Nokia 2015 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

164 NOKIA IN 2015

Notes to consolidated nancial statements continued

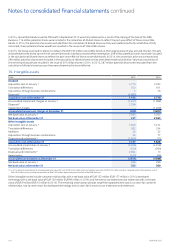

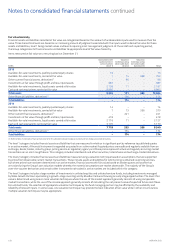

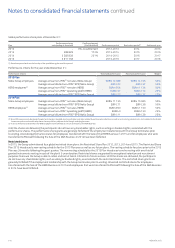

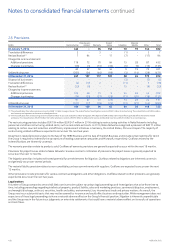

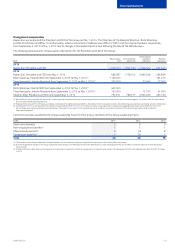

Global performance share plans at December 31:

Plan

Performance shares

outstanding at threshold

Confirmed payout

(% of threshold) Performance period Restriction period(1) Settlement year

2012 –0%, no settlement 2012-2013 2014 2015

2013 569 829 173% 2013-2014 2015 2016

2014 5 282 838 251% 2014-2015 2016 2017

2015 5 611 758 2015-2016 2017 2018

(1) Restriction period ends on the rst day of the year following the restriction period.

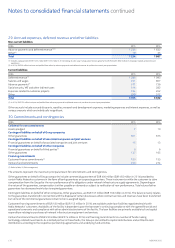

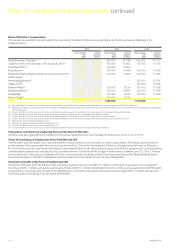

Performance criteria for the year ended December 31:

Performance criteria Threshold performance Maximum performance Weight

2015 Plan

Nokia Group employees Average annual non-IFRS(1) net sales (Nokia Group) EURm12 389 EURm14 736 50%

Average annual diluted non-IFRS(1) EPS (Nokia Group) EUR0.23 EUR0.37 50%

HERE employees(2) Average annual non-IFRS(1) net sales (HERE) EURm954 EURm1 134 50%

Average annual non-IFRS(1) operating prot (HERE) EURm67 EURm172 25%

Average annual diluted non-IFRS(1) EPS (Nokia Group) EUR0.23 EUR0.37 25%

2014 Plan

Nokia Group employees Average annual non-IFRS(1) net sales (Nokia Group) EURm11 135 EURm15 065 50%

Average annual diluted non-IFRS(1) EPS (Nokia Group) EUR0.11 EUR0.38 50%

HERE employees(2) Average annual non-IFRS(1) net sales (HERE) EURm950 EURm1 150 50%

Average annual non-IFRS(1) operating prot (HERE) EURm0 EURm130 25%

Average annual diluted non-IFRS(1) EPS (Nokia Group) EUR0.11 EUR0.38 25%

(1) Non-IFRS measures exclude goodwill impairment charges, intangible asset amortization and items related to purchase price allocation, as well as restructuring-related costs, costs related to the Alcatel

Lucent transaction and certain other items that may not be indicative of the Group’s underlying business.

(2) In 2015, Performance Share Plans for HERE employees were forfeited as a result of the Sale of the HERE Business.

Until the shares are delivered, the participants do not have any shareholder rights, such as voting or dividend rights, associated with the

performance shares. The performance share grants are generally forfeited if the employment relationship with the Group terminates prior

tovesting. Unvested performance shares for employees transferred with the Sale of the HERE Business in 2015 and for employees who were

transferred to Microsoft following the Sale of the D&S Business in 2014 have been forfeited.

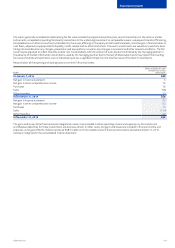

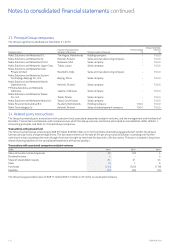

Restricted shares

In 2015, the Group administered four global restricted share plans: the Restricted Share Plan 2012, 2013, 2014 and 2015. The Restricted Share

Plan 2015 introduced a new vesting schedule for the 2015 Plan year as well as any future plans. The vesting schedule for plans prior to the 2015

Plan was 36 months following the grant quarter. The new vesting schedule for the 2015 Plan introduces tranche vesting with one third of

granted instruments vesting in each of the plan’s 3-year duration. Restricted shares are granted for exceptional retention and recruitment

purposes to ensure the Group is able to retain and recruit talent critical to its future success. Until the shares are delivered, the participants

donot have any shareholder rights, such as voting or dividend rights, associated with the restricted shares. The restricted share grants are

generally forfeited if the employment relationship with the Group terminates prior to vesting. Unvested restricted shares for employees

transferred with the Sale of the HERE Business in 2015 and employees that were transferred to Microsoft following the Sale of the D&S Business

in 2014 have been forfeited.