PNC Bank 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

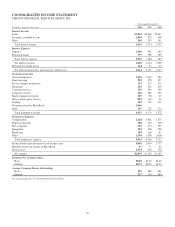

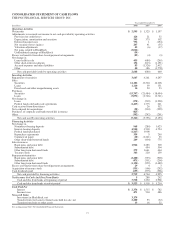

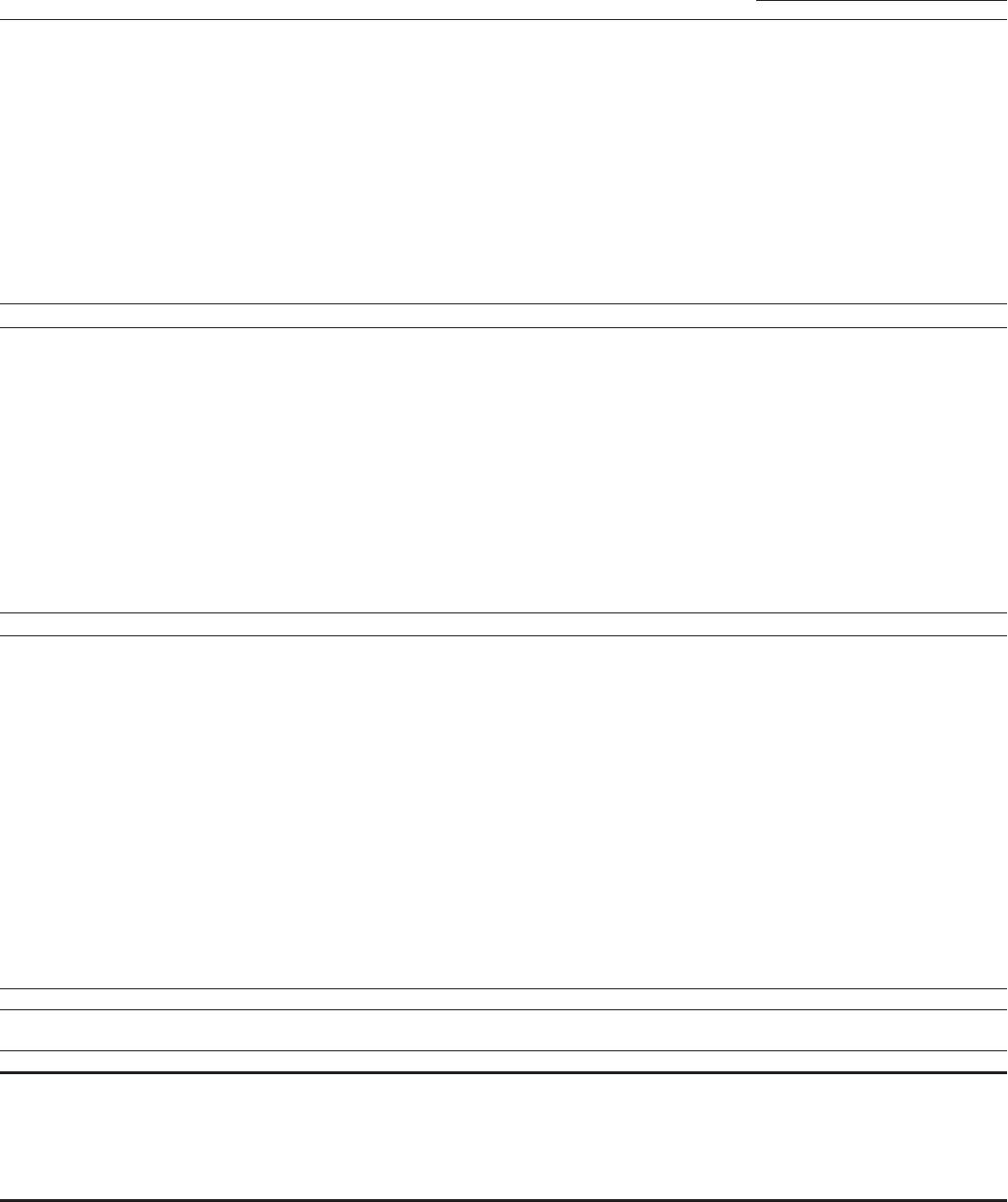

CONSOLIDATED STATEMENT OF CASH FLOWS

THE PNC FINANCIAL SERVICES GROUP, INC.

Year ended December 31

In millions 2006 2005 2004

Operating Activities

Net income $ 2,595 $ 1,325 $ 1,197

Adjustments to reconcile net income to net cash provided by operating activities

Provision for credit losses 124 21 52

Depreciation, amortization and accretion 345 375 302

Deferred income taxes 752 1 (194)

Net securities losses (gains) 207 41 (55)

Valuation adjustments 45 (6) (37)

Net gains related to BlackRock (2,066)

Undistributed earnings of BlackRock (39)

Excess tax benefits from share-based payment arrangements (29) (4) (3)

Net change in

Loans held for sale 435 (680) (265)

Other short-term investments 156 (613) (1,191)

Accrued expenses and other liabilities 83 (1,326) 2,432

Other 40 186 (1,778)

Net cash provided (used) by operating activities 2,648 (680) 460

Investing Activities

Repayment of securities 3,667 4,261 4,297

Sales

Securities 11,102 13,304 14,206

Loans 1,110 39 151

Foreclosed and other nonperforming assets 14 20 23

Purchases

Securities (15,707) (21,484) (18,094)

Loans (3,072) (2,746) (2,741)

Net change in

Loans (278) (219) (3,228)

Federal funds sold and resale agreements (1,413) 1,775 241

Cash received from divestitures 26 512

Net cash paid for acquisitions (58) (530) (299)

Purchases of corporate and bank-owned life insurance (425)

Other (302) (242) (261)

Net cash used by investing activities (5,362) (5,796) (5,193)

Financing Activities

Net change in

Noninterest-bearing deposits 968 (280) 1,023

Interest-bearing deposits 4,940 3,538 4,724

Federal funds purchased (1,417) 3,908

Repurchase agreements 359 5 265

Commercial paper (10) (2,241) 25

Other short-term borrowed funds 249 (404) 775

Sales/issuances

Bank notes and senior debt 1,964 2,285 500

Subordinated debt 494 504

Other long-term borrowed funds 279 1,641 464

Treasury stock 343 220 159

Repayments/maturities

Bank notes and senior debt (2,200) (755) (900)

Subordinated debt (471) (351) (200)

Other long-term borrowed funds (1,150) (559) (1,489)

Excess tax benefits from share-based payment arrangements 29 43

Acquisition of treasury stock (531) (166) (292)

Cash dividends paid (633) (575) (566)

Net cash provided by financing activities 2,719 6,764 4,995

Net Increase In Cash And Due From Banks 5288 262

Cash and due from banks at beginning of period 3,518 3,230 2,968

Cash and due from banks at end of period $ 3,523 $ 3,518 $ 3,230

Cash Paid For

Interest $ 2,376 $ 1,515 $ 782

Income taxes 471 504 486

Non-cash Items

Investment in BlackRock, net 3,179

Transfer from (to) loans to (from) loans held for sale, net 2,280 93 (32)

Transfer from loans to other assets 13 16 22

See accompanying Notes To Consolidated Financial Statements.

71