PNC Bank 2006 Annual Report Download - page 54

Download and view the complete annual report

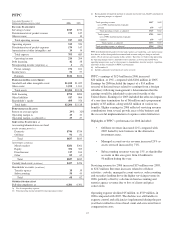

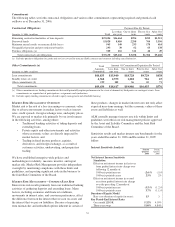

Please find page 54 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The impacts of distribution/out-of-pocket revenue and

expenses entirely offset each other and have no net effect on

PFPC’s earnings. The increases in these line items reflect the

increased 12b-1 fees (marketing, sales and servicing fees

associated with investment funds) during the fourth quarter of

2006 received by PFPC from fund accounts and then passed

on to PFPC’s fund clients as a result of the BlackRock/MLIM

transaction.

The decrease in custody fund assets at December 31, 2006

compared with December 31, 2005 resulted primarily from the

deconversion of a major client during the first quarter of 2006,

which was partially offset by new business, asset inflows from

existing customers, and equity market appreciation.

Subaccounting shareholder accounts serviced by PFPC

increased over the year-earlier period due to net new business

and growth in existing client accounts. Total assets serviced

by PFPC amounted to $2.2 trillion at December 31, 2006 and

$1.9 trillion at December 31, 2005.

C

RITICAL

A

CCOUNTING

P

OLICIES

A

ND

J

UDGMENTS

Our consolidated financial statements are prepared by

applying certain accounting policies. Note 1 Accounting

Policies in the Notes To Consolidated Financial Statements in

Item 8 of this Report describes the most significant accounting

policies that we use. Certain of these policies require us to

make estimates and strategic or economic assumptions that

may prove inaccurate or be subject to variations that may

significantly affect our reported results and financial position

for the period or in future periods.

We must use estimates, assumptions, and judgments when

financial assets and liabilities are required to be recorded at, or

adjusted to reflect, fair value. Assets and liabilities carried at

fair value inherently result in a higher degree of financial

statement volatility. Fair values and the information used to

record valuation adjustments for certain assets and liabilities

are based on either quoted market prices or are provided by

other independent third-party sources, when available. When

such third-party information is not available, we estimate fair

value primarily by using cash flow and other financial

modeling techniques. Changes in underlying factors,

assumptions, or estimates in any of these areas could

materially impact our future financial condition and results of

operations.

Allowances For Loan And Lease Losses And Unfunded

Loan Commitments And Letters Of Credit

We maintain allowances for loan and lease losses and

unfunded loan commitments and letters of credit at levels that

we believe to be adequate to absorb estimated probable credit

losses inherent in the loan portfolio. We determine the

adequacy of the allowances based on periodic evaluations of

the loan and lease portfolios and other relevant factors.

However, this evaluation is inherently subjective as it requires

material estimates, all of which may be susceptible to

significant change, including, among others:

• Expected default probabilities,

• Exposure at default,

• Loss given default,

• Amounts and timing of expected future cash flows on

impaired loans,

• Value of collateral,

• Estimated losses on consumer loans and residential

mortgages, and

• Amounts for changes in economic conditions and

potential estimation or judgmental imprecision.

In determining the adequacy of the allowance for loan and

lease losses, we make specific allocations to significant

impaired loans, to pools of watchlist and nonwatchlist loans

and to consumer and residential mortgage loans. We also

allocate reserves to provide coverage for probable losses not

covered in specific, pool and consumer reserve methodologies

related to qualitative and measurement factors. While

44