Nokia 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.128 NOKIA IN 2015

Termination benets

Termination benets are payable when employment is terminated

before the normal retirement date, or whenever an employee accepts

voluntary redundancy in exchange for these benets. The Group

recognizes termination benets when it is demonstrably committed

toeither terminating the employment of current employees according

to a detailed formal plan without possibility of withdrawal, or providing

termination benets as a result of an oer made to encourage

voluntary redundancy. Local laws may provide employees with the

right to benets from the employer upon termination whether the

termination is voluntary or involuntary. For these specic termination

benets, the portion of the benet that the company would be

required to pay to the employee in the case of voluntary termination

istreated as a constructive obligation determined by local law and

accounted for as a dened benet arrangement as described in the

pensions section above.

Share-based payment

The Group oers three types of global equity-settled share-based

compensation plans for employees: stock options, performance

shares and restricted shares.

Employee services received and the corresponding increase in

equityare measured by reference to the fair value of the equity

instruments at the grant date, excluding the impact of any non-market

vesting conditions. Non-market vesting conditions attached to the

performance shares are included in assumptions about the number

ofshares that the employee will ultimately receive. The Group reviews

the assumptions made on a regular basis and, where necessary,

revises its estimates of the number of performance shares that

areexpected to be settled. Plans that apply tranched vesting are

accounted for under the graded vesting model. Share-based

compensation is recognized as anexpense in the consolidated

incomestatement over the relevant service periods.

The Group has issued certain stock options which are accounted for as

cash-settled. The related employee services received and the liabilities

incurred are measured at the fair value of the liability. The fair value of

stock options is estimated based on the reporting date market value

less the exercise price of the stock options. The fair value of the liability

is remeasured at each statement of nancial position date and at

thedate of settlement, with changes in fair value recognized in the

consolidated income statement over the relevant service periods.

Income taxes

The income tax expense comprises current tax and deferred tax.

Taxisrecognized in the consolidated income statement except to

theextent that it relates to items recognized in other comprehensive

income or directly in equity, then the related tax is recognized in

othercomprehensive income or equity, respectively.

Current taxes are based on the results of the Group companies and

are calculated using the local tax laws and tax rates that are enacted

orsubstantively enacted at each consolidated statement of nancial

position date. Corporate taxes withheld at the source of the income

onbehalf of the Group companies, both recoverable and irrecoverable,

as well as penalties and interests on income taxes are accounted for

inincome taxes.

The Group periodically evaluates positions taken in tax returns with

respect to situations in which applicable tax regulation is subject to

interpretation. It adjusts the amounts recorded, where appropriate,

onthe basis of amounts expected to be paid to the tax authorities.

The amount of current income tax liabilities for uncertain income tax

positions is recognized when it is more likely than not that certain

taxpositions will be challenged and may not be fully sustained upon

review by tax authorities. The amounts recorded are based upon the

estimated future settlement amount at each consolidated statement

of nancial position date.

Deferred tax assets and liabilities are determined using the liability

method for all temporary dierences arising between the tax bases

ofassets and liabilities and their carrying amounts in the consolidated

nancial statements. Deferred tax assets are recognized to the extent

that it is probable that future taxable prot will be available against

which the unused tax losses, unused tax credits or deductible

temporary dierences can be utilized before the unused tax losses

orunused tax credits expire. Deferred tax assets are assessed

forrealizability at each statement of nancial position date. When

circumstances indicate it is no longer probable that deferred tax

assetswill be utilized, adjustments are made as necessary. Deferred

tax liabilities are recognized for temporary dierences that arise

between the fair value and the tax base of identiable net assets

acquired inbusiness combinations. Deferred tax assets and deferred

tax liabilities are oset for presentation purposes when there is a

legally enforceable right to set o current tax assets against current

tax liabilities, and the deferred tax assets and deferred tax liabilities

relate to income taxes levied by the same taxation authority on either

the same taxable entity or dierent taxable entities which intend

either to settle current tax liabilities and assets on a net basis, or

torealize the assets and settle the liabilities simultaneously in each

future period inwhich signicant amounts of deferred tax liabilities

ordeferred tax assets are expected to be settled or recovered.

Deferred tax liabilities are not recognized if they arise from the initial

recognition of goodwill. Deferred tax liabilities are provided on taxable

temporary dierences arising from investments in subsidiaries,

associates and joint arrangements, except for deferred tax liability

where the timing of the reversal of the temporary dierence is

controlled by the Group, and it is probable that the temporary

dierence will not reverse in the foreseeable future.

The enacted or substantively enacted tax rates at each consolidated

statement of nancial position date that are expected to apply in the

period when the asset is realized or the liability is settled are used in

the measurement of deferred tax assets and deferred tax liabilities.

Foreign currency translation

Functional and presentation currency

The nancial statements of all Group entities are measured using

functional currency, which is the currency of the primary economic

environment in which the entity operates. The consolidated nancial

statements are presented in euro, the functional and presentation

currency of the parent.

Transactions in foreign currencies

Transactions in foreign currencies are recorded at exchange rates

prevailing at the dates of the individual transactions. For practical

reasons, a rate that approximates the actual rate at the date of the

transaction is often used. At the end of the accounting period,

theunsettled balances on foreign currency monetary assets and

liabilities are valued at the exchange rates prevailing at the end of the

accounting period. Foreign exchange gains and losses arising from

statement of nancial position items and fair value changes of related

hedging instruments are recognized in nancial income and expenses.

Unrealized foreign exchange gains and losses related to non-current

available-for-sale investments, such as equity investments, are

recognized in other comprehensive income.

Foreign Group companies

All income and expenses of foreign Group companies where the

functional currency is not euro are translated into euro at the average

foreign exchange rates for the accounting period. All assets and

liabilities of foreign Group companies are translated into euro at

foreign exchange rates prevailing at the end of the accounting period.

Dierences resulting from the translation of income and expenses

atthe average rate and assets and liabilities at the closing rate are

recognized as translation dierences in other comprehensive income.

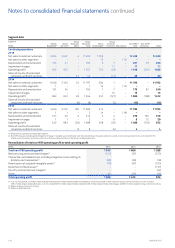

Notes to consolidated nancial statements continued