Nokia 2015 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

158 NOKIA IN 2015

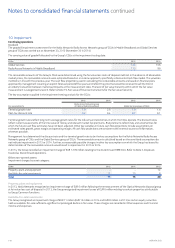

Fair value hierarchy

Financial assets and liabilities recorded at fair value are categorized based on the amount of unobservable inputs used to measure their fair

value. Three hierarchical levels are based on an increasing amount of judgment associated with the inputs used to derive fair value for these

assets and liabilities, level 1 being market values and level 3 requiring most management judgment. At the end of each reporting period,

theGroup categorizes its nancial assets and liabilities to appropriate level of fair value hierarchy.

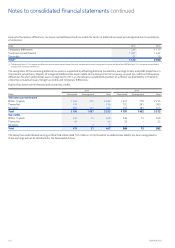

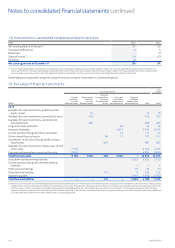

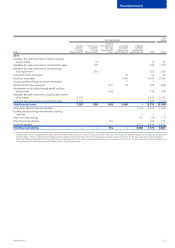

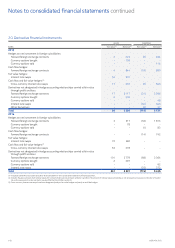

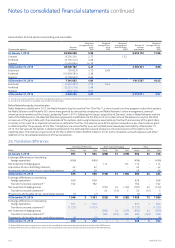

Items measured at fair value on a recurring basis at December 31:

EURm

Instruments with

quoted prices in

active markets

(level 1)

Valuation

technique using

observable data

(level 2)

Valuation

technique using

non-observable

data (level 3) Total

2015

Available-for-sale investments, publicly quoted equity shares 16 – – 16

Available-for-sale investments, carried at fair value 1 14 688 703

Other current nancial assets, derivatives(1) –96 –96

Investments at fair value through prot and loss, liquid assets 687 – – 687

Available-for-sale investments, liquid assets carried at fair value 2 156 11 – 2 167

Cash and cash equivalents carried at fair value 6 995 – – 6 995

Total assets 9 855 121 688 10 664

Other nancial liabilities, derivatives(1) –114 –114

Total liabilities –114 –114

2014

Available-for-sale investments, publicly quoted equity shares 14 – – 14

Available-for-sale investments, carried at fair value 1 13 556 570

Other current nancial assets, derivatives(1) –241 –241

Investments at fair value through prot and loss, liquid assets 418 – – 418

Available-for-sale investments, liquid assets carried at fair value 2 116 11 – 2 127

Cash and cash equivalents carried at fair value 5 170 – – 5 170

Total assets 7 719 265 556 8 540

Other nancial liabilities, derivatives(1) –174 –174

Total liabilities –174 –174

(1) Refer to Note 20, Derivative nancial instruments for the allocation between hedge accounted and non-hedge accounted derivatives.

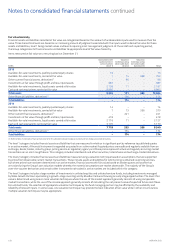

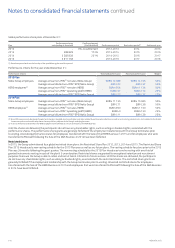

The level 1 category includes nancial assets and liabilities that are measured in whole or in signicant part by reference to published quotes

inan active market. A nancial instrument is regarded as quoted in an active market if quoted prices are readily and regularly available from an

exchange, dealer, broker, industry group, pricing service or regulatory agency and those prices represent actual and regularly occurring market

transactions on an arm’s-length basis. This category includes listed bonds and other securities, listed shares and exchange-traded derivatives.

The level 2 category includes nancial assets and liabilities measured using a valuation technique based on assumptions that are supported

byprices from observable current market transactions. These include assets and liabilities for which pricing is obtained via pricing services,

butwhere prices have not been determined in an active market, nancial assets with fair values based on broker quotes and assets that

arevalued using the Group’s own valuation models whereby the material assumptions are market observable. The majority of the Group’s

over-the-counter derivatives and certain other instruments not traded in active markets are included within this category.

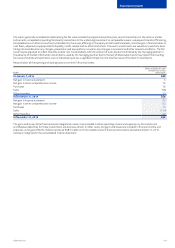

The level 3 category includes a large number of investments in unlisted equities and unlisted venture funds, including investments managed

byNokia Growth Partners specializing in growth-stage investing and by BlueRun Ventures focusing on early stage opportunities. The level 3 fair

value is determined using one or more valuation techniques where the use of the market approach generally consists of using comparable

market transactions, while the use of the income approach generally consists of calculating the net present value of expected future cash ows.

For unlisted funds, the selection of appropriate valuation techniques by the fund managing partner may be aected by the availability and

reliability of relevant inputs. In some cases, one valuation technique may provide the best indication of fair value while in other circumstances

multiple valuation techniques may be appropriate.

Notes to consolidated nancial statements continued