PNC Bank 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• FASB Staff Position No. (“FSP”) FAS 13-2,

“Accounting for a Change or Projected Change in the

Timing of Cash Flows Relating to Income Taxes

Generated by a Leveraged Lease Transaction.” This

guidance requires a recalculation of the timing of

income recognition for a leveraged lease under SFAS

13, “Accounting for Leases,” when a change in the

timing of income tax deductions directly related to

the leveraged lease transaction occurs or is projected

to occur. Any tax positions taken regarding the

leveraged lease transaction must be recognized and

measured in accordance with FIN 48 described

above. This guidance will be effective for PNC

beginning January 1, 2007 with the cumulative effect

of applying the provisions of this FSP being

recognized through an adjustment to opening retained

earnings. Any immediate or future reductions in

earnings from the change in accounting would be

recovered in subsequent years. Our adoption of the

guidance in FSP FAS 13-2 resulted in an after-tax

charge to beginning retained earnings at January 1,

2007 of approximately $149 million.

As described under the Loans And Leases section of the Note

1, we adopted SFAS 155 as of January 1, 2006. As described

under the Loan Sales, Securitizations And Retained Interest

section of Note 1, we also adopted SFAS 156 as of January 1,

2006. The adoption of SFAS 155 and SFAS 156 did not have

a material impact on our consolidated financial statements.

In June 2005, the Emerging Issues Task Force (“EITF”) of the

FASB issued EITF Issue 04-5, “Determining Whether a

General Partner, or the General Partners as a Group, Controls

a Limited Partnership or Similar Entity When the Limited

Partners Have Certain Rights.” EITF 04-5 provides that the

general partner(s) is presumed to control the limited

partnership (including certain limited liability companies),

unless the limited partners possess either substantive

participating rights or the substantive ability to dissolve the

limited partnership or otherwise remove the general partner(s)

without cause (“kick-out rights”). Kick-out rights are

substantive if they can be exercised by a simple majority of

the limited partners voting interests. The guidance was

effective for all limited partnerships as of January 1, 2006.

The adoption of this guidance did not have a material impact

on our consolidated financial statements.

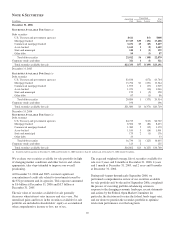

N

OTE

2A

CQUISITIONS

2006

B

LACK

R

OCK

/MLIM T

RANSACTION

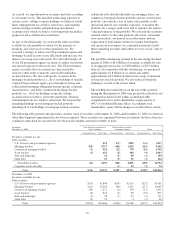

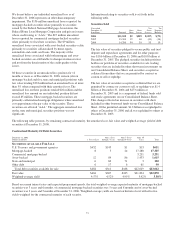

On September 29, 2006, Merrill Lynch contributed its

investment management business (“MLIM”) to BlackRock in

exchange for 65 million shares of newly issued BlackRock

common and preferred stock. BlackRock accounted for the

MLIM transaction under the purchase method of accounting.

Immediately following the closing, PNC continued to own

approximately 44 million shares of BlackRock common stock

representing an ownership interest of approximately 34% of

the combined company (as compared with 69% immediately

prior to the closing). Although PNC’s share ownership

percentage declined, PNC’s investment in BlackRock

increased due to the increase in total equity recorded by

BlackRock as a result of the MLIM transaction.

Upon the closing of the BlackRock/MLIM transaction, the

carrying value of our investment in BlackRock increased by

approximately $3.1 billion to $3.8 billion, primarily reflecting

PNC’s portion of the increase in BlackRock’s equity resulting

from the value of shares issued in the transaction.

We also recorded a liability at September 30, 2006 for

deferred taxes of approximately $.9 billion, related to the

excess of the book value over the tax basis of our investment

in BlackRock, and a liability of approximately $.6 billion

related to our obligation to provide shares of BlackRock

common stock to help fund BlackRock long-term incentive

plan (“LTIP”) programs. The LTIP liability will be adjusted

quarterly based on changes in BlackRock’s common stock

price and the number of remaining committed shares.

Accordingly, at each quarter-end PNC will record a charge to

earnings if the market price of BlackRock’s common stock

increases and will record a credit to earnings if BlackRock’s

stock price declines.

The overall balance sheet impact of the BlackRock/MLIM

transaction was an increase to our shareholders’ equity of

approximately $1.6 billion. The increase to equity was

comprised of an after-tax gain of approximately $1.3 billion,

net of the expense associated with the LTIP liability and the

deferred taxes, and an after-tax increase to capital surplus of

approximately $.3 billion. The recognition of the gain is

consistent with our existing accounting policy for the sale or

issuance by subsidiaries of their stock to third parties. The

gain represents the difference between our basis in BlackRock

stock prior to the BlackRock/MLIM transaction and the new

book value per share and resulting increase in value of our

investment realized from the transaction. The direct increase

to capital surplus rather than inclusion in the gain resulted

from the accounting treatment required due to existing

BlackRock repurchase commitments or programs.

For 2004, 2005 and for the nine months ended September 30,

2006, our Consolidated Income Statement included our former

approximately 69% - 71% ownership interest in BlackRock’s

net income through the closing date. However, beginning

September 30, 2006, our Consolidated Balance Sheet no

longer reflected the consolidation of BlackRock’s balance

sheet but recognized our ownership interest in BlackRock as

an investment accounted for under the equity method. This

accounting has resulted in a reduction in certain revenue and

noninterest expense categories on PNC’s Consolidated Income

Statement as our share of BlackRock’s net income is now

reported within asset management noninterest income.

81