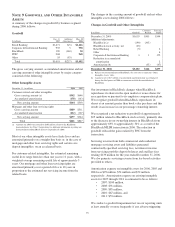

PNC Bank 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

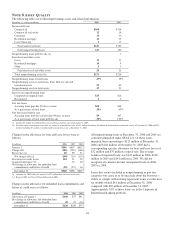

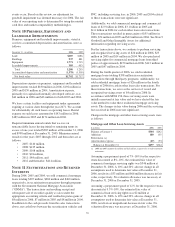

We do not believe any individual unrealized loss as of

December 31, 2006 represents an other-than-temporary

impairment. The $156 million unrealized losses reported for

mortgage-backed securities relate primarily to securities

issued by the Federal National Mortgage Association, the

Federal Home Loan Mortgage Corporation and private issuers

whose credit rating is “AAA.” The $25 million unrealized

losses reported for commercial mortgage-backed securities

relate primarily to fixed rate securities. The $9 million

unrealized losses associated with asset-backed securities relate

primarily to securities collateralized by home equity,

automobile and credit card loans. The majority of the

unrealized losses associated with both mortgage and asset-

backed securities are attributable to changes in interest rates

and not from the deterioration of the credit quality of the

issuer.

Of those securities in an unrealized loss position for 12

months or more as of December 31, 2006, sixteen (eleven

mortgage-backed and five state and municipal) positions with

fair value totaling $333 million had an unrealized loss of more

than 5% when compared with their amortized cost. The

unrealized loss on these positions totaled $26 million and the

unrealized loss amount on any individual position did not

exceed $5 million. These mortgage-backed securities are

primarily collateralized mortgage obligations where amortized

cost approximates the par value of the security. These

securities are all rated “AAA.” The aggregate unrealized loss

on the state and municipal securities positions was not

significant.

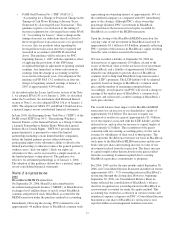

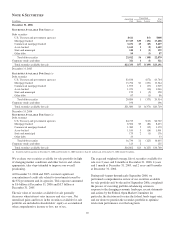

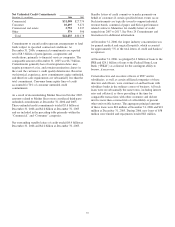

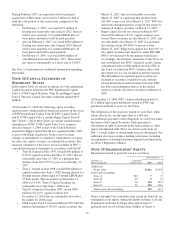

Information relating to securities sold is set forth in the

following table.

Securities Sold

Year ended

December 31

In millions Proceeds

Gross

Gains

Gross

Losses

Net

Gains

(Losses)

Tax

Expense

(Benefit)

2006 $11,102 $2 $209 $(207) $(72)

2005 13,304 19 60 (41) (14)

2004 14,206 94 39 55 19

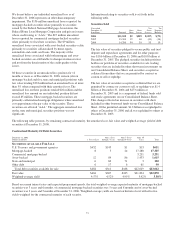

The fair value of securities pledged to secure public and trust

deposits and repurchase agreements and for other purposes

was $10.6 billion at December 31, 2006 and $10.8 billion at

December 31, 2005. The pledged securities include positions

held in our portfolio of securities available for sale, trading

securities that are included in other short-term investments on

our Consolidated Balance Sheet, and securities accepted as

collateral from others that we are permitted by contract or

custom to sell or repledge.

The fair value of securities accepted as collateral that we are

permitted by contract or custom to sell or repledge was $1.4

billion at December 31, 2006 and $273 million at

December 31, 2005 and is a component of federal funds sold

and resale agreements on our Consolidated Balance Sheet.

This change reflected an increase in securities sold short,

included in other borrowed funds on our Consolidated Balance

Sheet. Of the permitted amount, $1.3 billion was repledged to

others at December 31, 2006 and all was repledged to others at

December 31, 2005.

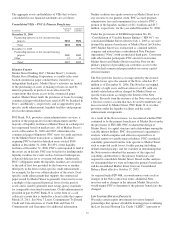

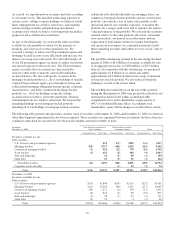

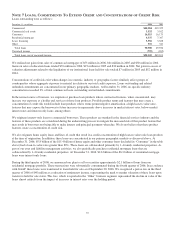

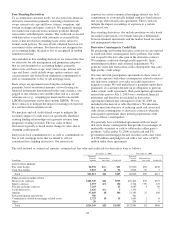

The following table presents, by remaining contractual maturity, the amortized cost, fair value and weighted-average yield of debt

securities at December 31, 2006.

Contractual Maturity Of Debt Securities

December 31, 2006

Dollars in millions 1 Year or Less

After 1 Year

through 5 Years

After 5 Years

through 10 Years

After 10

Years Total

S

ECURITIES

A

VAILABLE

F

OR

S

ALE

U.S. Treasury and government agencies $452 $145 $1 $13 $611

Mortgage-backed 8 5 24 17,288 17,325

Commercial mortgage-backed 3,231 3,231

Asset-backed 12 84 86 1,433 1,615

State and municipal 6 60 71 3 140

Other debt 6 17 6 61 90

Total debt securities available for sale $484 $311 $188 $22,029 $23,012

Fair value $484 $307 $185 $21,894 $22,870

Weighted-average yield 4.57% 4.52% 4.95% 5.42% 5.38%

Based on current interest rates and expected prepayment speeds, the total weighted-average expected maturity of mortgage-backed

securities was 3 years and 6 months, of commercial mortgage-backed securities was 5 years and 8 months and of asset-backed

securities was 2 years and 5 months at December 31, 2006. Weighted-average yields are based on historical cost with effective

yields weighted for the contractual maturity of each security.

91