PNC Bank 2006 Annual Report Download - page 76

Download and view the complete annual report

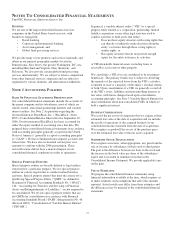

Please find page 76 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.initiative, could affect our financial performance over

the next several years.

• Our ability to grow successfully through acquisitions

is impacted by a number of risks and uncertainties

related both to the acquisition transactions

themselves and to the integration of the acquired

businesses into PNC after closing. These

uncertainties are present in transactions such as our

pending acquisition of Mercantile Bankshares

Corporation.

• Legal and regulatory developments could have an

impact on our ability to operate our businesses or our

financial condition or results of operations or our

competitive position or reputation. Reputational

impacts, in turn, could affect matters such as business

generation and retention, our ability to attract and

retain management, liquidity and funding. These

legal and regulatory developments could include:

(a) the unfavorable resolution of legal proceedings or

regulatory and other governmental inquiries;

(b) increased litigation risk from recent regulatory

and other governmental developments; (c) the results

of the regulatory examination process, our failure to

satisfy the requirements of agreements with

governmental agencies, and regulators’ future use of

supervisory and enforcement tools; (d) legislative and

regulatory reforms, including changes to laws and

regulations involving tax, pension, and the protection

of confidential customer information; and (e) changes

in accounting policies and principles.

• Our business and operating results are affected by our

ability to identify and effectively manage risks

inherent in our businesses, including, where

appropriate, through the effective use of third-party

insurance and capital management techniques.

• Our ability to anticipate and respond to technological

changes can have an impact on our ability to respond

to customer needs and to meet competitive demands.

• The adequacy of our intellectual property protection,

and the extent of any costs associated with obtaining

rights in intellectual property claimed by others, can

impact our business and operating results.

• Our business and operating results can be affected by

widespread natural disasters, terrorist activities or

international hostilities, either as a result of the

impact on the economy and financial and capital

markets generally or on us or on our customers,

suppliers or other counterparties specifically.

Also, risks and uncertainties that could affect the results

anticipated in forward-looking statements or from historical

performance relating to our equity interest in BlackRock, Inc.

are discussed in more detail in BlackRock’s filings with the

SEC, including in the Risk Factors sections of BlackRock’s

reports, accessible on the SEC’s website and on or through

BlackRock’s website at www.blackrock.com.

In addition, our pending acquisition of Mercantile Bankshares

presents us with a number of risks and uncertainties related

both to the acquisition transaction itself and to the integration

of the acquired businesses into PNC after closing. These risks

and uncertainties include the following:

• Completion of the transaction remains dependent on

customary closing conditions, including regulatory

approvals. The impact of the completion of the

transaction on PNC’s financial statements will be

affected by the timing of the transaction.

• The transaction may be more expensive to complete

than anticipated, including as a result of unexpected

factors or events.

• The integration of Mercantile’s business and

operations with those of PNC, which will include

conversion of Mercantile’s different systems and

procedures, may take longer than anticipated, may be

more costly than anticipated, and may have

unanticipated adverse results relating to Mercantile’s

or PNC’s existing businesses.

• The anticipated benefits, including anticipated

strategic gains and anticipated cost savings and other

synergies of the transaction, may be significantly

harder or take longer to be realized than anticipated

or may not be achieved in their entirety, including as

a result of unexpected factors or events, and attrition

in key client, partner and other relationships relating

to the transaction may be greater than expected.

• The anticipated benefits to PNC are dependent in part

on Mercantile’s business performance in the future,

and there can be no assurance as to actual future

results, which could be impacted by various factors,

including the risks and uncertainties generally related

to PNC’s and Mercantile’s performance (with respect

to Mercantile, see Mercantile’s SEC reports,

accessible on the SEC’s website) or due to factors

related to the acquisition of Mercantile and the

process of integrating it into PNC.

66