Nokia 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

Corporate governance

NOKIA IN 2015

Additionally in 2015, we also had outstanding awards under the 2007

and 2011 stock option plans and the Nokia Networks EIP. Stock options

under the 2007 option plan lapsed on January 1, 2016. No new awards

have been made under these plans since 2013. These are described in

the section on legacy equity compensation programs “—Legacy equity

compensation programs” below.

As of February 12, 2016, when new Nokia shares were issued as

consideration for the Alcatel Lucent securities tendered into the

subsequent French and/or U.S. oers, and consequently, included

inthe aggregate amount of Nokia shares, the aggregate maximum

dilution eect of our currently outstanding equity programs, assuming

that the performance shares would be delivered at maximum level and

including the aggregate amount of Nokia shares, wasapproximately

0.86%. The potential maximum dilution eect of the equity program

2016 would approximately be an additional 1.04%, assuming delivery

at maximumlevel for performance shares and the delivery of

matchingshares against the maximum amount of contributions of

approximately EUR 60 million under the employee share purchase

plan. Employees of Alcatel Lucent that have transferred as part of the

acquisition of Alcatel Lucent are only included in equity plans under

theequity program 2016.

Performance shares

The performance shares represent a commitment by us to deliver

Nokia shares to employees at a future point in time, subject to our

fulllment of pre-dened performance criteria. They vest to

participants after three years based on the performance of the

company against its targets for the rst two nancial years. The Board

believes the practice of a two-year performance period which gives

greater predictability in a fast changing environment and supports

greater alignment of underlying achievement with payments, is

appropriate in the current business context. Targets are set in the

context of the Board’s view of the future business plans for Nokia,

investor expectations and analyst forecasts, and the Board will

continue to review the suitability of the two-year performance period

for future years. The table below illustrates the performance criteria of

the performance share plans for 2013 through to 2016. Targets are

set by reference to the company’s long-term plans and in the context

of investment analysts’ forecasts for the business.

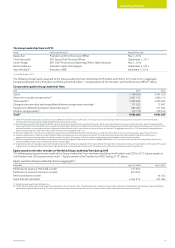

Performance criteria (non-IFRS)(1) 2016 2015 2014 2013

Average annual net sales Nokia Group Yes Yes(2) Yes Yes(3)

Average annual EPS Nokia Group Yes Yes(2) Yes Yes

Minimum settlement at below threshold performance(4) 25% 25% 25% 0%

(1) Non-IFRS measures exclude all material special items for all periods. Additionally, non-IFRS results exclude intangible asset amortization and other purchase price accounting-related items arising from

business acquisitions.

(2) The Board is expected to approve an amendment to the performance condition of the performance share plan 2015 in conjunction with the publication of Nokia’s Q1/2016 results announcement to

reect the new organizational structure and scope of the Nokia Group. The amendment would adjust the net sales and EPS performance targets to remove the HERE related impact for the 4th quarter

of 2015 following the sale of HERE in 2015 and restate the 2016 targets based on the combined Nokia Group following the acquisition of Alcatel Lucent in January 2016.

(3) The performance condition was amended at the time of the Sale of the D&S Business to reect the new prole of the business and dierent annual revenue levels of the new business. The amendment

introduced a metric set on the basis of the Average Net Sales Index over the two-year performance period in replacement of the metric set on the basis of the Average Annual Net Sales Revenue. The

‘Net Sales Index’ relates to the nal non-IFRS annual net sales achieved through the business operations of Nokia Group (excluding Nokia Networks) in relation to 2013 and for Nokia Networks, HERE and

Nokia Technologies in relation to 2014, expressed as a percentage of the annual target set for each year. A separate Annual Net Sales Index will be calculated for 2013 and 2014, and the average of the

two will be calculated following the close of 2014 and used, in part, to determine the nal payout under the Plan, which will occur after the one-year restriction period in 2016.

(4) In 2014, a minimum payout level was introduced to reinforce the retentive impact of the plan by giving some certainty to remaining employees during the transformation of Nokia following the Sale

ofthe D&S Business and integration of the Nokia Networks business.

Until the shares have vested and been delivered to the participants, they carry no voting or dividend rights. The performance share grants are

generally forfeited if the employment relationship terminates with Nokia prior to vesting.