PNC Bank 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.B

LACK

R

OCK

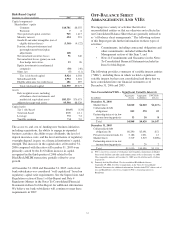

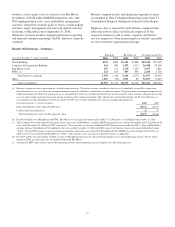

Our BlackRock business segment earned $187 million in 2006

and $152 million in 2005. For this PNC business segment

presentation, our share of MLIM transaction integration costs

for 2006 have been reclassified from BlackRock to “Other.” In

addition, these business segment earnings have been reduced

by minority interest in income of BlackRock, excluding

MLIM transaction integration costs, totaling $65 million and

$71 million in 2006 and 2005, respectively. Also, these

business segment earnings are net of additional PNC income

taxes recorded on PNC’s share of BlackRock’s earnings.

PNC’s BlackRock business segment earnings increased

$35 million, or 23%, compared with 2005. We have modified

the presentation of historical BlackRock business segment

results as described above to conform with the current

business segment reporting presentation in this Item 7. Higher

earnings in 2006 reflected higher investment advisory and

administrative fees due to an increase in assets under

management, including BlackRock’s acquisition of MLIM at

the end of the third quarter of 2006 as further discussed below.

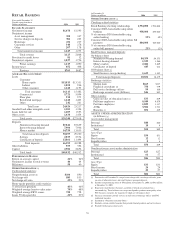

PNC’s investment in BlackRock was $3.9 billion at

December 31, 2006. Based upon BlackRock’s closing market

price of $151.90 per common share at December 31, 2006, the

market value of our investment in BlackRock was

approximately $6.7 billion at that date. As such, an additional

$2.8 billion of value was not recognized in our investment

account at that date.

B

LACK

R

OCK

/MLIM T

RANSACTION

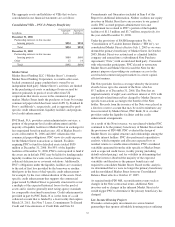

On September 29, 2006, Merrill Lynch contributed its

investment management business to BlackRock in exchange

for 65 million shares of newly issued BlackRock common and

preferred stock. BlackRock accounted for the MLIM

transaction under the purchase method of accounting.

Immediately following the closing, PNC continued to own

approximately 44 million shares of BlackRock common stock,

representing an ownership interest of approximately 34% of

the combined company after the closing (as compared with

69% immediately prior to the closing). Although PNC’s share

ownership percentage declined, PNC’s investment in

BlackRock increased due to the increase in total equity

recorded by BlackRock as a result of the MLIM transaction.

Upon the closing of the BlackRock/MLIM transaction, the

carrying value of our investment in BlackRock increased by

approximately $3.1 billion to $3.8 billion, primarily reflecting

PNC’s portion of the increase in BlackRock’s equity resulting

from the value of shares issued in that transaction.

We also recorded a liability at September 30, 2006 for

deferred taxes of approximately $.9 billion, related to the

excess of the book value over the tax basis of our investment

in BlackRock, and a liability of approximately $.6 billion

related to our obligation to provide shares of BlackRock

common stock to help fund BlackRock LTIP programs

described below. The LTIP liability will be adjusted quarterly

based on changes in BlackRock’s common stock price and the

number of remaining committed shares. Accordingly, at each

quarter-end PNC will record a charge to earnings if the market

price of BlackRock’s common stock increases and will record

a credit to earnings if BlackRock’s stock price declines.

The overall balance sheet impact of the BlackRock/MLIM

transaction was an increase to our shareholders’ equity of

approximately $1.6 billion. The increase to equity was

comprised of an after-tax gain of approximately $1.3 billion,

net of the expense associated with the LTIP liability and the

deferred taxes, and an after-tax increase to capital surplus of

approximately $.3 billion. The recognition of the gain is

consistent with our existing accounting policy for the sale or

issuance by subsidiaries of their stock to third parties. The

gain represents the difference between our basis in BlackRock

stock prior to the BlackRock/MLIM transaction and the new

book value per share and resulting increase in value of our

investment realized from the transaction. The direct increase

to capital surplus rather than inclusion in the gain resulted

from the accounting treatment required due to existing

BlackRock repurchase commitments or programs.

For 2005 and the nine months ended September 30, 2006, our

Consolidated Income Statement included our former

approximately 69% - 70% ownership interest in BlackRock’s

net income through the closing date. However, beginning

September 30, 2006, our Consolidated Balance Sheet no

longer reflected the consolidation of BlackRock’s balance

sheet but recognized our ownership interest in BlackRock as

an investment accounted for under the equity method. This

accounting has resulted in a reduction in certain revenue and

noninterest expense categories on PNC’s Consolidated Income

Statement as our share of BlackRock’s net income is now

reported within asset management noninterest income.

B

LACK

R

OCK

LTIP P

ROGRAMS

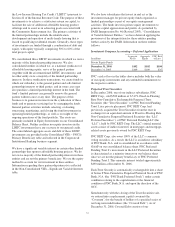

BlackRock adopted the 2002 LTIP program to help attract and

retain qualified professionals. At that time, we agreed to

transfer 4 million of the shares of BlackRock common stock

then held by us to fund the 2002 and future programs

approved by BlackRock’s board of directors, subject to certain

conditions and limitations. PNC’s noninterest income in the

fourth quarter of 2006 included a $12 million charge related to

our commitment to fund BlackRock LTIP programs. This

charge represents the mark-to-market of our BlackRock LTIP

obligation as of December 31, 2006 and is a result of the

fourth quarter increase in the market value of BlackRock

common shares. This increase in price also increased the

unrecognized value of our investment in BlackRock at

December 31, 2006 by approximately $128 million.

Prior to 2006, BlackRock granted awards under the 2002 LTIP

program of approximately $230 million, of which

approximately $210 million was paid on January 30, 2007.

41