PNC Bank 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

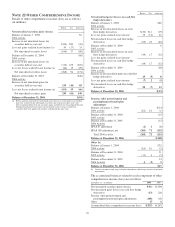

There were no options granted in excess of market value in

2006, 2005 or 2004. Shares of common stock available during

the next year for the granting of options and other awards

under the Incentive Plans were 42,767,760 at December 31,

2006.

During 2006, we issued approximately 4.9 million shares from

treasury stock in connection with stock option exercise

activity. As with past exercise activity, we intend to utilize

treasury stock for future stock option exercises.

As discussed in Note 1 Accounting Policies, we adopted the

fair value recognition provisions of SFAS 123 prospectively

to all employee awards including stock options granted,

modified or settled after January 1, 2003. As permitted under

SFAS 123, we recognized compensation expense for stock

options on a straight-line basis over the pro rata vesting

period. Total compensation expense recognized related to

PNC stock options in 2006 was $31 million compared with

$29 million in 2005 and $21 million in 2004.

P

RO

F

ORMA

E

FFECTS

A table is included in Note 1 Accounting Policies that sets

forth pro forma net income and basic and diluted earnings per

share as if compensation expense had been recognized under

SFAS 123 and 123R, as amended, for stock options for 2006,

2005 and 2004.

For purposes of computing stock option expense and pro

forma results, we estimated the fair value of stock options

using the Black-Scholes option pricing model. The model

requires the use of numerous assumptions, many of which are

very subjective. Therefore, the pro forma results are estimates

of results of operations as if compensation expense had been

recognized for all stock-based compensation awards and are

not indicative of the impact on future periods.

We used the following assumptions in the option pricing

model for purposes of estimating pro forma results as well as

to determine actual stock option expense:

• The risk-free interest rate is based on the US

Treasury yield curve,

• The dividend yield represents average yields over the

previous three-year period,

• Volatility is measured using the fluctuation in

month-end closing stock prices over a five-year

period, and

• The expected life assumption represents the period of

time that options granted are expected to be

outstanding and is based on a weighted-average of

historical option activity.

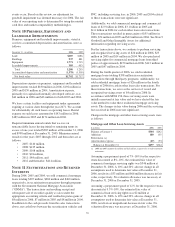

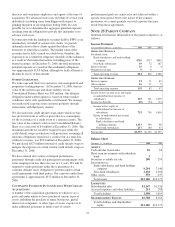

Option Pricing Assumptions

Weighted-average for the year

ended December 31 2006 2005 2004

Risk-free interest rate 4.5% 3.8% 3.4%

Dividend yield 3.7 3.8 3.6

Volatility 20.5 25.7 28.9

Expected life 5.1 yrs. 4.8 yrs. 4.9 yrs.

I

NCENTIVE

/P

ERFORMANCE

U

NIT

S

HARE AND

R

ESTRICTED

S

TOCK

A

WARDS

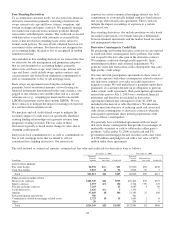

The fair value of nonvested incentive/performance unit shares

and restricted stock awards is initially determined based on the

average of the high and low of our common stock price on the

date of grant. Incentive/performance unit shares are

subsequently valued subject to the achievement of one or

more financial and other performance goals over a three-year

period. The Personnel and Compensation Committee of the

Board of Directors approves the final award of incentive/

performance unit shares. Restricted stock awards have various

vesting periods ranging from 36 months to 60 months. There

are no financial or performance goals associated with any of

our restricted stock awards.

The weighted-average grant-date fair value of incentive share

and restricted stock awards granted in 2006, 2005 and 2004

was $67.36, $53.81 and $54.46 per share, respectively. We

recognize compensation expense for incentive/performance

unit shares and restricted stock awards ratably over the

corresponding vesting and/or performance periods for each

type of program. Total compensation expense recognized

related to PNC incentive/performance unit share and restricted

stock awards during 2006 was approximately $45 million

compared with $44 million in 2005 and $25 million in 2004.

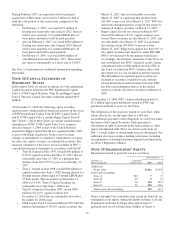

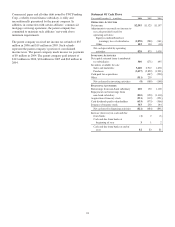

A summary of nonvested incentive/performance unit shares

and restricted stock award activity follows:

Shares in thousands

Nonvested

Incentive/

Performance

Unit Shares

Weighted-

Average

Grant

Date Fair

Value

Nonvested

Restricted

Shares

Weighted-

Average

Grant

Date Fair

Value

Dec. 31, 2005 660 $41.01 2,209 $50.84

Granted 186 69.58 595 64.19

Awarded as restricted (649) 41.02 649 66.95

Vested (917) 53.14

Forfeited (11) 40.51 (111) 53.06

Dec. 31, 2006 186 $69.58 2,425 $57.45

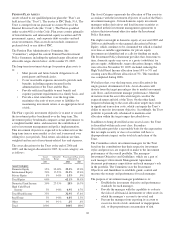

At December 31, 2006, there was $47 million of unrecognized

deferred compensation expense related to nonvested share-

based compensation arrangements granted under the Incentive

Plans. This cost is expected to be recognized as expense over a

period of no longer than five years. The total fair value of

incentive/performance unit share and restricted stock awards

vested during 2006, 2005 and 2004 was approximately $63

million, $3 million and $5 million, respectively.

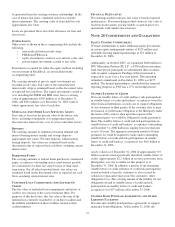

Additionally in 2006, we granted a performance unit incentive

award to a certain senior executive. The grant is share-

denominated with an initial specified target number of 30,000

share units. The potential award is dependent on the

achievement of certain performance criteria over a three-year

period ending December 31, 2008. Final awarded performance

units will be paid only in cash. Total compensation expense

recognized related to this incentive award during 2006 was

approximately $1 million.

106