PNC Bank 2006 Annual Report Download - page 30

Download and view the complete annual report

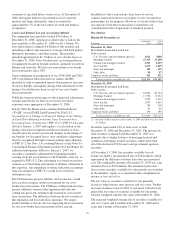

Please find page 30 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM

7-

MANAGEMENT

’

S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

E

XECUTIVE

S

UMMARY

T

HE

PNC F

INANCIAL

S

ERVICES

G

ROUP

,I

NC

.

PNC is one of the largest diversified financial services

companies in the United States based on assets, with

businesses engaged in retail banking, corporate and

institutional banking, asset management and global fund

processing services. We provide many of our products and

services nationally and others in our primary geographic

markets located in Pennsylvania; New Jersey; the greater

Washington, DC area, including Maryland and Virginia; Ohio;

Kentucky; and Delaware. We also provide certain global fund

processing services internationally.

K

EY

S

TRATEGIC

G

OALS

Our strategy to enhance shareholder value centers on

achieving revenue growth in our various businesses

underpinned by prudent management of risk, capital and

expenses. In each of our business segments, the primary

drivers of growth are the acquisition, expansion and retention

of customer relationships. We strive to achieve such growth in

our customer base by providing convenient banking options,

leading technological systems and a broad range of fee-based

products and services. We also intend to grow through

appropriate and targeted acquisitions and, in certain

businesses, by expanding into new geographical markets.

In recent years, we have managed our interest rate risk to

achieve a moderate risk profile with limited exposure to

earnings volatility resulting from interest rate fluctuations and

shape of the yield curve. Our actions have created a balance

sheet characterized by strong asset quality and flexibility to

adjust, where appropriate, to changing interest rates and

market conditions.

B

LACK

R

OCK

/MLIM T

RANSACTION

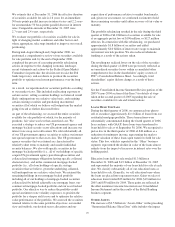

On September 29, 2006, Merrill Lynch contributed its

investment management business to BlackRock in exchange

for 65 million shares of newly issued BlackRock common and

preferred stock. BlackRock accounted for the MLIM

transaction under the purchase method of accounting.

Immediately following the closing, PNC continued to own

approximately 44 million shares of BlackRock common stock,

representing an ownership interest of approximately 34% of

the combined company after the closing (as compared with

69% immediately prior to the closing). Although PNC’s share

ownership percentage declined, PNC’s investment in

BlackRock increased due to the increase in total equity

recorded by BlackRock as a result of the MLIM transaction.

Further information regarding the BlackRock/MLIM

transaction is included in the BlackRock discussion within the

Business Segments Review section of this Item 7.

M

ERCANTILE

B

ANKSHARES

A

CQUISITION

On October 8, 2006, we entered into a definitive agreement

with Mercantile Bankshares Corporation (“Mercantile”) for

PNC to acquire Mercantile. Mercantile shareholders will be

entitled to .4184 shares of PNC common stock and $16.45 in

cash for each share of Mercantile, or in the aggregate

approximately 53 million shares of PNC common stock and

$2.1 billion in cash. Based on PNC’s recent stock prices, the

transaction is valued at approximately $6.0 billion in the

aggregate.

Mercantile is a bank holding company with approximately

$18 billion in assets that provides banking and investment and

wealth management services through 240 offices in Maryland,

Virginia, the District of Columbia, Delaware and southeastern

Pennsylvania. This transaction will enable us to significantly

expand our presence in the mid-Atlantic region, particularly

within the attractive Baltimore and Washington, DC markets.

Our Mercantile integration strategy development and planning

is progressing on track and has achieved several important

objectives, including identifying leadership personnel for

certain key positions within the Mercantile service territory.

Our priority for the integration is the retention of customers

and customer-facing staff. The transaction is subject to

customary closing conditions, including regulatory approvals,

and is expected to close in March 2007.

T

HE

O

NE

PNC I

NITIATIVE

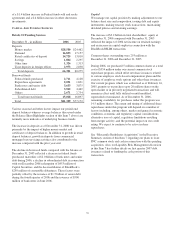

The One PNC initiative began in January 2005 and is an

ongoing, company-wide initiative with goals of moving closer

to the customer, improving our overall efficiency and

targeting resources to more value-added activities. PNC

expects to realize $400 million of total annual pretax earnings

benefit by mid-2007 from this initiative.

PNC plans to achieve approximately $300 million of cost

savings through a combination of workforce reduction and

other efficiencies. Approximately 3,000 positions had been

eliminated through December 31, 2006. We recognized

employee severance and other implementation costs of $11

million in 2006 and $54 million in 2005. Estimated remaining

charges to be incurred in early 2007 are not significant. In

addition, PNC intends to achieve at least $100 million in net

revenue growth through the implementation of various pricing

and business growth enhancements driven by the One PNC

initiative. The initiative is progressing according to plan.

We realized a net pretax financial benefit from the One PNC

program of approximately $265 million in 2006. We achieved

an annualized run rate benefit of $320 million in the fourth

quarter of 2006.

K

EY

F

ACTORS

A

FFECTING

F

INANCIAL

P

ERFORMANCE

Our financial performance is substantially affected by several

external factors outside of our control, including:

• General economic conditions,

20