Nokia 2015 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146 NOKIA IN 2015

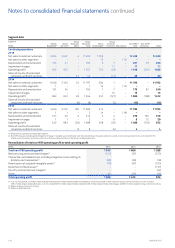

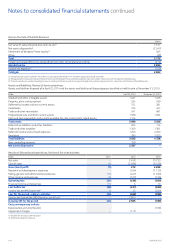

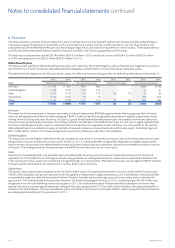

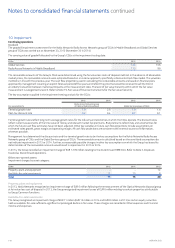

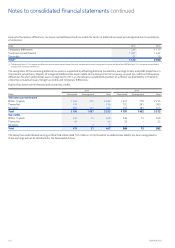

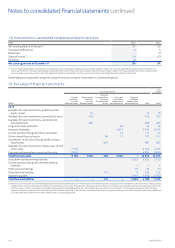

Movements in pension remeasurements recognized in other comprehensive income for the years ended December 31:

EURm 2015 2014 2013

Return on plan assets (excluding interest income), gain 244 15

Changes in demographic assumptions, (loss)/gain –(1) 4

Changes in nancial assumptions, gain/(loss) 114 (321) 93

Experience adjustments, (loss)/gain –(16) 6

Current year change in asset ceiling (6) 4(4)

Total 110 (290) 114

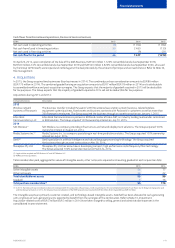

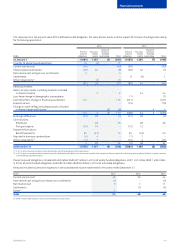

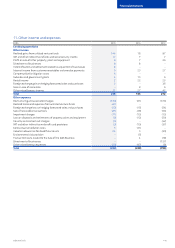

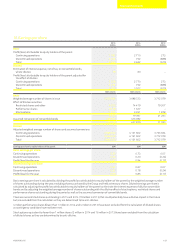

Actuarial assumptions

The principal actuarial weighted average assumptions used for determining the dened benet obligation:

%2015 2014

Discount rate for determining present values 3.0 2.6

Annual rate of increase in future compensation levels 2.6 1.9

Pension growth rate 1.3 1.4

Ination rate 1.4 1.6

Assumptions regarding future mortality are set based on actuarial advice in accordance with published statistics and experience in each country.

The discount rates and mortality tables used for the signicant plans:

2015 2014 2015

Discount rate % Mortality table

Germany 2.5 2.0 Richttafeln 2005 G

United Kingdom 3.6 3.5 S2PA table adjusted(1)

India 7.8 7.9 IALM (2006-08)

Switzerland 0.7 0.9 BVG2010G

Total weighted average for all countries 3.0 2.6

(1) Tables are adjusted down by one year for males and down by three years for females.

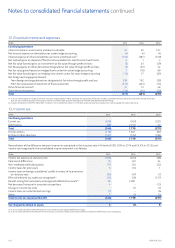

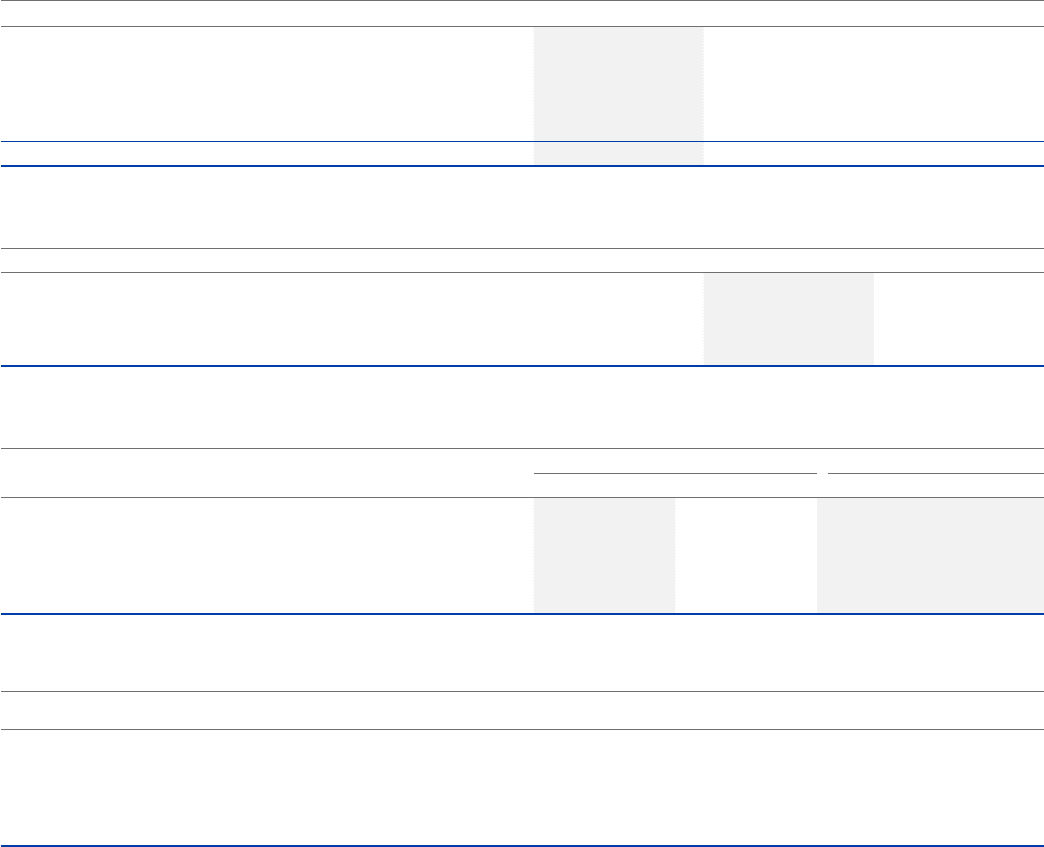

The sensitivity of the dened benet obligation to changes in the principal assumptions:

Change in assumption

Increase in assumption(1)

EURm

Decrease in assumption(1)

EURm

Discount rate for determining present values 1.0% 235 (299)

Annual rate of increase in future compensation levels 1.0% (43) 36

Pension growth rate 1.0% (169) 165

Ination rate 1.0% (192) 186

Life expectancy 1 year (54) 54

(1) Positive movement indicates a reduction in the dened benet obligation; a negative movement indicates an increase in the dened benet obligation.

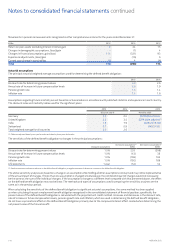

The above sensitivity analyses are based on a change in an assumption while holding all other assumptions constant and may not be representative

of the actual impact of changes. If more than one assumption is changed simultaneously, the combined impact of changes would not necessarily

be the same as the sum of the individual changes. If the assumptions change to a dierent level compared with that presented above, the eect

on the dened benet obligation may not be linear. The methods and types of assumptions used in preparing the sensitivity analyses are the

same as in the previous period.

When calculating the sensitivity of the dened benet obligation to signicant actuarial assumptions, the same method has been applied

aswhen calculating the post-employment benet obligation recognized in the consolidated statement of nancial position; specically, the

present value of the dened benet obligation is calculated with the projected unit credit method. Increases and decreases in the discount rate,

rate of increase in future compensation levels, pension growth rate and ination, which are used in determining the dened benet obligation,

do not have a symmetrical eect on the dened benet obligation primarily due to the compound interest eect created when determining the

net present value of the future benet.

Notes to consolidated nancial statements continued