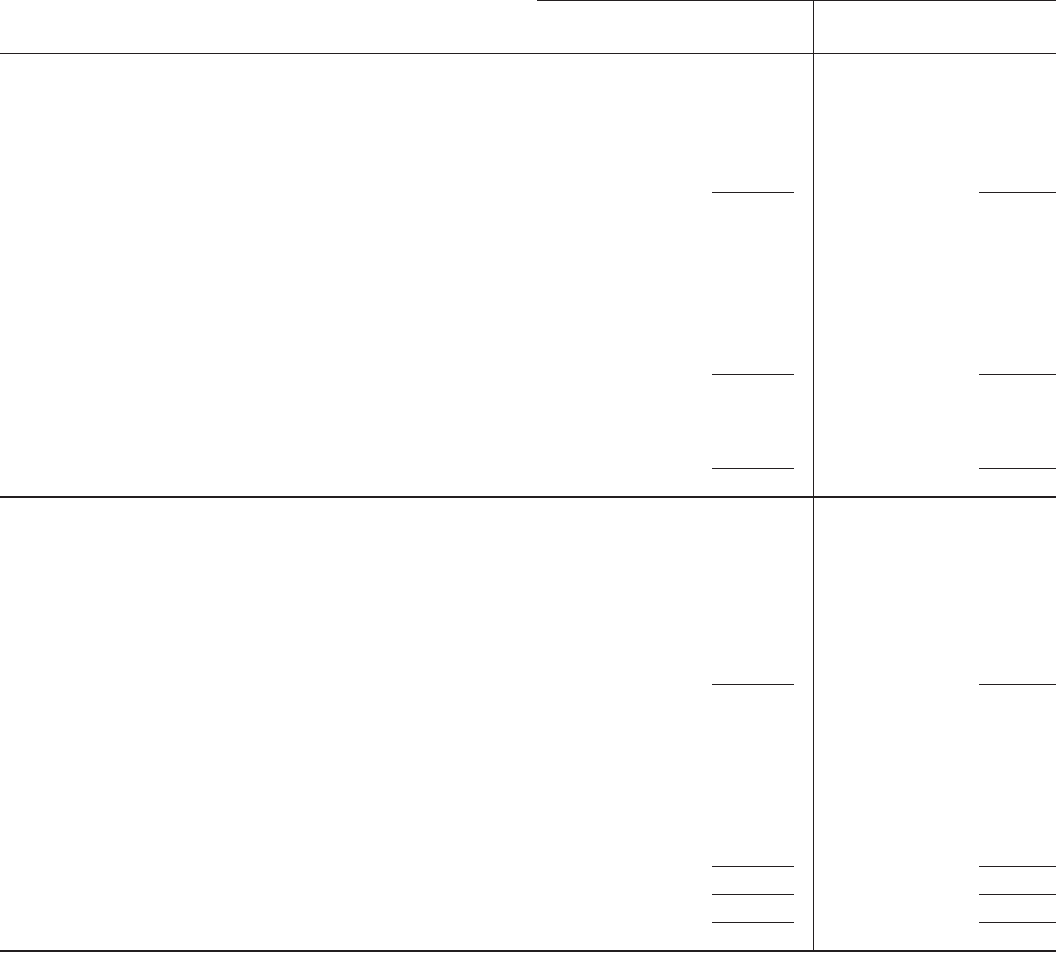

Analysis Of Year-To-Year Changes In Net Interest Income

2006/2005 2005/2004

Increase/(Decrease) in Income/Expense

Due to Changes in:

Increase/(Decrease) in Income/Expense

Due to Changes in:

Taxable-equivalent basis - in millions Volume Rate Total Volume Rate Total

Interest-Earning Assets

Securities available for sale

Mortgage-backed, asset-backed, and other debt $188 $107 $295 $130 $66 $196

U.S. Treasury and government agencies (85) 14 (71) 11 50 61

State and municipal (1) (1) (3) (4) (7)

Corporate stocks and other 4 (2) 2 (3) 5 2

Total securities available for sale 92 133 225 135 117 252

Loans, net of unearned income

Commercial 76 233 309 130 174 304

Commercial real estate 41 33 74 25 31 56

Consumer (5) 109 104 111 66 177

Residential mortgage 41 13 54 110 1 111

Lease financing (8) (1) (9) (23) (1) (24)

Other (5) 9 4 (2) 8 6

Total loans, net of unearned income 129 407 536 345 285 630

Loans held for sale 19 34 53 24 33 57

Federal funds sold and resale agreements 52833 (15) 10 (5)

Other (4) 27 23 60 1 61

Total interest-earning assets $253 $617 $870 $541 $454 $995

Interest-Bearing Liabilities

Interest-bearing deposits

Money market $44 $216 $260 $21 $231 $252

Demand 32 32 12324

Savings (3) (3) (6) 55

Retail certificates of deposit 85 126 211 77 50 127

Other time (8) 15 7 33 33

Time deposits in foreign offices 52 53 105 21 35 56

Total interest-bearing deposits 111 498 609 97 400 497

Borrowed funds

Federal funds purchased 41 45 86 24345

Repurchase agreements 36 36 13 34 47

Bank notes and senior debt (2) 47 45 14 39 53

Subordinated debt 19 53 72 23 35 58

Commercial paper (87) 24 (63) 63844

Other (14) 16 2 45 8 53

Total borrowed funds (46) 224 178 105 195 300

Total interest-bearing liabilities 95 692 787 187 610 797

Change in net interest income $138 $(55) $83 $342 $(144) $198

Changes attributable to rate/volume are prorated into rate and volume components.

118