Nokia 2015 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

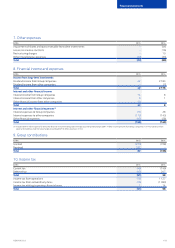

183

Financial statements

NOKIA IN 2015

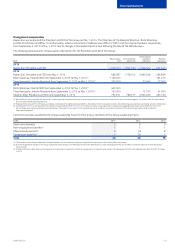

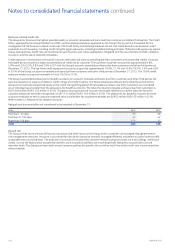

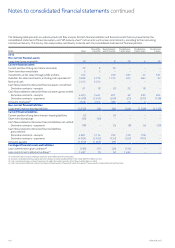

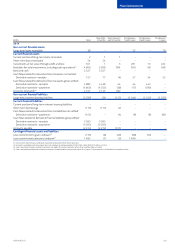

EURm Total

Due within

3 months

Due between 3

and 12 months

Due between

1 and 3 years

Due between

3 and 5 years

Due beyond

5 years

2014

Non-current nancial assets

Long-term loans receivable 38 – – 22 –16

Current nancial assets

Current portion of long-term loans receivable 2 1 1 – – –

Short-term loans receivable 24 24 – – – –

Investments at fair value through prot and loss 501 1 5 261 10 224

Available-for-sale investments, including cash equivalents(1) 4 806 2 609 904 926 68 299

Bank and cash 2 527 2 527 – – – –

Cash ows related to derivative nancial assets net settled:

Derivative contract—receipts 127 17 (4) 27 34 53

Cash ows related to derivative nancial assets gross settled:

Derivative contracts—receipts 4 982 4 439 54 44 445 –

Derivative contracts—payments (4 800) (4 355) (38) (17) (390) –

Accounts receivable(2) 2 727 2 135 592 – – –

Non-current nancial liabilities

Long-term interest-bearing liabilities (3 786) (34) (113) (1 044) (1 520) (1 075)

Current nancial liabilities

Current portion of long-term interest-bearing liabilities – – – – – –

Short-term borrowings (115) (113) (2) –––

Cash ows related to derivative nancial liabilities net settled:

Derivative contracts—payments (101) –(4) (8) (8) (81)

Cash ows related to derivative nancial liabilities gross settled:

Derivative contracts—receipts 5 065 5 065 – – – –

Derivative contracts—payments (5 203) (5 203) – – – –

Accounts payable (2 313) (2 212) (101) – – –

Contingent nancial assets and liabilities

Loan commitments given undrawn(3) (155) (8) (49) (68) (30) –

Loan commitments obtained undrawn(4) 1 493 (1) (2) 1 496 – –

(1) Instruments that include a call feature have been presented at their nal maturities.

(2) Accounts receivable maturity analysis does not include accrued receivables of EUR 1 285 million (EUR 703 million in 2014).

(3) Loan commitments given undrawn have been included in the earliest period in which they could be drawn or called.

(4) Loan commitments obtained undrawn have been included based on the period in which they expire. These amounts include related commitment fees.