PNC Bank 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

events occur. Based on this review, no adjustment for

goodwill impairment was deemed necessary for 2006. The fair

value of our reporting units is determined by using discounted

cash flow and market comparability methodologies.

N

OTE

10 P

REMISES

,E

QUIPMENT AND

L

EASEHOLD

I

MPROVEMENTS

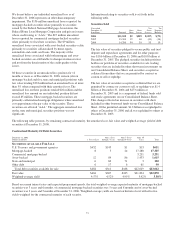

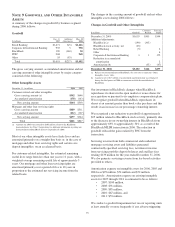

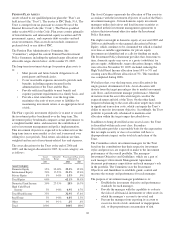

Premises, equipment and leasehold improvements, stated at

cost less accumulated depreciation and amortization, were as

follows:

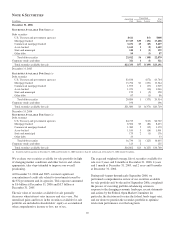

December 31 - in millions 2006 2005

Land $187 $186

Buildings 937 881

Equipment 1,771 1,735

Leasehold improvements 385 453

Total 3,280 3,255

Accumulated depreciation and amortization (1,578) (1,538)

Net book value $1,702 $1,717

Depreciation expense on premises, equipment and leasehold

improvements totaled $180 million in 2006, $192 million in

2005 and $159 million in 2004. Amortization expense,

primarily for capitalized internally developed software, was

$44 million in 2006 and $43 million for both 2005 and 2004.

We lease certain facilities and equipment under agreements

expiring at various dates through the year 2071. We account

for substantially all such leases as operating leases. Rental

expense on such leases amounted to $193 million in 2006,

$189 million in 2005 and $174 million in 2004.

Required minimum annual rentals that we owe on

noncancelable leases having initial or remaining terms in

excess of one year totaled $965 million at December 31, 2006

and $998 million at December 31, 2005. Minimum annual

rentals for the years 2007 through 2012 and thereafter are as

follows:

• 2007: $140 million,

• 2008: $125 million,

• 2009: $108 million,

• 2010: $94 million,

• 2011: $84 million, and

• 2012 and thereafter: $414 million.

N

OTE

11 S

ECURITIZATIONS AND

R

ETAINED

I

NTERESTS

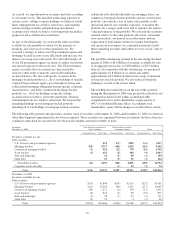

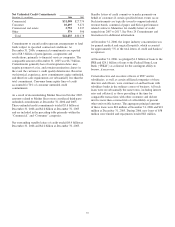

During 2006, 2005 and 2004, we sold commercial mortgage

loans totaling $307 million, $284 million and $460 million,

respectively, in securitization transactions through programs

with the Government National Mortgage Association

(“GNMA”). The transactions and resulting receipt and

subsequent sale of securities qualify as sales under the

appropriate accounting criteria and resulted in pretax gains of

$8 million in 2006, $7 million in 2005 and $8 million in 2004.

In addition to the cash proceeds from the sales transactions

above, net cash flows between the securitization vehicles and

PNC, including servicing fees, in 2006, 2005 and 2004 related

to those transactions were not significant.

Additionally, we sold commercial mortgage and commercial

loans of $2.9 billion in 2006, $3.1 billion in 2005 and

$1.6 billion in 2004 for cash in other loan sales transactions.

These transactions resulted in pretax gains of $55 million in

2006, $54 million in 2005 and $42 million in 2004. See Note 9

Goodwill and Other Intangible Assets for additional

information regarding servicing assets.

For the transactions above, we continue to perform servicing

and recognized servicing assets of $26 million in 2006, $23

million in 2005 and $14 million in 2004. We also purchased

servicing rights for commercial mortgage loans from third

parties of approximately $150 million in 2006, $112 million in

2005 and $47 million in 2004.

During the fourth quarter of 2006, we sold residential

mortgage loans totaling $358 million in securitization

transactions through third party programs. Additionally, we

sold residential mortgage loans of $26 million in the fourth

quarter of 2006 for cash in other loan sales transactions. For

these transactions, we serve as the servicer of record and

recognized servicing assets of $4 million in 2006. In

accordance with SFAS 156, these servicing assets were

initially measured at fair value and we have elected the fair

value method to value these residential mortgage servicing

assets. The changes in fair value during 2006 and the servicing

fees received in 2006 were not significant.

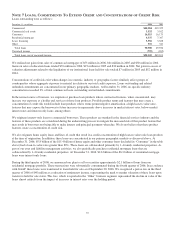

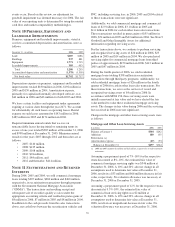

Changes in the mortgage and other loan servicing assets were

as follows:

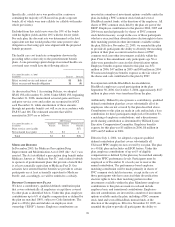

Mortgage and Other Loan Servicing Assets

In millions 2006 2005

Balance at January 1 $344 $242

Additions 180 135

Retirements (a)

Amortization expense (47) (33)

Balance at December 31 $477 $344

(a) 2006 and 2005 included $2 million and $25 million, respectively, of fully amortized

retirements.

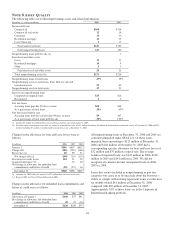

Assuming a prepayment speed of 7%-16% for the respective

strata discounted at 8%-10%, the estimated fair value of

commercial mortgage servicing rights was $546 million at

December 31, 2006. A 10% and 20% adverse change in all

assumptions used to determine fair value at December 31,

2006, results in a $33 million and $66 million decrease in fair

value, respectively. No valuation allowance was necessary at

December 31, 2006 or December 31, 2005.

Assuming a prepayment speed of 12% for the respective strata

discounted at 9.5%-10%, the estimated fair value of

commercial loan servicing rights was $2 million at

December 31, 2006. A 10% and 20% adverse change in all

assumptions used to determine fair value at December 31,

2006, results in an insignificant decrease in fair value. No

valuation allowance was necessary at December 31, 2006.

96