PNC Bank 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P

ENSION

P

LAN

A

SSETS

Assets related to our qualified pension plan (the “Plan”) are

held in trust (the “Trust”). The trustee is PNC Bank, N.A. The

Trust is exempt from tax pursuant to section 501(a) of the

Internal Revenue Code (the “Code”). The Plan is qualified

under section 401(a) of the Code. Plan assets consist primarily

of listed domestic and international equity securities and US

government, agency, and corporate debt securities and real

estate investments. Plan assets do not include common or

preferred stock or any debt of PNC.

The Pension Plan Administrative Committee (the

“Committee”) adopted the current Pension Plan Investment

Policy Statement, including the updated target allocations and

allowable ranges shown below, on November 29, 2005.

The long-term investment strategy for pension plan assets is

to:

• Meet present and future benefit obligations to all

participants and beneficiaries,

• Cover reasonable expenses incurred to provide such

benefits, including expense incurred in the

administration of the Trust and the Plan,

• Provide sufficient liquidity to meet benefit and

expense payment requirements on a timely basis, and

• Provide a total return that, over the long term,

maximizes the ratio of trust assets to liabilities by

maximizing investment return, at an appropriate level

of risk.

The Plan’s specific investment objective is to meet or exceed

the investment policy benchmark over the long term. The

investment policy benchmark compares actual performance to

a weighted market index, and measures the contribution of

active investment management and policy implementation.

This investment objective is expected to be achieved over the

long term (one or more market cycles) and is measured over

rolling five-year periods. Total return calculations are time-

weighted and are net of investment-related fees and expenses.

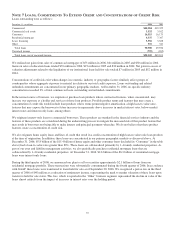

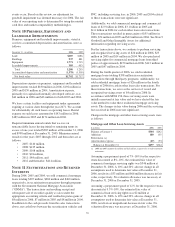

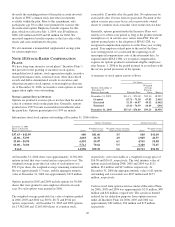

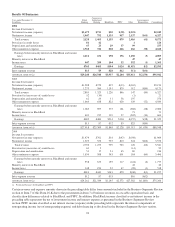

The asset allocations for the Trust at the end of 2006 and

2005, and the target allocation for 2007, by asset category, are

as follows:

Target

Allocation

Allowable

Range

Percentage of Plan Assets

at December 31

2007 2006 2005

Asset Category

Domestic Equity 35% 32-38% 39.3% 39.0%

International Equity 20% 17-23% 21.3% 19.6%

Private Equity 5% 0-8% 1.5% .9%

Total Equity 60% 62.1% 59.5%

Domestic Fixed Income 30% 27-33% 28% 30.7%

High Yield Fixed

Income 5% 0-8% 4.9% 6.7%

Total Fixed Income 35% 32.9% 37.4%

Real Estate 5% 0-8% 4.8% 2.5%

Other 0% 0-1% .2% .6%

Total 100% 100% 100%

The Asset Category represents the allocation of Plan assets in

accordance with the investment objective of each of the Plan’s

investment managers. Certain domestic equity investment

managers utilize derivatives and fixed income securities as

described in their investment management agreements to

achieve their investment objective under the Investment

Policy Statement.

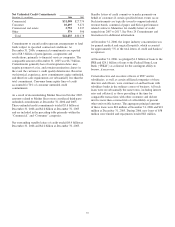

The slight overweight in domestic equity at year-end 2005 and

2006 was attributable to the targeted allocation in Private

Equity, which continues to be committed but which is funded

over time as suitable opportunities for private equity

investment are identified and as calls for funding are made.

The Investment Policy Statement provides that, from time to

time, domestic equity may serve as a proxy (substitute) for

private equity. Additionally, target allocation changes, which

were effective November 29, 2005, included reducing the

High Yield Fixed Income allocation from 10% to 5% and

creating a new Real Estate allocation of 5%. This transition

was completed during 2006.

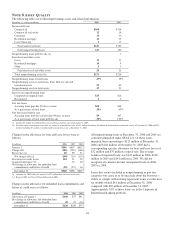

We believe that, over the long term, asset allocation is the

single greatest determinant of risk. Asset allocation will

deviate from the target percentages due to market movement,

cash flows, and investment manager performance. Material

deviations from the asset allocation targets can alter the

expected return and risk of the Trust. On the other hand,

frequent rebalancing to the asset allocation targets may result

in significant transaction costs, which can impair the Trust’s

ability to meet its investment objective. Accordingly, the Trust

portfolio is periodically rebalanced to maintain asset

allocation within the target ranges described above.

In addition to being diversified across asset classes, the Trust

is diversified within each asset class. Secondary

diversification provides a reasonable basis for the expectation

that no single security or class of securities will have a

disproportionate impact on the total risk and return of the

Trust.

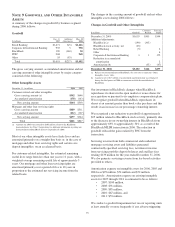

The Committee selects investment managers for the Trust

based on the contributions that their respective investment

styles and processes are expected to make to the investment

performance of the overall portfolio. The managers’

Investment Objectives and Guidelines, which are a part of

each manager’s Investment Management Agreement,

document performance expectations and each manager’s role

in the portfolio. The Committee uses the Investment

Objectives and Guidelines to establish, guide, control and

measure the strategy and performance for each manager.

The purpose of investment manager guidelines is to:

• Establish the investment objective and performance

standards for each manager,

• Provide the manager with the capability to evaluate

the risks of all financial instruments or other assets in

which the manager’s account is invested, and

• Prevent the manager from exposing its account to

excessive levels of risk, undesired or inappropriate

risk, or disproportionate concentration of risk.

102