PNC Bank 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.through D preferred stock are entitled to a number of votes

equal to the number of full shares of common stock into which

such preferred stock is convertible. Series A through D

preferred stock have the following conversion privileges: (i) one

share of Series A or Series B is convertible into eight shares of

PNC common stock; and (ii) 2.4 shares of Series C or Series D

are convertible into four shares of PNC common stock.

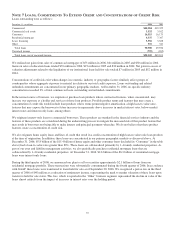

During 2000, our Board of Directors adopted a shareholder

rights plan providing for issuance of share purchase rights. The

rights plan provided that, except as otherwise provided in the

plan, if a person or group becomes beneficial owner of 10% or

more of PNC outstanding common stock, all holders of the

rights, other than such person or group, may purchase our

common stock or equivalent preferred stock at half of market

value. On February 14, 2007, our Board of Directors agreed to

amend the existing rights agreement for the shareholder rights

plan in order to accelerate the final expiration date of the

outstanding share purchase rights issued under the plan from

May 25, 2010 to February 28, 2007. The effect of this

amendment is that the outstanding share purchase rights expired

on February 28, 2007, and the shareholder rights plan pursuant

to which the rights were issued is of no further force or effect

after that date.

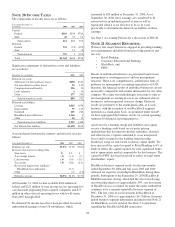

We have a dividend reinvestment and stock purchase plan.

Holders of preferred stock and PNC common stock may

participate in the plan, which provides that additional shares

of common stock may be purchased at market value with

reinvested dividends and voluntary cash payments. Common

shares issued pursuant to this plan were: 535,394 shares in

2006, 688,665 shares in 2005 and 744,266 shares in 2004.

At December 31, 2006, we had reserved approximately

44.3 million common shares to be issued in connection with

certain stock plans and the conversion of certain debt and

equity securities.

In February 2005, our Board of Directors authorized the

purchase of up to 20 million shares of our common stock in

open market or privately negotiated transactions. The 2005

repurchase authorization was a replacement and continuation

of the 2004 repurchase program. The 2005 program will

remain in effect until fully utilized or until modified,

superseded or terminated. During 2006, we purchased

5 million common shares at a total cost of $354 million under

the 2005 program. During 2005, we purchased .5 million

common shares at a total cost of $26 million under both the

2005 and 2004 common stock repurchase programs, all of

which occurred during the first quarter.

N

OTE

16 F

INANCIAL

D

ERIVATIVES

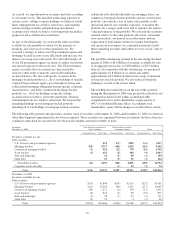

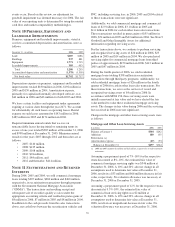

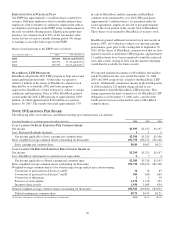

We use a variety of derivative financial instruments to help

manage interest rate, market and credit risk and reduce the

effects that changes in interest rates may have on net income,

fair value of assets and liabilities, and cash flows. These

instruments include interest rate swaps, interest rate caps and

floors, futures contracts, and total return swaps.

Fair Value Hedging Strategies

We enter into interest rate and total return swaps, interest rate

caps, floors and futures derivative contracts to hedge

designated commercial mortgage loans held for sale,

commercial loans, bank notes, senior debt and subordinated

debt for changes in fair value primarily due to changes in

interest rates. Adjustments related to the ineffective portion of

fair value hedging instruments are recorded in interest income,

interest expense or noninterest income depending on the

hedged item.

Cash Flow Hedging Strategy

We enter into interest rate swap contracts to modify the

interest rate characteristics of designated commercial loans

from variable to fixed in order to reduce the impact of interest

rate changes on future interest income. We are hedging our

exposure to the variability of future cash flows for all

forecasted transactions for a maximum of 10 years for hedges

converting floating-rate commercial loans to fixed. The fair

value of these derivatives is reported in other assets or other

liabilities and offset in accumulated other comprehensive

income (loss) for the effective portion of the derivatives.

When the hedged transaction culminates, any unrealized gains

or losses related to these swap contracts are reclassified from

accumulated other comprehensive income (loss) into earnings

in the same period or periods during which the hedged

forecasted transaction affects earnings and are included in

interest income. Ineffectiveness of the strategy, as defined by

risk management policies and procedures, if any, is reported in

interest income.

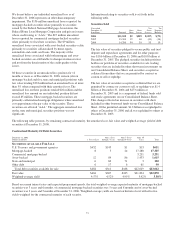

During the next twelve months, we expect to reclassify to

earnings $30 million of pretax net losses, or $19 million after-

tax, on cash flow hedge derivatives currently reported in

accumulated other comprehensive income (loss). This amount

could differ from amounts actually recognized due to changes

in interest rates and the addition of other hedges subsequent to

December 31, 2006. These net losses are anticipated to result

from net cash flows on receive fixed interest rate swaps that

would impact interest income recognized on the related

floating rate commercial loans.

As of December 31, 2006 we have determined that there were

no hedging positions where it was probable that certain

forecasted transactions may not occur within the originally

designated time period.

For those hedge relationships that require testing for

ineffectiveness, any ineffectiveness present in the hedge

relationship is recognized in current earnings. The ineffective

portion of the change in value of these derivatives resulted in a

$4 million net loss in 2006 compared with a net loss of $3

million in 2005.

During the third quarter of 2006, we recognized a $20 million

pretax loss charged to other noninterest income associated

with our application of the “short-cut” method of fair value

hedge accounting for trust preferred securities.

99