PNC Bank 2006 Annual Report Download - page 119

Download and view the complete annual report

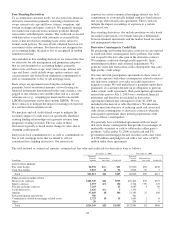

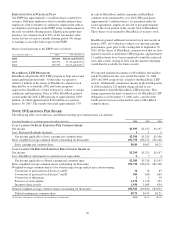

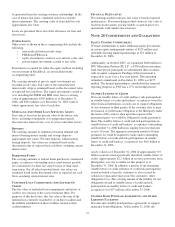

Please find page 119 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have allocated the allowances for loan and lease losses

and unfunded loan commitments and letters of credit based on

our assessment of risk inherent in the loan portfolios. Our

allocation of the costs incurred by operations and other

support areas not directly aligned with the businesses is

primarily based on the use of services.

Total business segment financial results differ from total

consolidated results. The impact of these differences is

reflected in the “Intercompany Eliminations” and “Other”

categories. “Intercompany Eliminations” reflects activities

conducted among our businesses that are eliminated in the

consolidated results. “Other” includes residual activities that

do not meet the criteria for disclosure as a separate reportable

business, such as gains or losses related to BlackRock, 2006

BlackRock/MLIM integration costs, One PNC implementation

costs, asset and liability management activities, related net

securities gains or losses, certain trading activities, equity

management activities and minority interest in income of

BlackRock up to September 29, 2006, differences between

business segment performance reporting and financial

statement reporting (GAAP), and most corporate overhead.

Assets, revenue and earnings attributable to foreign activities

were not material in the periods presented.

B

USINESS

S

EGMENT

P

RODUCTS

A

ND

S

ERVICES

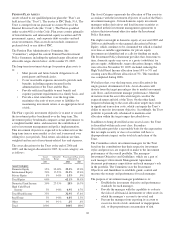

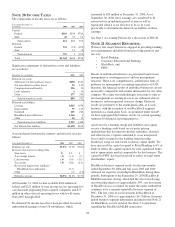

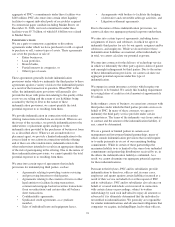

Retail Banking provides deposit, lending, brokerage, trust,

investment management, and cash management services to

approximately 2.5 million consumer and small business

customers within our primary geographic area. Our customers

are serviced through approximately 850 offices in our branch

network, the call center located in Pittsburgh and the Internet

–www.pncbank.com. The branch network is located primarily

in Pennsylvania; New Jersey; the greater Washington, DC

area, including Maryland and Virginia; Ohio; Kentucky; and

Delaware. Brokerage services are provided through PNC

Investments, LLC, and J.J.B. Hilliard, W.L. Lyons, Inc. Retail

Banking also serves as investment manager and trustee for

employee benefit plans and charitable and endowment assets

and provides nondiscretionary defined contribution plan

services and investment options through its Vested Interest®

product. These services are provided to individuals and

corporations primarily within our primary geographic markets.

Corporate & Institutional Banking provides lending, treasury

management, and capital markets products and services to

mid-sized corporations, government entities, and selectively to

large corporations. Lending products include secured and

unsecured loans, letters of credit and equipment leases.

Treasury management services include cash and investment

management, receivables management, disbursement services,

funds transfer services, information reporting, and global trade

services. Capital markets-related products and services include

foreign exchange, derivatives, loan syndications, mergers and

acquisitions advisory and related services to middle-market

companies, securities underwriting, and securities sales and

trading. Corporate & Institutional Banking also provides

commercial loan servicing, real estate advisory and

technology solutions for the commercial real estate finance

industry. Corporate & Institutional Banking provides products

and services generally within our primary geographic markets,

with certain products and services provided nationally.

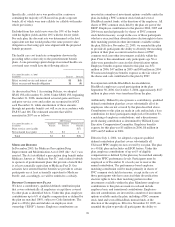

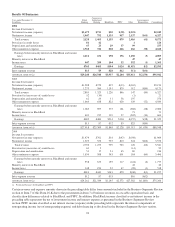

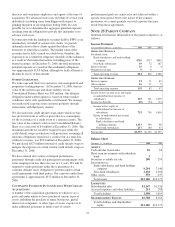

BlackRock is one of the world’s largest publicly traded

investment management firms. As of December 31, 2006,

BlackRock’s assets under management were approximately

$1.1 trillion. The firm manages assets on behalf of institutions

and individuals worldwide through a variety of equity, fixed

income, cash management and alternative investment

products. In addition, BlackRock provides BlackRock

Solutions®investment system, risk management, and financial

advisory services to a growing number of institutional

investors. The firm has a major presence in key global

markets, including the United States, Europe, Asia, Australia

and the Middle East.

See Note 2 Acquisitions regarding the BlackRock/MLIM

transaction.

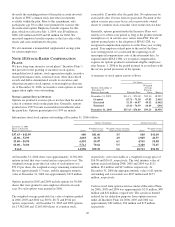

PFPC is a leading full service provider of processing,

technology and business solutions for the global investment

industry. Securities services include custody, securities

lending, and accounting and administration for funds

registered under the 1940 Act and alternative investments.

Investor services include transfer agency, managed accounts,

subaccounting, and distribution. PFPC serviced $2.2 trillion in

total assets and 68 million shareholder accounts as of

December 31, 2006 both domestically and internationally

through its Ireland and Luxembourg operations.

109