PNC Bank 2006 Annual Report Download - page 47

Download and view the complete annual report

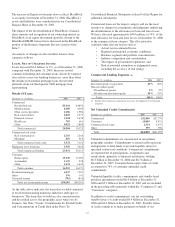

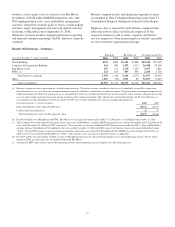

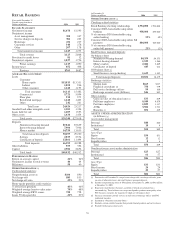

Please find page 47 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Retail Banking’s 2006 earnings increased $83 million, or

12%, to $765 million compared with 2005. Revenue increased

9% and noninterest expense increased 6% compared with the

prior year, creating positive operating leverage. The increase

in earnings was driven by improved fee income from

customers, higher taxable-equivalent net interest income

fueled by continued customer and balance sheet growth, and a

sustained focus on expense management. Retail Banking’s

sustained focus on expense management has allowed for

additional investments in the business as described below.

Highlights of Retail Banking’s performance during 2006

include the following:

• We made the following investments in the business:

– Branch expansion and renovation,

– Expansion of the private client group serving the

mass affluent customer segment,

– Execution on the fourth quarter 2005 purchase of

majority ownership of our merchant services

business, and

– Introduction of a new simplified checking account

line and PNC-branded credit card program.

• Retail Banking’s efficiency ratio improved to 58% in

2006 compared with 60% a year earlier, despite the

investments made in the business.

• Consumer and small business checking relationships

increased 20,000 compared with December 31, 2005.

Checking relationship growth has been mitigated by our

focus on consolidating low-activity and low-balance

accounts, while seeking higher quality deposits. Since the

launch of our new simplified product line, the average

balances of new accounts increased approximately 20%

and account activation is up 5% when compared with the

same period of last year.

• Since December 31, 2005, consumer-related checking

households using online banking increased 10% and

checking households using online bill payment increased

97%.

• The small business area continued its positive

momentum. Average small business loans increased 13%

for the year compared with 2005 on the strength of

increased demand from both existing customers and new

relationships. Small business checking relationships

increased 3%.

• The wealth management business sustained solid growth

over 2005 as asset management fees increased

$15 million, or 4%. Assets under management totaled

$54 billion at December 31, 2006, a 10% increase

compared with December 31, 2005 due to the positive

market impact in the second half of 2006 and increased

sales efforts.

• Customer assets in brokerage accounts totaled $46 billion

at December 31, 2006 compared with $42 billion at

December 31, 2005. Brokerage fees increased

$19 million, or 9%, over the prior year.

• The branch network increased a net 13 branches to a total

of 852 branches at December 31, 2006 compared with

December 31, 2005. This increase was comprised of 24

new branches, offset by 11 branch consolidations. Our

strategy is to continue to optimize our network by

opening new branches in high growth areas, relocating

branches to areas of higher opportunity and cost

efficiency, and consolidating branches in areas of

declining market opportunity. We relocated seven

branches during 2006.

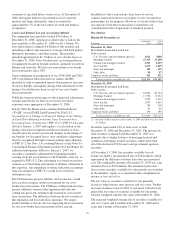

Total revenue for 2006 was $3.125 billion compared with

$2.868 billion for 2005. Taxable-equivalent net interest

income of $1.678 billion increased $85 million, or 5%,

compared with 2005 due to a 7% increase in average deposits

and a 5% increase in average loan balances. Net interest

income growth has been somewhat mitigated by declining

spreads on the loan portfolio. In the current rate environment,

we expect the spread we receive on both loans and deposits to

be under pressure.

Noninterest income increased $172 million, or 13%, compared

with the prior year primarily driven by increased asset

management fees, brokerage fees, consumer services fees and

service charges on deposits. This growth can be attributed

primarily to the following:

• Consolidation of our merchant services activities,

• Customer growth,

• Higher gains on asset sales,

• Comparatively favorable equity markets,

• Increased assets under management,

• Increased brokerage account assets and activities,

• Expansion of the branch network, including our new

greater Washington, DC area market,

• Increased third party loan servicing activities, and

• Various pricing actions resulting from the One PNC

initiative.

The provision for credit losses increased $29 million in 2006

compared with 2005. The increased provision is primarily a

result of a single large overdraft situation and growth within

the commercial loan portfolio.

Noninterest expense for 2006 totaled $1.827 billion, an

increase of $101 million, or 6%, compared with 2005.

Expense increases were primarily attributable to continued

growth of the company’s branch network, including our new

greater Washington, DC area market, the consolidation of

PNC’s merchant services activities, expansion of the private

client group, investments in various initiatives such as the new

simplified checking account product line and new

PNC-branded credit card, and an increase in volume-related

expenses tied to revenue, partially offset by lower staff-related

expense as a result of One PNC initiatives.

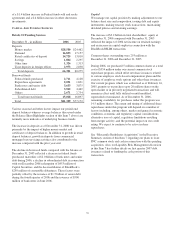

The new simplified checking product line is expected to

continue to increase checking account households and average

37