PNC Bank 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

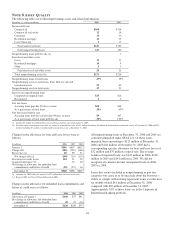

We also own an interest-only strip related to education loans

totaling $59 million and $58 million, respectively, at

December 31, 2006 and December 31, 2005. This strip was

retained from the sales of education loans to a third party trust

prior to 2003. Loans that are held by the trust supporting the

value of the strip were $88 million and $123 million at

December 31, 2006 and December 31, 2005, respectively. The

principal of these loans is effectively guaranteed by the federal

government. The trust related to the securitization will

terminate in 2007.

N

OTE

12 D

EPOSITS

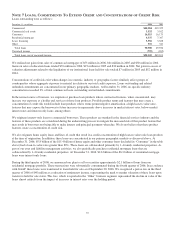

The aggregate amount of time deposits with a denomination of

$100,000 or more was $8.7 billion at December 31, 2006 and

$7.1 billion at December 31, 2005.

Contractual maturities of time deposits for the years 2007

through 2012 and thereafter are as follows:

• 2007: $16.5 billion,

• 2008: $.6 billion,

• 2009: $.4 billion,

• 2010: $.1 billion,

• 2011: $.1 billion, and

• 2012 and thereafter: $1.3 billion.

N

OTE

13 B

ORROWED

F

UNDS

Bank notes at December 31, 2006 totaling $1.1 billion have

interest rates ranging from 2.75% to 10.25% with

approximately $575 million maturing in 2007. Senior and

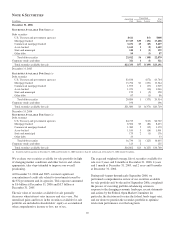

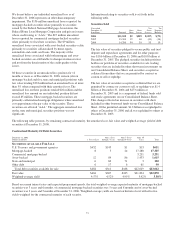

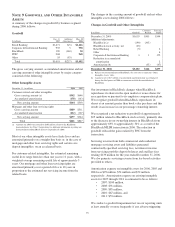

subordinated notes consisted of the following:

December 31, 2006

Dollars in millions Outstanding Stated Rate Maturity

Senior

Exchangeable $1,000 4.96% 2036

All other 1,535 4.20%–5.34% 2008-2010

Total senior 2,535

Subordinated

Junior 1,074 5.94%–10.01% 2007-2033

All other 2,888 4.88%–9.65% 2007-2017

Total

subordinated 3,962

Total senior

and

subordinated $6,497

Included in outstandings for the senior and subordinated notes

in the table above are basis adjustments of $13 million and $3

million, respectively, related to fair value accounting hedges

as of December 31, 2006.

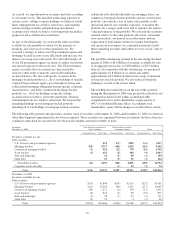

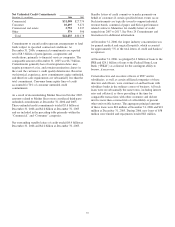

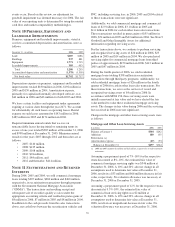

Total borrowed funds at December 31, 2006 have scheduled

or anticipated repayments for the years 2007 through 2012 and

thereafter as follows:

• 2007: $8.4 billion,

• 2008: $1.4 billion,

• 2009: $.8 billion,

• 2010: $.8 billion,

• 2011: $6 million, and

• 2012 and thereafter: $3.6 billion.

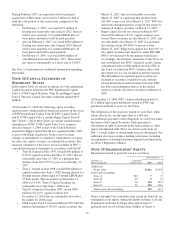

Included in borrowed funds at December 31, 2006 are $1 billion

of Floating Rate Exchangeable Senior Notes (“Exchangeable

Notes”) that were issued through PNC Funding Corp

(“Funding”), a subsidiary of PNC. These notes commenced on

December 20, 2006 and are due December 20, 2036. Interest

will be paid at a floating rate equal to 3-month LIBOR, reset

quarterly, minus 40 basis points, quarterly in arrears, provided

that such interest rate will never be less than 0% per annum.

The Exchangeable Notes are guaranteed by PNC.

Holders may exchange the Exchangeable Notes for, as

specified by Funding, shares of PNC common stock, cash, or a

combination of shares and cash at any time on or prior to

maturity based on an initial exchange price per share of

approximately $128.56, subject to adjustment. Holders have

the right to require PNC to repurchase all or a portion of the

Exchangeable Notes on December 20, 2007 and periodically

thereafter for an amount equal to 100% of the principal plus

accrued and unpaid interest. Beginning on December 26,

2007, PNC may redeem the Exchangeable Notes in whole at

any time, or in part from time to time, for an amount equal to

100% of the principal plus accrued and unpaid interest.

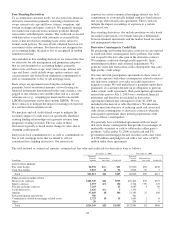

In connection with the issuance of the Exchangeable Notes,

PNC entered into a Registration Rights Agreement

(“Agreement”) with the initial purchaser of the Exchangeable

Notes. As part of the Agreement PNC agreed to file a

registration statement with the SEC, as soon as practicable but

in any event within 120 days after the issue date, to register

for resale the Exchangeable Notes and the common stock

deliverable upon exchange for the Exchangeable Notes. PNC

also agreed, among other things, to use its best efforts to cause

the registration statement to be declared effective as promptly

as practicable but in any event within 240 days after the issue

date and to keep the registration statement continuously

effective until registration is no longer applicable.

If PNC does not meet these obligations, PNC will be subject

to liquidated damages equal to 0.25% per annum of the

principal amount of the Exchangeable Notes outstanding.

Assuming the Exchangeable Notes remain outstanding

through 2036 and PNC does not meet these obligations, the

maximum consideration that PNC could be required to

transfer under this Agreement is approximately $75 million.

We have not recorded a liability for this Agreement at

December 31, 2006.

See Note 14 Capital Securities of Subsidiary Trusts for

information about the $1.1 billion of junior subordinated debt.

97