PNC Bank 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

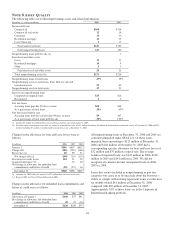

As a result, we repositioned our securities portfolio according

to our market views. This included reallocating exposure to

certain sectors, selling securities holdings we believed would

likely underperform on a relative value basis, and retaining

certain existing securities and purchasing incremental

securities all of which we believe will outperform the market

going forward as further discussed below.

As part of the rebalancing, we assessed the entire securities

available for sale portfolio of which, for the majority of

positions, fair value was less than amortized cost. We

executed a strategy to reduce our US government agency and

mortgage-backed security sector allocations and increase our

interest rate swap sector allocation. We sold substantially all

of our US government agency securities to reduce our interest

rate spread exposure to that asset class. The US government

agency securities that we retained are characterized by

relatively short terms to maturity and smaller individual

security balances. We also sold specific securities in the

mortgage-backed portfolio (i.e., all of our holdings of specific

coupon US government agency pass-through securities and

collateralized mortgage obligations having specific collateral

characteristics), and in the commercial mortgage-backed

portfolio (i.e., all of our holdings of specific vintage

securities) that we believe, given the underlying collateral,

will underperform on a relative value basis. We retained the

remaining holdings in our mortgage-backed portfolio

including all of our holdings of mortgage-backed securities

collateralized by hybrid adjustable rate mortgage loans, our

commercial mortgage-backed portfolio and our asset-backed

portfolio. Our objective was to reduce the portfolio credit

spread and interest rate volatility exposures, to position the

portfolio for a steeper yield curve and to optimize the relative

value performance of the portfolio. We assessed the securities

retained relative to the same portfolio objectives, our market

view and outlook, our desired sector allocations and our

expectation of performance relative to market benchmarks,

and, given our assessment, we confirmed our intent to hold

these remaining securities until either recovery of fair value or

maturity.

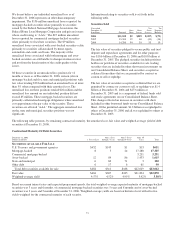

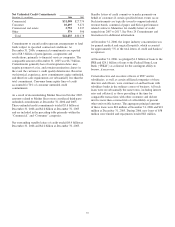

The portfolio rebalancing resulted in the sale during the third

quarter of 2006 of $6.0 billion of securities available for sale

at an aggregate pretax loss of $196 million, or $127 million

after-tax. In connection with this rebalancing, we purchased

approximately $1.8 billion of securities and added

approximately $4.0 billion of interest rate swaps to maintain

our interest rate risk position. We also reduced wholesale

funding as a result of the actions taken.

The resulting net realized losses on the sale of the securities

during the third quarter of 2006 were previously reflected as net

unrealized securities losses within accumulated other

comprehensive loss in the shareholders’ equity section of

PNC’s Consolidated Balance Sheet. Accordingly, total

shareholders’ equity did not change as a result of these actions.

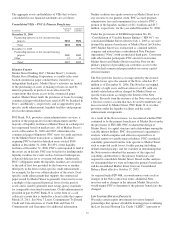

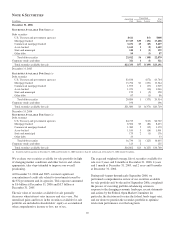

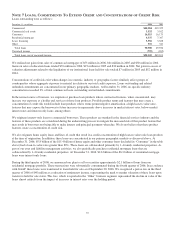

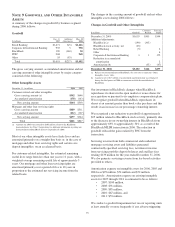

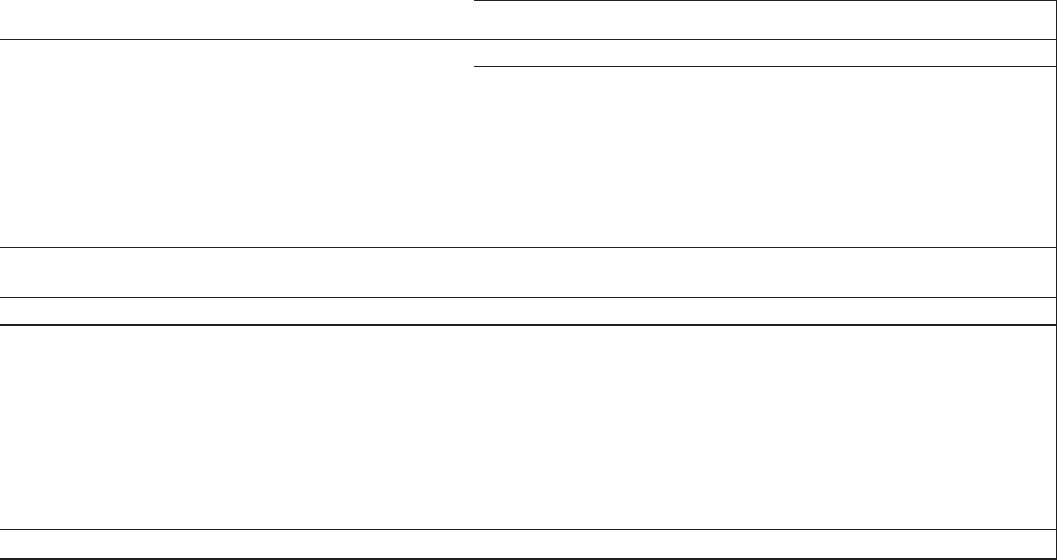

The following table presents unrealized loss and fair value of securities at December 31, 2006 and December 31, 2005 for which an

other-than-temporary impairment has not been recognized. These securities are segregated between investments that have been in a

continuous unrealized loss position for less than twelve months and twelve months or more.

In millions

December 31, 2006

Unrealized loss position less

than 12 months

Unrealized loss position

12 months or more Total

Unrealized Loss Fair Value Unrealized Loss Fair Value Unrealized Loss Fair Value

Securities available for sale

Debt securities

U.S. Treasury and government agencies $15 $(3) $302 $(3) $317

Mortgage-backed $(8) 2,717 (148) 6,925 (156) 9,642

Commercial mortgage-backed (3) 924 (22) 778 (25) 1,702

Asset-backed (1) 414 (8) 649 (9) 1,063

State and municipal 16 (2) 88 (2) 104

Other debt 65 (3) 59 (3) 124

Total debt securities (12) 4,151 (186) 8,801 (198) 12,952

Corporate stocks and other (1) 10 (1) 10

Total $(12) $4,151 $(187) $8,811 $(199) $12,962

December 31, 2005

Securities available for sale

Debt securities

U.S. Treasury and government agencies $(33) $1,898 $(39) $1,553 $(72) $3,451

Mortgage-backed (161) 10,544 (90) 2,321 (251) 12,865

Commercial mortgage-backed (29) 1,272 (8) 339 (37) 1,611

Asset-backed (8) 835 (2) 98 (10) 933

State and municipal (1) 58 (1) 53 (2) 111

Other debt (1) 59 4 (1) 63

Total $(233) $14,666 $(140) $4,368 $(373) $19,034

90