Nokia 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

159

Financial statements

NOKIA IN 2015

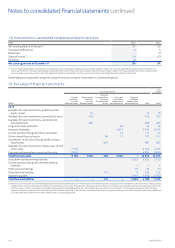

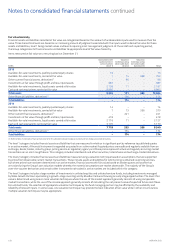

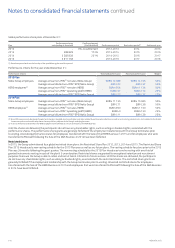

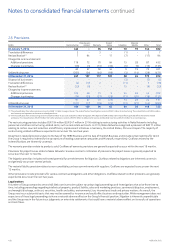

The inputs generally considered in determining the fair value include the original transaction price, recent transactions in the same or similar

instruments, completed or pending third-party transactions in the underlying investment or comparable issuers, subsequent rounds of nancing,

recapitalizations or other transactions undertaken by the issuer, oerings in the equity or debt capital markets, and changes in nancial ratios or

cash ows, adjusted as appropriate for liquidity, credit, market and/or other risk factors. The level 3 investments are valued ona quarterly basis

taking into consideration any changes, projections and assumptions, as well as any changes in economic and other relevant conditions. The fair

value may be adjusted to reect illiquidity and/or non-transferability, with the amount of such discount estimated by the managing partner in

the absence of market information. Assumptions used by the managing partner due to the lack of observable inputs may impact the resulting

fair value of individual investments, but no individual input has a signicant impact on the total fair value of the level 3 investments.

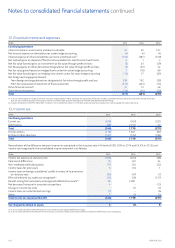

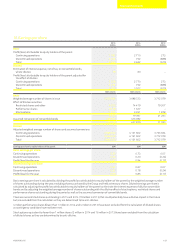

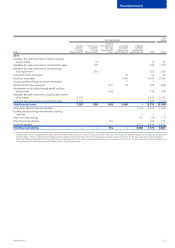

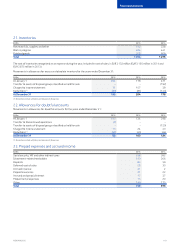

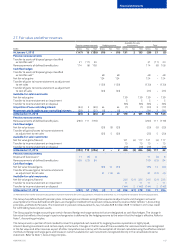

Reconciliation of the opening and closing balances on level 3 nancial assets:

EURm

Other available-for-sale

investments carried

at fair value

At January 1, 2014 429

Net gain in income statement 5

Net gain in other comprehensive income 72

Purchases 78

Sales (58)

Other transfers 30

At December 31, 2014 556

Net gain in income statement 96

Net gain in other comprehensive income 83

Purchases 70

Sales (146)

Other transfers 29

At December 31, 2015 688

The gains and losses from nancial assets categorized in level 3 are included in other operating income and expenses as the investment

anddisposal objectives for these investments are business-driven. In other cases, the gains and losses are included in nancial income and

expenses. A net gain of EUR 4 million (net loss of EUR 2 million in 2014) related to level 3 nancial instruments held at December 31, 2015

hasbeen recognized in the consolidated income statement.