PNC Bank 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

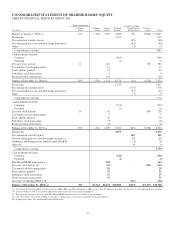

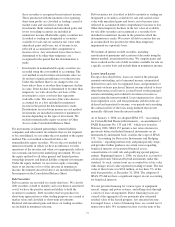

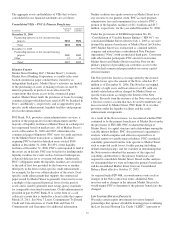

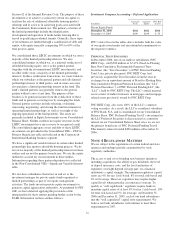

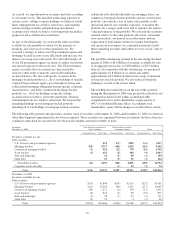

The following table shows the effect on net income and

earnings per share if we had applied the fair value recognition

provisions of SFAS 123, as amended, to all outstanding and

unvested awards in each period.

Pro Forma Net Income And Earnings Per Share

Year ended December 31

In millions, except for per share data 2006 2005 2004

Net income $2,595 $1,325 $1,197

Add: Stock-based employee

compensation expense included in

reported net income, net of related

tax effects 63 54 33

Deduct: Total stock-based employee

compensation expense determined

under the fair value method for all

awards, net of related tax effects (63) (60) (50)

Pro forma net income $2,595 $1,319 $1,180

Earnings per share

Basic-as reported $8.89 $4.63 $4.25

Basic-pro forma 8.89 4.60 4.19

Diluted-as reported $8.73 $4.55 $4.21

Diluted-pro forma 8.73 4.52 4.15

See Note 18 Stock-Based Compensation Plans for additional

information.

R

ECENT

A

CCOUNTING

P

RONOUNCEMENTS

In February 2007, the FASB issued SFAS 159, “The Fair

Value Option for Financial Assets and Financial Liabilities –

Including an amendment of FASB Statement No. 115.” This

statement permits entities to choose to measure many financial

instruments and certain other items at fair value. The fair

value option may be applied on an instrument by instrument

basis with a few exceptions. The election is irrevocable and

must be applied to entire instruments and not to portions of

instruments. For PNC, the election to apply the standard and

measure certain financial instruments at fair value would be

effective prospectively beginning January 1, 2008.

During 2006, the FASB issued the following:

• SFAS 158, “Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Plans – an

amendment of FASB Statements No. 87, 88, 106, and

132(R).” This statement affects the accounting and

reporting for our qualified pension plan, our

nonqualified retirement plans, our postretirement

welfare benefit plans and our postemployment

benefit plan. SFAS 158 requires recognition on the

balance sheet of the over- or underfunded position of

these plans as the difference between the fair value of

plan assets and the related benefit obligations. To the

extent that a plan’s net funded status differs from the

amounts currently recognized on the balance sheet,

the difference, net of tax, will be recorded as part of

accumulated other comprehensive income or loss

(“AOCI”) within the shareholders’ equity section of

the balance sheet. This guidance also requires the

recognition of any unrecognized actuarial gains and

losses and unrecognized prior service costs to AOCI,

net of tax. Post-adoption changes in unrecognized

actuarial gains and losses as well as unrecognized

prior service costs will be recognized in other

comprehensive income, net of tax. SFAS 158 was

effective for PNC as of December 31, 2006, with no

restatements permitted for prior year-end reporting

periods. The year-end 2006 adjustment to our plans’

funded status for all unamortized net actuarial losses

and prior service costs was $132 million after tax.

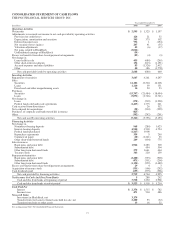

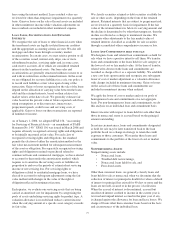

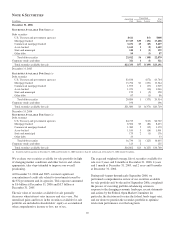

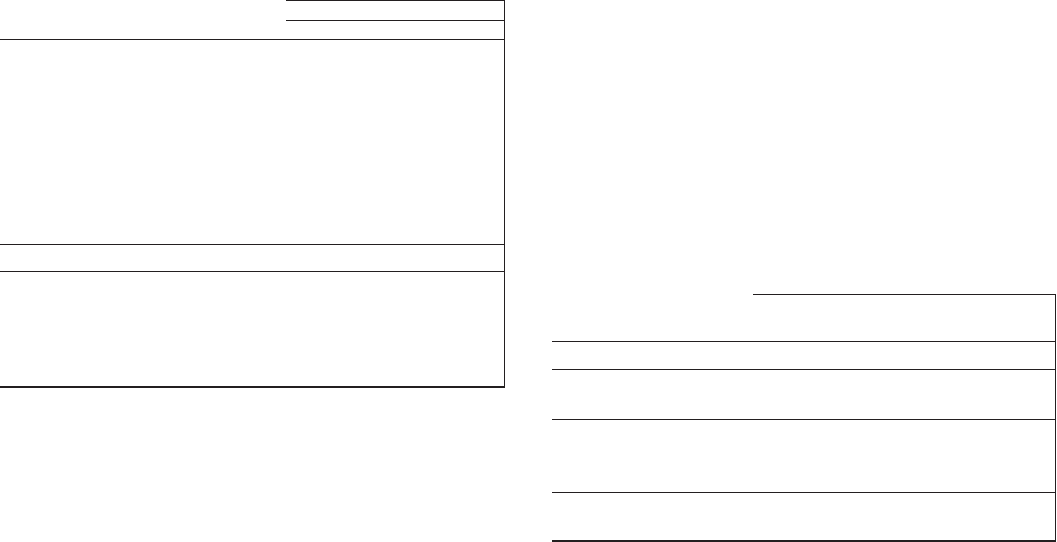

The following table summarizes the effect of the

initial impact of adopting SFAS 158.

Incremental Effect of Applying SFAS 158 on Individual

Line Items in the Consolidated Balance Sheet

December 31, 2006

In millions

Before

Application of

SFAS 158 Adjustments

After

Application of

SFAS 158

Other assets $ 9,117 $(188) $ 8,929

Total assets 102,008 (188) 101,820

Other liabilities 4,784 (56) 4,728

Total liabilities 90,203 (56) 90,147

Accumulated other

comprehensive loss (103) (132) (235)

Total shareholders’

equity $ 10,920 $(132) $ 10,788

• SFAS 157, “Fair Value Measurements,” defines fair

value and establishes a framework for measuring fair

value which includes permissible valuation

techniques and a hierarchy of inputs utilized in the

measurement process. This statement applies

whenever other accounting standards require or

permit fair value measurement. We anticipate

applying SFAS 157 prospectively beginning

January 1, 2008, as required.

• FASB Interpretation No. 48 (“FIN 48”), “Accounting

for Uncertainty in Income Taxes – an interpretation

of FASB Statement No. 109.” FIN 48 clarifies the

accounting for uncertainty in income taxes

recognized in the financial statements and sets forth

recognition, derecognition and measurement criteria

for tax positions taken or expected to be taken in a

tax filing. For PNC, this guidance will apply to all tax

positions taken or expected to be taken beginning on

January 1, 2007. We do not expect the adoption of

FIN 48 to have a significant impact on our

consolidated financial statements.

80