Nokia 2015 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156 NOKIA IN 2015

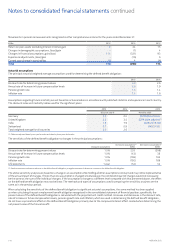

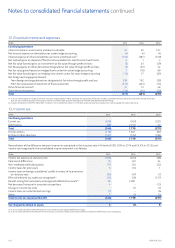

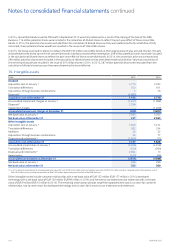

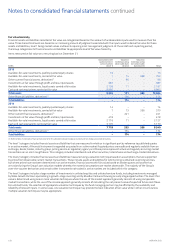

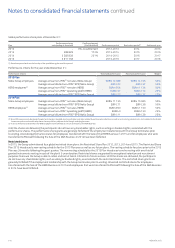

18. Investments in associated companies and joint ventures

EURm 2015 2014

Net carrying amount at January 1 51 65

Translation dierences 6 5

Deductions – (7)

Share of results(1) 29 (12)

Dividends (2) –

Net carrying amount at December 31 84 51

(1) In 2015, the Group recorded a correction which increased the results of associated companies and joint ventures by EUR 25 million. The correction related to the results of a joint venture for the

fourthquarter of 2014. The Group had historically accounted for the results of the joint venture in arrears as the results have not been material. The Group evaluated these items in relation to the

current period as well as the periods in which they originated and determined that the corrections are immaterial to the consolidated nancial statements in all periods.

Shareholdings in associated companies and joint ventures comprise investments in unlisted companies.

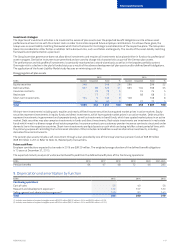

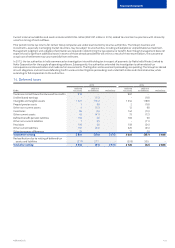

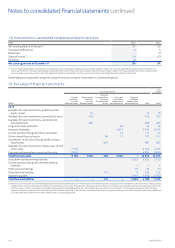

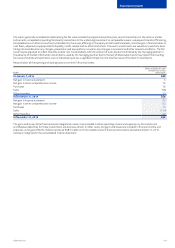

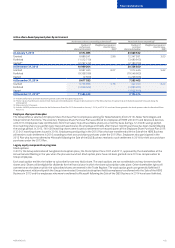

19. Fair value of nancial instruments

EURm

Carrying amounts

Fair

value(1)

Current

available-

for-sale

financial assets

Non-current

available-

for-sale

financial assets

Financial

instruments at

fair value

through profit

or loss

Loans and

receivables

measured at

amortized cost

Financial

liabilities

measured at

amortized cost Total Total

2015

Available-for-sale investments, publicly quoted

equity shares 16 16 16

Available-for-sale investments, carried at fair value 703 703 703

Available-for-sale investments, carried at cost

lessimpairment 285 285 285

Long-term loans receivable 49 49 39

Accounts receivable 3 913 3 913 3 913

Current portion of long-term loans receivable 21 21 21

Other current nancial assets 96 11 107 107

Investments at fair value through prot and loss,

liquid assets 687 687 687

Available-for-sale investments, liquid assets carried

at fair value 2 167 2 167 2 167

Cash and cash equivalents carried at fair value 6 995 6 995 6 995

Total nancial assets 9 162 1 004 783 3 994 – 14 943 14 933

Long-term interest-bearing liabilities 2 023 2 023 2 100

Current portion of long-term interest-bearing

liabilities 1 1 1

Short-term borrowings 50 50 50

Other nancial liabilities 114 8 122 122

Accounts payable 1 910 1 910 1 910

Total nancial liabilities – – 114 – 3 992 4 106 4 183

(1) For items not carried at fair value, the following fair value measurement methods are used. The fair value is estimated to equal the carrying amount for available-for-sale investments carried at cost less

impairment for which it is not possible to estimate fair value reliably as there is no active market for these private fund investments. These assets are tested for impairment annually using a discounted

cash ow analysis. The fair value of loans receivable and loans payable is estimated based on the current market values of similar instruments (level 2). The fair values of long-term interest bearing

liabilities are based on discounted cash ow analysis (level 2) or quoted prices (level 1). The fair value is estimated to equal the carrying amount for short-term nancial assets and nancial liabilities due

to limited credit risk and short time to maturity. Refer to Note 1, Accounting principles.

Notes to consolidated nancial statements continued