PNC Bank 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

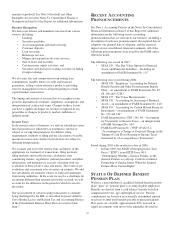

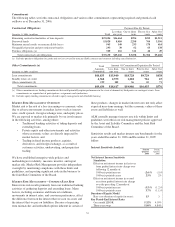

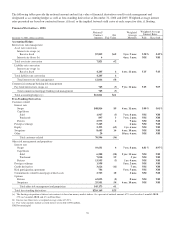

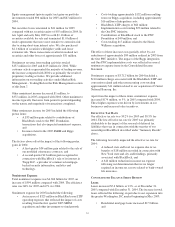

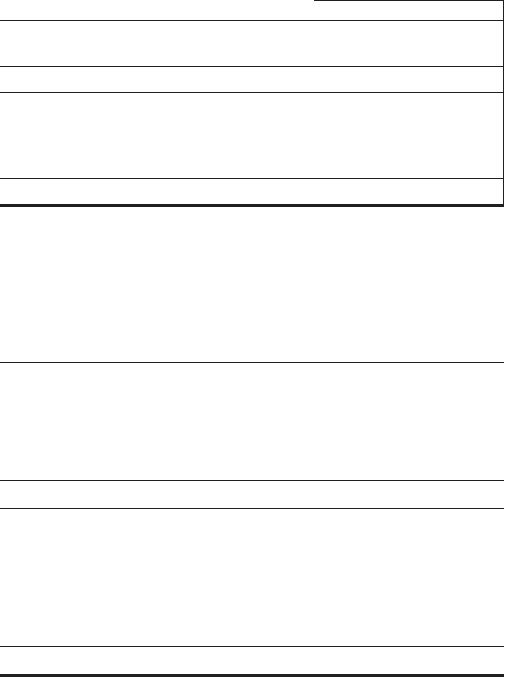

Total trading revenue for 2006, 2005 and 2004 was as follows:

Year end December 31 - in millions 2006 2005 2004

Net interest income (expense) $(6) $9 $13

Noninterest income 183 157 113

Total trading revenue $177 $166 $126

Securities underwriting and

trading (a) $38 $47 $48

Foreign exchange 55 39 31

Financial derivatives 84 80 47

Total trading revenue $177 $166 $126

(a) Includes changes in fair value for certain loans accounted for at fair value.

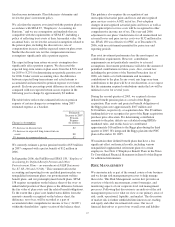

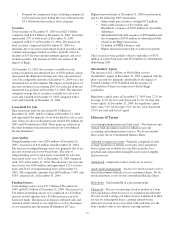

Average trading assets and liabilities consisted of the

following:

Year ended - in millions

December 31

2006

December 31

2005

December 31

2004

Assets

Securities (a) $1,712 $1,850 $871

Resale agreements (b) 623 663 166

Financial derivatives (c) 1,148 772 605

Loans at fair value (c) 128

Total assets $3,611 $3,285 $1,642

Liabilities

Securities sold short (d) $965 $993 $275

Repurchase agreements and

other borrowings (e) 833 1,044 249

Financial derivatives (f) 1,103 825 594

Borrowings at fair value (f) 31

Total liabilities $2,932 $2,862 $1,118

(a) Included in Interest-earning assets-Other on the Average Consolidated Balance

Sheet And Net Interest Analysis.

(b) Included in Federal funds sold and resale agreements.

(c) Included in Noninterest-earning assets-Other.

(d) Included in Other borrowed funds.

(e) Included in Repurchase agreements and Other borrowed funds.

(f) Included in Accrued expenses and other liabilities.

M

ARKET

R

ISK

M

ANAGEMENT

–E

QUITY

A

ND

O

THER

I

NVESTMENT

R

ISK

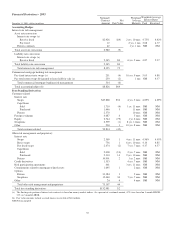

Equity investment risk is the risk of potential losses associated

with investing in both private and public equity markets. In

addition to extending credit, taking deposits, and underwriting

and trading financial instruments, we make and manage direct

investments in a variety of transactions, including

management buyouts, recapitalizations, and later-stage growth

financings in a variety of industries. We also have investments

in affiliated and non-affiliated funds that make similar

investments in private equity and in debt and equity-oriented

hedge funds. The economic and/or book value of these

investments and other assets such as loan servicing rights are

directly affected by changes in market factors.

The primary risk measurement for equity and other

investments is economic capital. Economic capital is a

common measure of risk for credit, market and operational

risk. It is an estimate of the worst-case value depreciation over

one year within a 99.9% confidence level. Given the illiquid

nature of many of these types of investments, it can be a

challenge to determine their fair values. Market Risk

Management and Finance provide independent oversight of

the valuation process.

Various PNC business units manage our private equity and

other investment activities. Our businesses are responsible for

making investment decisions within the approved policy limits

and associated guidelines.

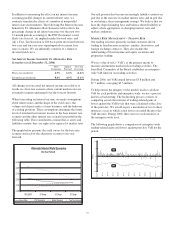

Private Equity

The private equity portfolio is comprised of investments that

vary by industry, stage and type of investment. Private equity

investments are reported at fair value. Changes in the values

of private equity investments are reflected in our results of

operations. Due to the nature of the direct investments, we

must make assumptions as to future performance, financial

condition, liquidity, availability of capital, and market

conditions, among other factors, to determine the estimated

fair value of the investments. Market conditions and actual

performance of the investments could differ from these

assumptions. Accordingly, lower valuations may occur that

could adversely impact earnings in future periods. Also, the

valuations may not represent amounts that will ultimately be

realized from these investments. See Private Equity Asset

Valuation in the Critical Accounting Policies And Judgments

section of this Item 7 for additional information.

At December 31, 2006, private equity investments carried at

estimated fair value totaled $463 million compared with

$449 million at December 31, 2005. As of December 31,

2006, approximately 45% of the amount is invested directly in

a variety of companies and approximately 55% is invested in

various limited partnerships. Private equity unfunded

commitments totaled $123 million at December 31, 2006

compared with $78 million at December 31, 2005.

See Note 24 Commitments And Guarantees in the Notes To

Consolidated Financial Statements regarding our commitment

to PNC Mezzanine Partners III, LP, which is consolidated for

financial reporting purposes as PNC has a 57% ownership

interest.

Other Investments

We also make investments in affiliated and non-affiliated

funds with both traditional and alternative investment

strategies. The economic values could be driven by either the

fixed-income market or the equity markets, or both.

PNC owns approximately 44 million shares of BlackRock

common stock, accounted for under the equity method. The

primary risk measurement, similar to other equity investments,

is economic capital.

In November 2006, we invested an aggregate of $100 million

in FIM Holdings, LLC (“FIM”) as a non-managing member

with a 1.25% ownership interest. FIM acquired a 51%

56