Nokia 2015 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154 NOKIA IN 2015

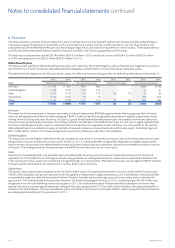

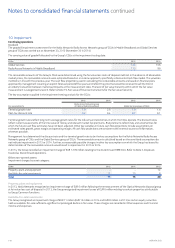

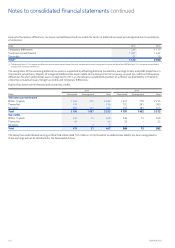

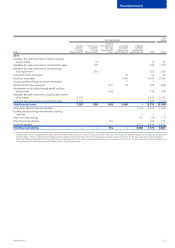

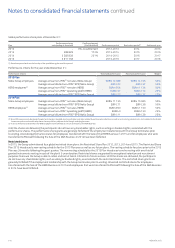

In 2014, convertible bonds issued to Microsoft in September 2013 were fully redeemed as a result of the closing of the Sale of the D&S

Business. 116million potential shares were included in the calculation of diluted shares to reect the part-year eect of these convertible

bonds. In 2013, the potential shares were excluded from the calculation of diluted shares as they were determined to be antidilutive. If fully

converted, these potential shares would have resulted in the issuance of 368million shares.

In 2015, the Group exercised its option to redeem the EUR 750 million convertible bonds at their original amount plus accrued interest. Virtually

all bondholders elected to convert their convertible bonds into Nokia shares before redemption. 269million potential shares have been included

in the calculation of diluted shares to reect the part-year eect of these convertible bonds. In 2014, the conversion price was increased and

298million potential shares were included in the calculation of diluted shares as they were determined to be dilutive. Voluntary conversion of

the entire bond would have resulted in the issue of 307million shares in 2014. In 2013, 287million potential shares were excluded from the

calculation of diluted shares because they were determined to be antidilutive.

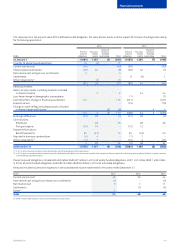

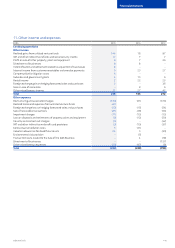

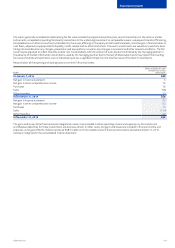

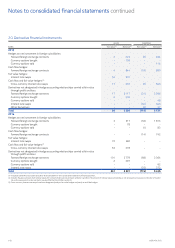

16. Intangible assets

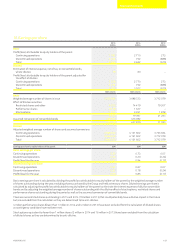

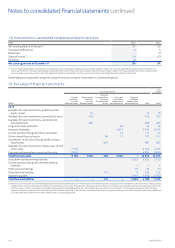

EURm 2015 2014

Goodwill

Acquisition cost atJanuary 1 5 770 5 293

Translation dierences 350 401

Acquisitions through business combinations 7 76

Disposals(1) (4 982) –

Acquisition cost at December 31 1 145 5 770

Accumulated impairment charges at January 1 (3 207) (1 998)

Disposals(1) 2 299 –

Impairment charges – (1 209)

Accumulated impairment charges at December 31 (908) (3 207)

Net book value at January 1 2 563 3 295

Net book value at December 31 237 2 563

Other intangible assets

Acquisition cost atJanuary 1 5 646 5 214

Translation dierences 382 334

Additions 26 32

Acquisitions through business combinations 56 77

Disposals and retirements(1) (2 973) (11)

Acquisition cost at December 31 3 137 5 646

Accumulated amortization at January 1 (5 296) (4 918)

Translation dierences (350) (290)

Disposals and retirements(1) 2 934 10

Amortization (102) (98)

Accumulated amortization at December 31 (2 814) (5 296)

Net book value at January 1 350 296

Net book value at December 31 323 350

(1) In 2015, disposals and retirements include goodwill with acquisition cost of EUR 4 982 million and accumulated impairment of EUR 2 299 million and other intangible assets with acquisition cost of

EUR 2 892 million and accumulated amortization of EUR 2 853 million disposed as part of the Sale of the HERE Business.

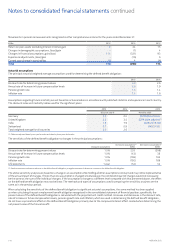

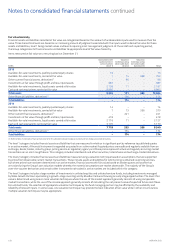

Other intangible assets include customer relationships with a net book value of EUR 132 million (EUR 177 million in 2014), developed

technologywith a net book value of EUR 126 million (EUR 99 million in 2014), and licenses to use tradename and trademark with a net book

value of EUR 9 million (EUR 10 million in 2014). The remaining amortization periods range from approximately two to six years for customer

relationships, two to seven years for developed technology and six years for licenses to use tradename and trademark.

Notes to consolidated nancial statements continued